Bullish Nasdaq-100 going into 2026

AS THE Nasdaq-100 (NDX) approaches the final trading days of 2025, price action continues to reflect a resilient, albeit slowing, advance.

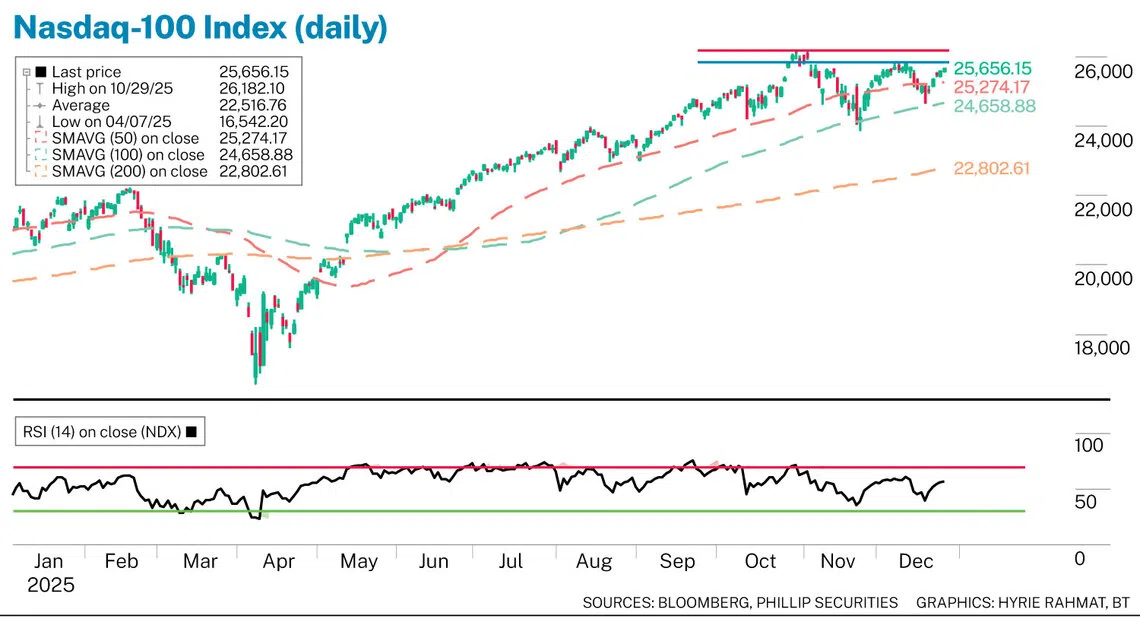

Following two sharp drawdowns and subsequent rebounds in mid-November and mid-December from the October-November highs, the index has stabilised and retested key technical levels forming a W-shaped pattern for the final two months of 2025.

Recent resistance sits near 25,830, representing a prior high in early December, with a slightly higher barrier at 26,180, a peak established in late October. These levels are now the focal points for bulls aiming to extend the market higher into year-end and potentially into early 2026.

In contrast, near-term support is defined by the moving average structure and historical price floors. The 50-day simple moving average (SMA) – around 25,275 – currently provides the first line of technical support, with the 100-day SMA near 24,660 serving as a deeper cushion should volatility increase.

Correction zone

Below both, a more robust longer-term support tier near 24,000 reflects the late-November correction zone, where the market found durable buying interest earlier in the rally. Overall, the recent price behaviour indicates that the broad uptrend remains intact, even though momentum has softened compared with the strong rally seen through mid-September.

The NDX has recovered above its shorter-term moving averages, suggesting that buyers remain in control at current levels, and the upward slope of these moving averages continues to affirm a bullish skew in the medium term.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Technical indicators such as the Relative Strength Index (RSI) also show momentum skewed to the upside in the final trading sessions of 2025, consistent with seasonal and sentiment trends heading into year-end, though a broader view of the RSI reveals that the strength of the advance has diminished since mid-September.

This divergence between price and momentum suggests caution, as the pace of the uptrend may be decelerating even as prices remain elevated. Seasonal factors reinforce this cautiously optimistic backdrop. The traditional “Santa Claus rally” has historically supported gains in the last week of December, as lighter trading volumes and year-end positioning often lift indices into the New Year.

Past performance, though not indicative of future performance, shows major benchmarks like the NDX and S&P 500 tend to post positive returns in this period, driven by a combination of lighter volume, tax-related flows, and forward-looking investor positioning.

Notably, early December weakness, now showing signs of recovery, can often set the stage for such a seasonal uptick as traders enter year-end with a more constructive bias. Despite these seasonal tailwinds, the technical context suggests a narrower path for further gains.

Significant hurdle

The near-term resistance around 25,830 to 26,180 remains a significant hurdle. A clear break and sustained close above this region would be a bullish signal, opening the possibility of testing even higher swing levels established in October and early December.

Conversely, an inability to clear this resistance zone, coupled with a pullback below the 50-day SMA, could prompt a re-test of the 100-day SMA and the broader structural support around 24,000.

The convergence of multiple technical layers at these levels underscores their importance: if they hold, the market retains the constructive medium-term trend; if they fall, a period of extended consolidation or broader retracement could unfold.

In summary, the NDX as of late December 2025 remains technically positioned to edge higher, supported by key moving averages and seasonal patterns. However, the strength of the advance has eased compared with earlier in the year, and the twin hurdles at key resistance levels of 25,830 and 26,180 will be critical gauges for directional conviction.

With broader market breadth appearing more mixed and daily trading volumes easing into the holiday season, investors should monitor how the index behaves around these pivotal resistance and support levels as it transitions into 2026.

The writer is manager of dealing and investor education at Phillip Securities

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.