US dollar surges against Singapore dollar, major currencies on Trump’s tariffs

The greenback has gained against many major currencies, sending the Canadian dollar to its weakest since 2003 and the euro to its lowest since November 2022

THE US dollar strengthened against the Singapore dollar on Monday (Feb 3), building on sharp gains over the weekend as US President Donald Trump announced tariffs on goods from China, Canada and Mexico.

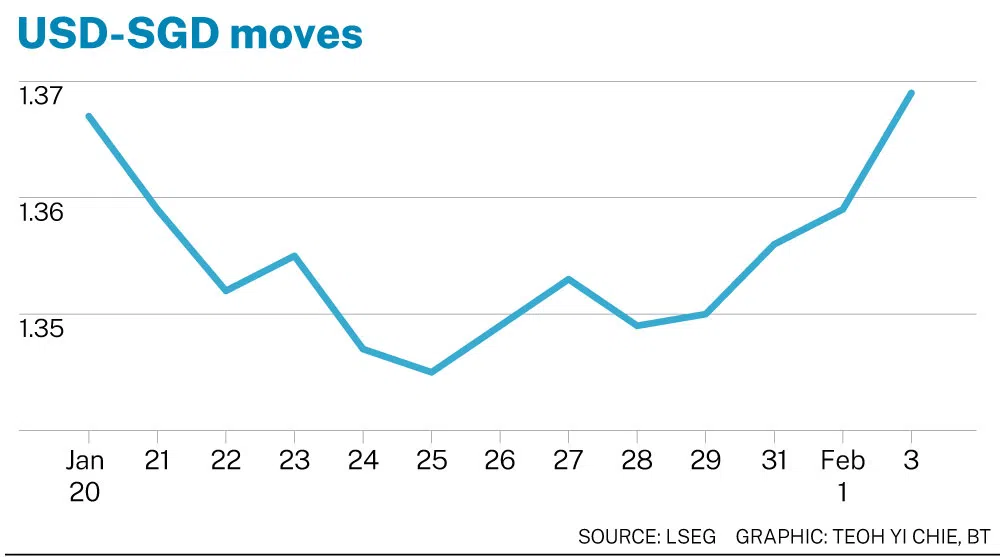

The greenback rose as much as 0.9 per cent against the Singapore dollar, fetching S$1.3681 in the early hours of Asia trade on Monday. It was last at S$1.3664.

Since Saturday, the US dollar has leapt 0.97 per cent against the Singapore currency, from the currency pair trading at around S$1.353 on Saturday. Since early last week, the greenback has strengthened 1.8 per cent against the Asian currency.

The dollar index gained against most global currencies on Monday, as it last strengthened more than 1 per cent to 109.63.

It gained against many major currencies, sending the Canadian dollar to its weakest since 2003, the euro to its lowest since November 2022 and the Mexican peso to a near three-year low, according to Bloomberg data. The Australian dollar, a proxy for the Chinese economy, fell to an almost five-year low.

Losses had started gaining steam on Friday. UOB noted in a Feb 3 note that the Japanese yen led losses within the group of G10 currencies on Friday, with the US dollar rising 0.6 per cent. The greenback strengthened the most – gaining 1.45 per cent – against the Malaysian ringgit.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Trump ordered 25 per cent tariffs on Canadian and Mexican imports and 10 per cent on goods from China on Saturday US time, although news had already leaked earlier in the week with Reuters citing sources that the announcement would take place on that day. The tariffs will start on Tuesday.

The escalation in trade tensions is sparking expectations of higher inflation and higher-for-longer US rates. Demand for currencies from other countries would weaken as their imports get more expensive.

The Indonesian rupiah, Indian rupee and Philippine peso should outperform the more trade-related Singapore dollar, Malaysian ringgit and Korean won, said Maybank in a note on Friday.

The Monetary Authority of Singapore (MAS) also eased its monetary policy for the first time since 2020 on Jan 24 this year on expectations of slower growth than initially forecast.

The MAS said it will “slightly” reduce the slope of the Singapore dollar nominal effective exchange rate policy band, with no change to the width of the band or the level at which it is centred.

The central bank manages policy by using the exchange rate – as opposed to interest rates.

“Market reaction to MAS easing has been rather muted – a possible indication that this move was expected,” said Maybank in another Feb 3 note.

“We expect the Singapore dollar be sheltered given the correlation of SG/US rates. Moreover, Singapore is unlikely to be singled out by the US for additional tariffs given that it has a bilateral trade deficit with the US. Regional safe -haven properties are also likely to be supportive of the Singapore dollar,” said Maybank.

Against the Singapore dollar, the US dollar weakened from levels around S$1.35 before the announcement, to around S$1.34 in the days following. The greenback, however, strengthened again from Jan 28.

“MAS policy continues to be supportive of Singapore dollar strength and we look for the resilience to continue even with this easing,” said Maybank.

The greenback-Sing dollar exchange rate has wide impact on Singapore as the two countries have a close and substantial trade relationship, underpinned by the US-Singapore Free Trade Agreement that entered in force on January 1, 2004.

According to the US Trade Representative office, the US enjoyed a US$38 billion goods and services trade surplus with Singapore in 2022 on a total trade value of US$122 billion. Exports were US$80.5 billion; imports were US$42.2 billion.

US foreign direct investment in Singapore (stock) stood at US$309.4 billion in 2022, an 8.7 per cent increase from 2021. US direct investment in Singapore is led by non-bank holding companies, manufacturing, and wholesale trade.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.