🌏 Can Gen Z invest responsibly?

- Find out more and sign up for Thrive at bt.sg/thrive

Call me an E-S-Genius

Sustainable investing takes environmental, social and governance (ESG) factors into account when screening for potential investments. Often used interchangeably with ESG investing, it refers to strategies that seek to provide for societal good without sacrificing returns.

By putting their money where their values are, investors can encourage companies to act responsibly. For instance, they can invest in companies with excellent environmental practices instead of companies in the gas or coal industries 🚂.

Sustainable investing won’t solve the climate crisis overnight, but backing companies that have committed to driving change is a start.

Let’s be real – most of us invest to get financial returns. As it turns out, recent years have shown that investing responsibly doesn’t have to come at the expense of returns – you can even beat the market.

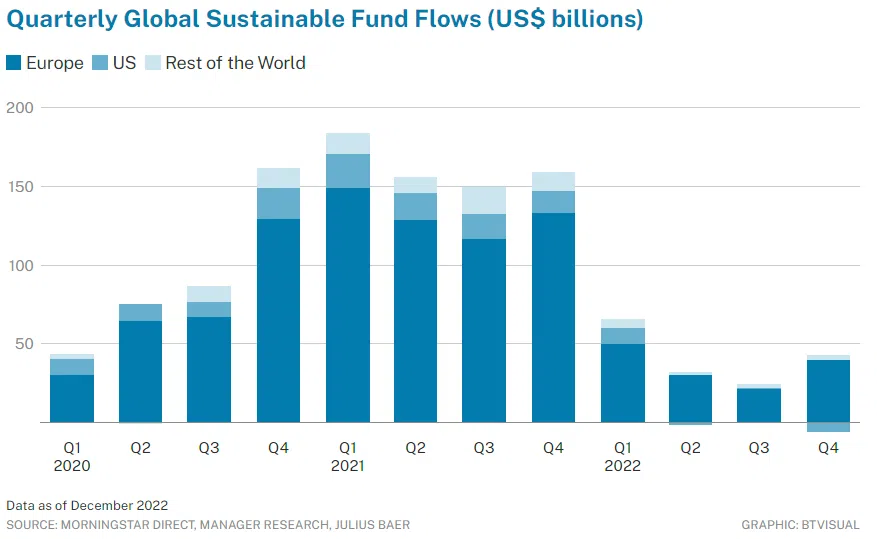

That is one reason for the remarkable growth in the amount of money flowing into sustainable investments over the years. It’s worth pointing out, though, that ESG-focused funds haven’t been too hot since 2022, in the face of the Russia-Ukraine war and this year’s banking turmoil.

Still, proponents say that ESG investing is a long-term play – great for young investors – because they sift out companies that could potentially implode for operating in an unsustainable or unethical manner.

How to get started

Here are four popular ESG strategies you can employ in your investments.

1. Negative screening

In negative screening, you exclude companies that do not meet your sustainability criteria from your investment portfolio. If slowing climate change is important to you, you may remove all fossil fuel companies from your portfolio.

2. Positive screening

Positive screening, as the name implies, is the opposite. Instead of setting criteria for excluding companies, you decide on an area where you want to see a company have a positive impact.

Often, positive screening involves selecting companies that are top performers based on your chosen criteria, such as those with the lowest carbon footprint in each sector.

3. ESG integration

This strategy involves incorporating a company’s ESG profile as one of the factors when you decide whether to buy a stock, alongside traditional financial metrics such as cash flow or financial ratios.

Employing such a strategy helps to mitigate the risk that the company you invest in faces financial or reputational harm for poor ESG practices. The priority for such a strategy is still the company’s financial performance.

4. Thematic investing

In thematic investing, you identify one issue relating to sustainability and invest in a group of companies that address it.

This should bring you higher returns as the companies you target benefit from broader positive ESG developments, such as the shift to renewable energy.

Do your research

No matter what strategy you pick, you’ll need to have access to ESG data and information.

Thankfully, there are data providers that score companies based on ESG factors. Among the most popular is MSCI, which rates companies from CCC to AAA (from worst to best) based on their exposure to ESG risks and how well they manage those risks relative to peers.

MSCI has a tool on its website that shows you a company’s ratings for free. For example, if you pull up Apple, you’ll see that MSCI rates it BBB, or “average”, among companies in its industry.

The tool enables you to find helpful information to aid your research, such as whether the company has committed to reduce carbon emissions and whether it has been accused of controversial behaviour.

Another way is to invest in ESG funds that reflect your investment preferences. Do note: these are not recommendations, but some possibilities for you to research:

- iShares ESG Aware MSCI USA ETF: This is a derivative of the MSCI USA index, and tracks the performance of US companies that have positive ESG characteristics.

- SPDR S&P 500 ESG Screened UCITS ETF: Tracks the S&P 500 index but excludes companies involved in ESG controversies or with exposure to civilian firearms, tobacco and thermal coal.

- Invesco Solar ETF: Tracks the performance of companies in the global solar energy business.

- Robo-advisers such as Syfe and Endowus provide ESG-themed portfolios to invest in.

As with any investment, ESG investing comes with its risks. Integrating sustainability considerations across investments is challenging and complex, given the lack of common reporting standards and the difficulty in applying them across a diverse range of industries.

There’s also the risk of greenwashing, where some businesses market themselves as sustainable by providing false and misleading information about their practices.

The good news? Effort is being poured into establishing common global standards. Regulators are also cracking down on greenwashing. We still have some way to go, but we’re getting there.

TL;DR:

- Sustainable investing is one way to put your money in businesses that align with your personal values

- Sustainable investing has demonstrated returns not far off from conventional investments

- Excluding or including specific companies, or investing in particular ESG themes, are some popular strategies

- Plenty of funds applying such strategies are available for investment

Copyright SPH Media. All rights reserved.