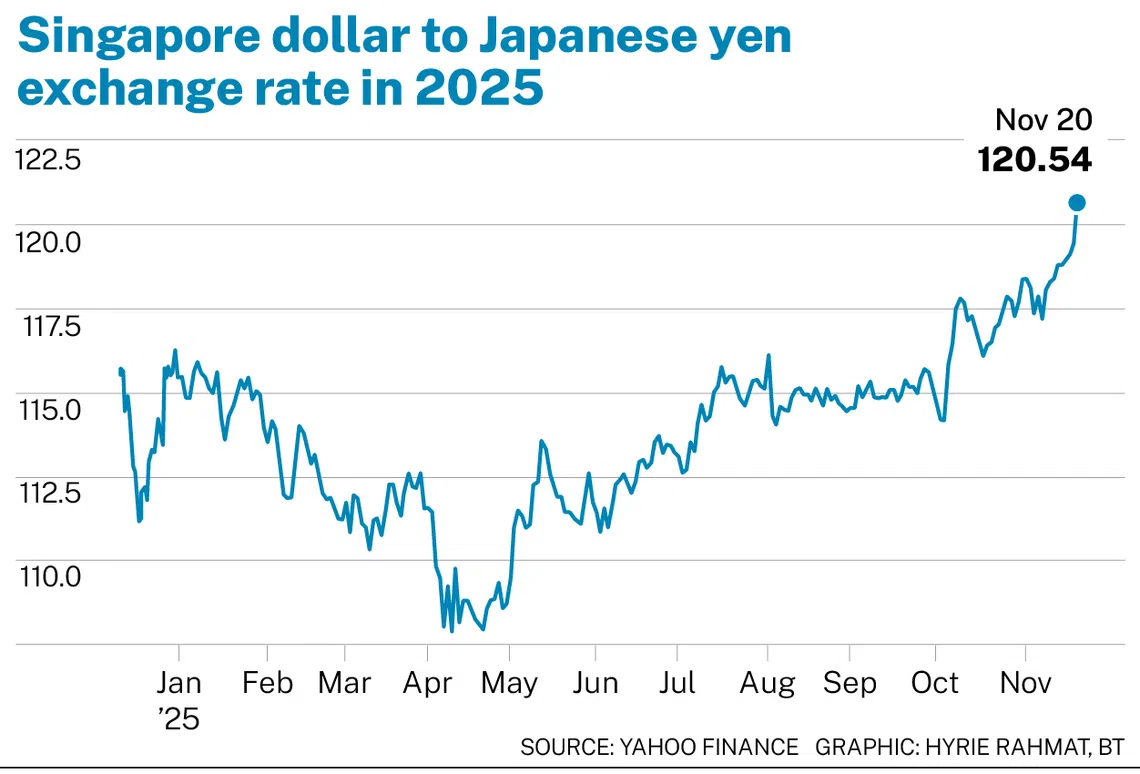

Fresh high: Singdollar stays above S$1-to-120-yen mark

The exchange rate first crossed the threshold on Nov 19

[SINGAPORE] The Singapore dollar stayed above the S$1-to-120-yen mark on Thursday (Nov 20), standing at 120.39 yen as at 6.35pm, after having peaked at 120.64 at around 3pm, Bloomberg data indicated.

The exchange rate first breached the threshold on Wednesday evening.

The Singdollar has appreciated 4.4 per cent against the yen in the year to date.

Mastercard’s Travel Trends 2025 report in May noted that the number of Singaporean visitors to Japan in 2024 hit a record high, thanks to a 40 per cent rise in the Singdollar against the yen – despite airfares and hotels getting pricier.

Christopher Wong, executive director and FX strategist at OCBC, said the Singapore dollar’s relative strength has been largely driven by persistent weakness in the Japanese yen.

“Several factors continue to weigh on the yen, including ongoing fiscal concerns, delayed normalisation of Bank of Japan (BOJ) policy, and geopolitical tensions between China and Japan,” he said.

Wong added that the Japanese government is signalling greater fiscal flexibility. But he said that such fiscal expansion raises concerns over a heavier fiscal burden amid rising debt servicing costs and questions about fiscal discipline, even if it could support growth.

This may “continue to undermine the yen in the near term”, he said.

Although intervention risks are rising as the yen weakens further, he pointed out that that is unlikely to reverse the yen’s broader depreciation trend; instead, it will likely only moderate the pace of decline rather than change its overall direction.

The fresh high notched by the Singdollar against the yen has practical implications for travellers, corporates and markets, said Saktiandi Supaat, head of FX research and strategy at Maybank.

“A stronger Singdollar means lower travel and import costs from Japan for Singapore households and businesses. For corporates exporting into Japan, however, the stronger Singdollar may weigh on price competitiveness,” he said.

He expects the Singdollar to remain elevated “with a slight upward bias” over the next few weeks, barring a surprise shift in fiscal policy from the BOJ, and improvements in the situation between China and Japan.

He noted that structural drivers – such as the soft Japanese inflation momentum and the demand for the Singdollar due to its safe-haven status – remain intact.

While he expects the Singdollar to hold around 120 yen through the end of 2025, he forecasts it will weaken to about 112 yen by end-2026.

In a note published on Thursday, DBS forecast a “high likelihood of elevated JPY volatility” due to policy risks. It added that investors could monitor intervention risks in the yen and Japanese Government Bond markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.