CDL to add zing to its portfolio with redevelopments, divestments

It is also looking at listing a Reit on SGX for UK commercial properties; group H1 net profit plunges 99% to just S$3.1m

Singapore

DESPITE seeing its first-half bottom line whittled to just S$3.1 million, City Developments Ltd (CDL) is looking to rejuvenate its portfolio by redeveloping some assets. It is also planning to divest some non-core hotels held by the group, and some of the investment properties held by Sincere Property Group in China. (CDL completed the acquisition of an effective 51.01 per cent stake in Sincere only in April.)

On the fund management side, the group is looking to list a Reit on the Singapore Exchange holding UK commercial properties; this could take place in Q1 next year.

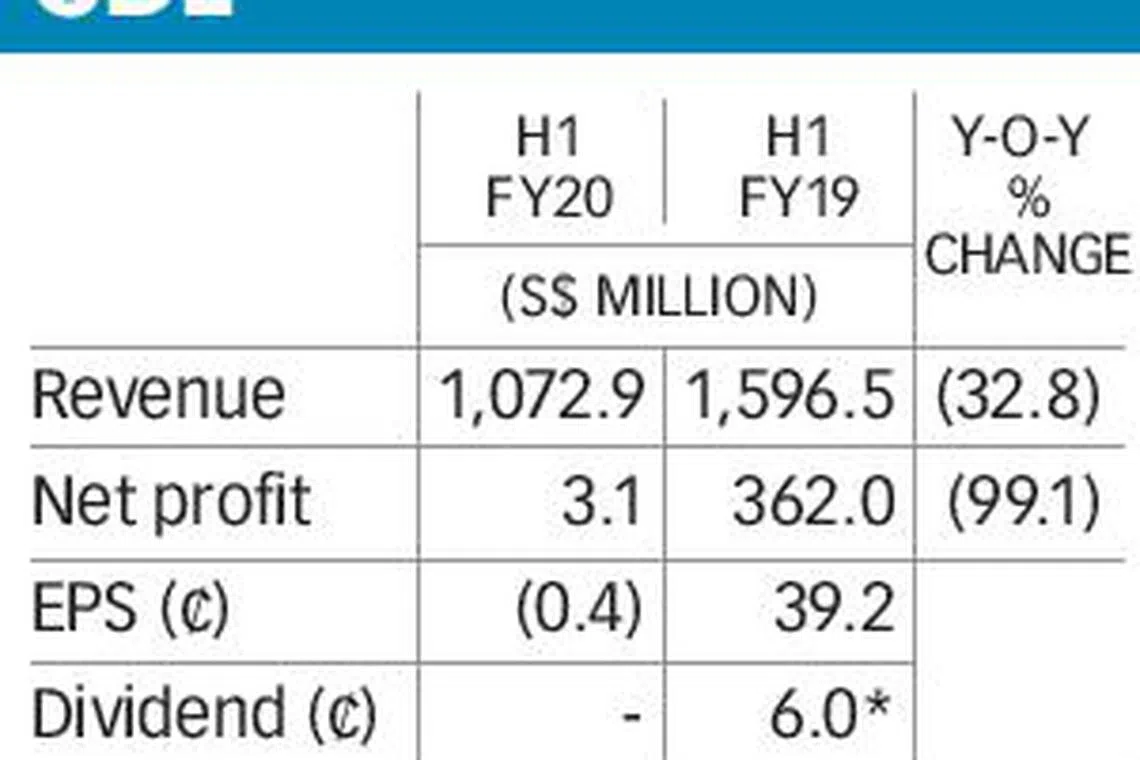

The group will not be paying shareholders an interim dividend for FY2019.

CDL's S$3.1 million group net profit for the first-half ended June 30 is a sharp fall from the S$362 million net earnings in the year-ago period.

The earnings drag came mainly from its hotel operations segment, which posted a pre-tax loss of S$208.2 million (including S$33.9 million of impairment losses made in view of the Covid-19 pandemic).

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Also eroding the bottom line was lower divestment gains in H1 2020. Included in H1 2019 was a substantial S$197.2 million pre-tax gain from the unwinding of the group's profit participation securities 2 platform, following the sale of Manulife Centre in Bras Basah Road, and 7 and 9 Tampines Grande.

The group's bottom line was expected to receive a substantial fillip from a negative goodwill item arising from CDL's completion of the 51.01 per cent stake in Sincere. But the item turned out to be a lot smaller than what the market had been expecting.

A negative goodwill, and fair value of the call option to acquire a further 9 per cent stake in Sincere totalling S$50.9 million was recognised in H1 2020. "The group also accounted for a post-acquisition share of loss of Sincere due to financing and marketing costs incurred by Sincere, and depreciation of Sincere's investment properties due to alignment of accounting policy," CDL said in its statement.

Profit before tax from property development fell to about S$115 million in H1 2020 from S$180 million in the year-ago period. This had to do with H1 2020 contributions coming largely from The Tapestry, Whistler Grand and Amber Park, which had thinner profit margins.

In contrast, the contribution in H1 2019 came primarily from New Futura, Gramercy Park and Hong Leong City Center in Suzhou, which had higher profit margins.

That said, the group's top management was upbeat about Singapore's private housing market at a virtual briefing on Thursday. CDL's group chief executive, Sherman Kwek, said: "We are very encouraged and we see our property development business in Singapore as being quite resilient.

"So far, while sales volumes are down, we've continued to move inventory, and the pricing has remained fairly stable. In fact, (at) some of the projects, we've been increasing pricing as we start to shift a greater amount of inventory. So I still see that the outlook is pretty positive for residential in Singapore; it would just take a while to come back."

CDL's executive chairman, Kwek Leng Beng, stressed that there are "a lot of overseas people" coming in to Singapore to pick up properties, which he read as "a very good sign". Even during the circuit-breaker partial lockdown, the group sold units at the high-end Boulevard 88 and South Beach Residences to foreigners.

A tie-up between CDL and Hong Leong Holdings is slated to launch a 566-unit condo, Penrose, along Sims Drive in the third quarter of this year.

In the CBD, the group is progressing on its redevelopment plans for Fuji Xerox Towers, a freehold office building, by capitalising on the Urban Redevelopment Authority's CBD Incentive Scheme.

Subject to the approval of the relevant authorities, the plan is to develop a 51-storey mixed-use integrated project on the site, with around 60 per cent of gross floor area (GFA) for residential units for sale and serviced apartments for rent, and the remaining 40 per cent gross floor area for commercial purposes. There is potential for 25 per cent uplift in GFA to about 655,000 sq ft.

The submission for provisional permission is being prepared; demolition-related works are slated to begin in the second half of 2021.

Over in the Singapore River area, CDL is actively exploring the redevelopment of Central Mall - a freehold commercial building with a cluster of adjoining 99-year conservation shophouses - to revitalise the area with a proposed mixed-use integrated development comprising office, retail, serviced apartments and hotel components.

Preliminary planning applications are being reviewed for the proposal, which is subject to approval under the URA's Strategic Development Incentive Scheme.

A collaboration with the neighbouring Central Square owned by the Far East Organization group is expected.

Mr Sherman Kwek said that after the privatisation of Millennium & Copthorne Hotels, and the investment in Sincere, the group is not looking to make any "big, substantial game-changing acquisitions" at the moment. "We need to conserve cash and ensure that we can ride out the current pandemic."

The senior Mr Kwek said the group will strive for cash preservation, prudent capital management and business optimisation to boost liquidity and fortify the group's balance sheet.

As at June 30, the group's cash and available undrawn committed bank facilities totalled S$4.0 billion. Since then, this position has improved to S$5.1 billion.

Revenue slipped 32.8 per cent to S$1.07 billion in H1 FY2020 from S$1.6 billion in H1 FY2019.

CDL posted loss per share of 0.4 Singapore cent in H1 FY2020 after factoring in the preference dividend payout of S$6.4 million for the first half. In H1 FY2019, the group posted earnings per share of 39.2 cents.

The counter closed 12 cents higher at S$8.46 on Thursday. The group had released its results before the stock market opened.

In a report titled "A H1 2020 to forget as redevelopment/divestments loom", Citi Research analyst Brandon Lee said he is maintaining his "Buy" recommendation for the counter.

"City Developments' H1 FY2020 results reflect the severe impact of Covid-19, particularly on its hotels. However, improved US occupancy offers confidence that its overseas hotels are starting to see some light."

Mr Sherman Kwek acknowledged that there will be construction delays at the group's ongoing projects caused by the work stoppage during the circuit-breaker period and the continued labour shortage thereafter, among the measures to keep workers Covid-free.

That said, he added: "I anticipate that our projects should all resume and, it is hoped, (reach) optimal capacity within the next two months or so.

"We are working closely with our contractors, including allowing for extension of time. I have always believed it's a partnership..."

While some naysayers are predicting the eventual demise of office space amid the work-from-home trend which has taken root this pandemic, Mr Sherman Kwek made a passionate case for office space.

"If you think about it ... all of our life experiences, whom have you learned the most from? It's usually from your mentors, be it your boss or other people that you respect at work, and you'll never craft that sort of relationship by working from home.

"I mean, these sorts of relationships and mentorships are all crafted when you're in the office, working with someone and creating interpersonal relationships."

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.