India’s private-credit market faces risks as exuberance grows

One risk stems from first-time managers of capital, who may have lighter standards in underwriting, due diligence and loan structuring

THERE have been rising concerns about weaker lending standards in India’s direct-lending sector, as new participants rush into the country’s fast-growing private-credit market.

“We have seen a bunch of first-time managers raise a lot of local capital,” Indranil Ghosh, head of Pan-Asia special situations at Cerberus, said at the Bloomberg India Credit Forum in Mumbai last Friday (Oct 18). “With some of those managers, I suspect that the underwriting standards, the diligence standards, the structuring, covenants are slightly lighter than what a lot of the global firms and well-established domestic institutions are used to.”

The term “private credit” can mean different things in different places. By some definitions of the term, India is considered one of its original practitioners with its rich history of non-bank lenders.

However, the country has remained relatively new to the sort of funding that many observers associate with private credit. India has only recently been more involved with local and global funds that are focused specifically on strategies such as direct lending, special situations and mezzanine finance.

Local companies have been fuelling competition against global giants such as Cerberus and Oaktree Capital Management. India’s direct-lending market has yet to come through a full credit cycle and troubles at some players may eventually result in consolidation, said Cerberus’s Ghosh.

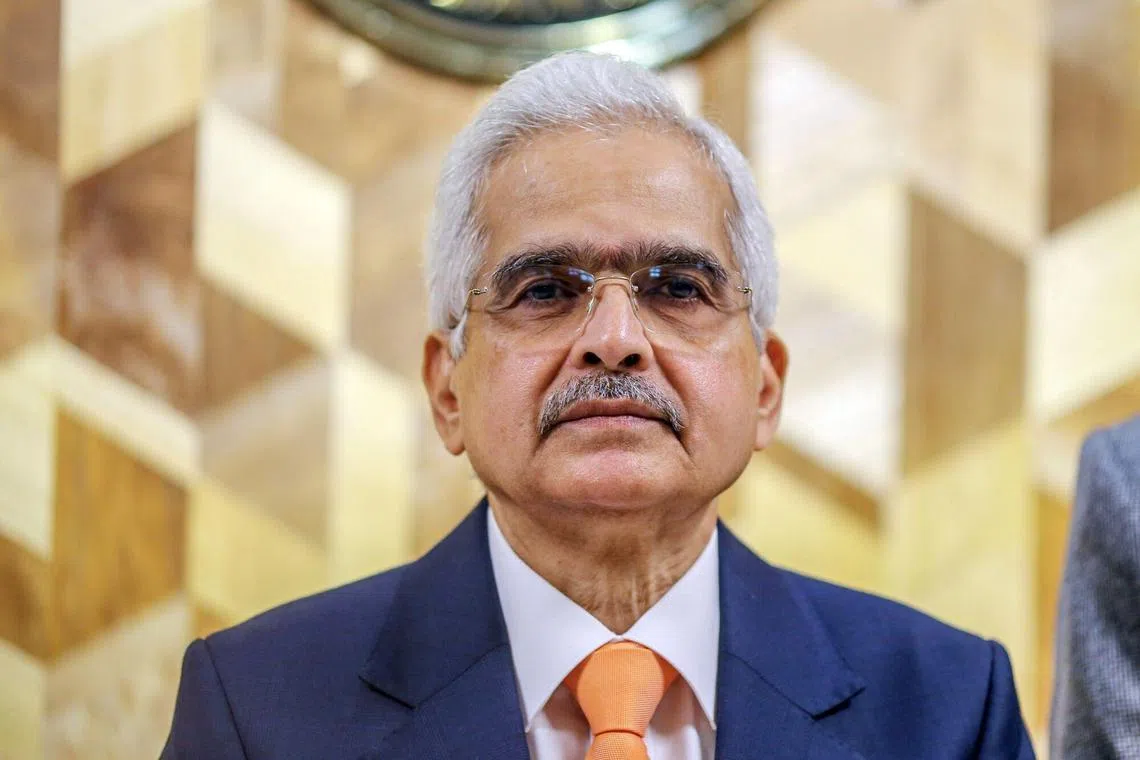

India’s central bank chief has remained relatively optimistic about the outlook for the sector. However, he expressed concern from a global perspective.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Reserve Bank of India (RBI) governor Shaktikanta Das said that the central bank does not see the kind of risks observed globally in India’s private-credit market. At the global level, the “robustness and resilience of private credit is yet to be tested” and “every central bank or every regulator should be looking into” the possible risks, he added.

Since 2019, the global private-credit industry has more than doubled in size to US$1.7 trillion.

The market’s opaque nature has attracted greater scrutiny from regulators, including the European Central Bank and the Bank of England, as higher borrowing costs weigh on weaker borrowers and trigger more bad loans.

Current private debt returns fail to justify the growing risk in private credit, said Mohit Mittal, chief investment officer of core strategies at Pacific Investment Management. He warned of “more complacency” in the sector.

In India, with the proliferation of credit funds, there is the possibility that some covenants could get diluted and prices become stretched, said Lakshmi Iyer, chief executive officer of investments and strategy at Kotak Alternate Asset Managers.

But she has remained upbeat about the long-term outlook for the industry in India, citing growing interest from local investors in the sector. “We are still just at the tip of the iceberg as far as the size and scale of the credit markets in India,” the chief executive added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services