CapitaLand Ascott Trust H2 DPS inches up 0.8% to S$0.0358

The rise in H2 FY2025 DPS follows a 4% growth in revenue to S$439.1 million for the half year

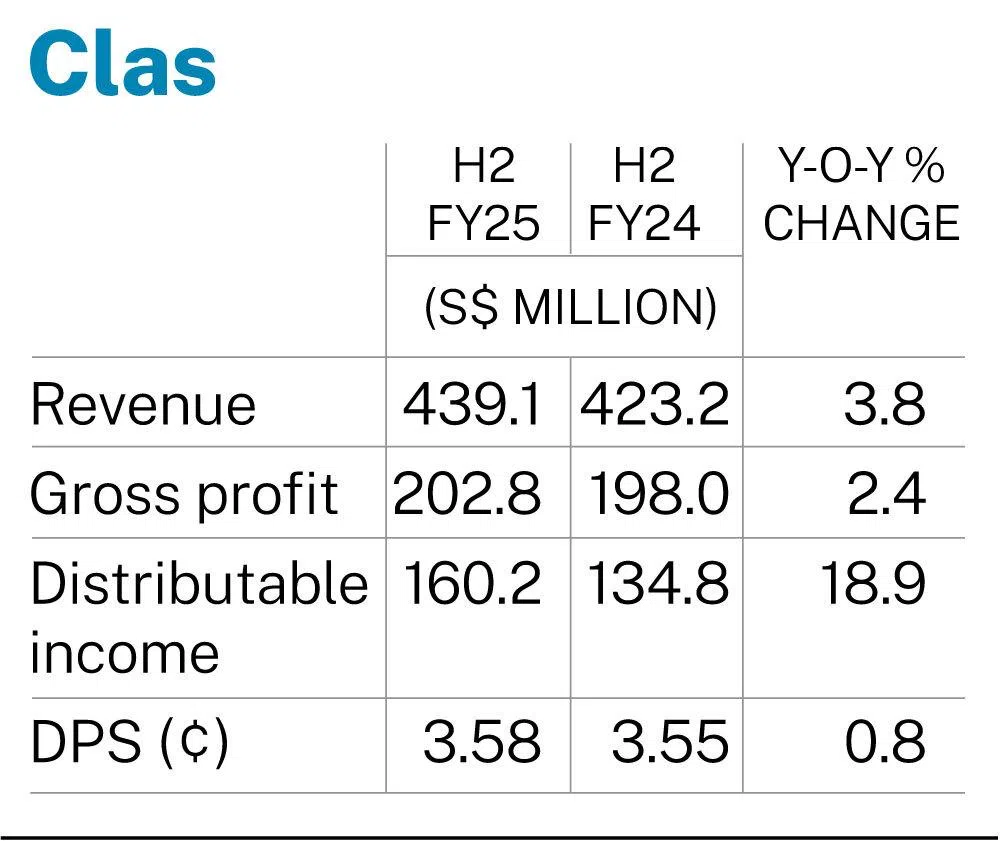

[SINGAPORE] CapitaLand Ascott Trust (Clas) on Thursday (Jan 29) posted a marginal 0.8 per cent rise in distribution per stapled security (DPS) to S$0.0358 for the second half ended Dec 31, 2025, from S$0.0355 in the year-ago period.

Its core DPS fell 4 per cent on the year to S$0.0295, from S$0.0308 in H2 FY2024. This was mainly due to the property tax adjustments in FY2024 and FY2025, said the managers of Clas in a bourse filing on Thursday evening. Excluding these adjustments, core DPS would have been “relatively stable”.

The distribution will be paid out on Feb 27, after the record date on Feb 6.

The rise in H2 FY2025 DPS follows a 4 per cent increase in revenue to S$439.1 million for the half year, from S$423.2 million in the year-ago period. Gross profit rose 2 per cent to S$202.8 million, from S$198 million a year prior.

The managers attributed the growth to stronger operating performance, portfolio reconstitution and asset enhancement initiatives (AEIs), which helped offset the impact of foreign-currency depreciation against the Singapore dollar and property tax adjustments.

There was a slight uptick in its revenue per available unit (RevPAU) to S$171 a day in the half-year, from S$167 a day in the year-ago period.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

These pushed distributable income in the three months to S$160.2 million, up 19 per cent from H2 FY2024’s S$134.8 million.

For the full-year, distributable income jumped 11 per cent year on year to S$256.7 million, from S$231.2 million in FY2024. Revenue rose 3 per cent on the year to S$837.6 million, from S$809.5 million the previous year.

This brought DPS for FY2025 to S$0.061, holding steady from FY2024. After adjusting for non-periodic items, core DPS stood at S$0.0535, down 3 per cent from S$0.0549 recorded in the same period the year before.

Net asset value per stapled security stood at S$1.17 as at end-2025. Gearing fell to 37.7 per cent, from 39.3 per cent, following the divestment of Citadines Central Shinjuku Tokyo in October 2025, and higher asset values from portfolio valuation gains. This will provide ample debt headroom to support growth, said the managers.

The interest cover ratio was “healthy” at 3 times, with 78 per cent of debt effectively on fixed rates.

Weighted average debt maturity stood at 3.4 years, with average cost of debt remaining “low” at 2.9 per cent per annum.

An Australian master lease, which accounts for 3 per cent of gross rental income from master leases, is set to expire in Q4 2026. The bulk of master leases, at 78 per cent, expire in 2030 and beyond.

Serena Teo, chief executive of the managers, said in a statement on Thursday that the managers intend to strengthen the resilience of Clas’ portfolio by bolstering its presence in key markets and recycling capital from divestments.

“We are progressing towards our medium-term portfolio allocation of 25 to 30 per cent in the living sector, while maintaining 70 to 75 per cent in hospitality assets,” she noted. More AEIs are also planned in cities such as London, Sydney and New York, which will improve asset performance and value, she added.

Stapled securities of Clas closed flat on Thursday at S$0.965, before the announcement.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.