Coffee on boil: Not everyone’s cup of tea

The combination of weather disruptions, logistics challenges and strong demand has created a volatile yet resilient market

COFFEE, once seen as a luxury, has evolved into a daily necessity, deeply ingrained in the lifestyles of millions worldwide. Yet, behind the familiar aroma that greets coffee drinkers each morning, the global coffee market is facing a perfect storm of challenges. From extreme weather events in Brazil and Vietnam to logistics disruptions and shifts in supply chains, the industry’s volatility is set to continue.

Brazil, the world’s largest producer of Arabica coffee, and Vietnam, which leads in Robusta production, are facing severe weather-related disruptions that are driving up coffee prices. Brazil has been grappling with the driest weather since 1981, compounded by low rainfall throughout 2024. These harsh conditions have led to a significant reduction in the country’s coffee production, causing concern throughout the global market.

Meanwhile, Vietnam, the second-largest coffee producer, has also been hit hard by weather-related challenges. Typhoon Yagi, combined with El Nino conditions, resulted in a reported 20 per cent drop in coffee production, marking the lowest output in four years. The excessive dryness forecast for the coming months threatens further reductions, exacerbating the existing supply concerns for Robusta coffee.

Beyond the weather challenges, logistics disruptions are also playing a role in driving up coffee prices. Clogged ports and shipping delays – particularly in the Red Sea region – have hindered the timely movement of coffee, further tightening the market. As global coffee demand remains robust and largely uninterrupted, these supply chain bottlenecks are adding to the already elevated prices.

This disruption comes at a time when global coffee stocks are at dangerously low levels. Industry data highlights the alarming state of coffee inventories, raising fears that several years of adverse production could render these stocks irreparable. The pressure on physical markets is undeniable, with premiums being placed on available supplies.

While Arabica coffee remains the preferred choice for many coffee chains and consumers, the market has witnessed an unprecedented surge in Robusta prices. Robusta – generally viewed as the less desirable of the two major coffee varieties due to its stronger, more bitter taste – has experienced price gains of 80 per cent throughout 2024, compared to a 38 per cent rise in Arabica prices.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Initially, the shift to Robusta was driven by price-conscious consumers and businesses looking for more affordable alternatives to Arabica. However, as Robusta prices soared, its appeal as a cost-saving option is beginning to wane. With a price surge of more than 10 per cent in just two weeks, some analysts argued that Robusta’s meteoric rise may be unsustainable, particularly if weather conditions improve and production stabilises.

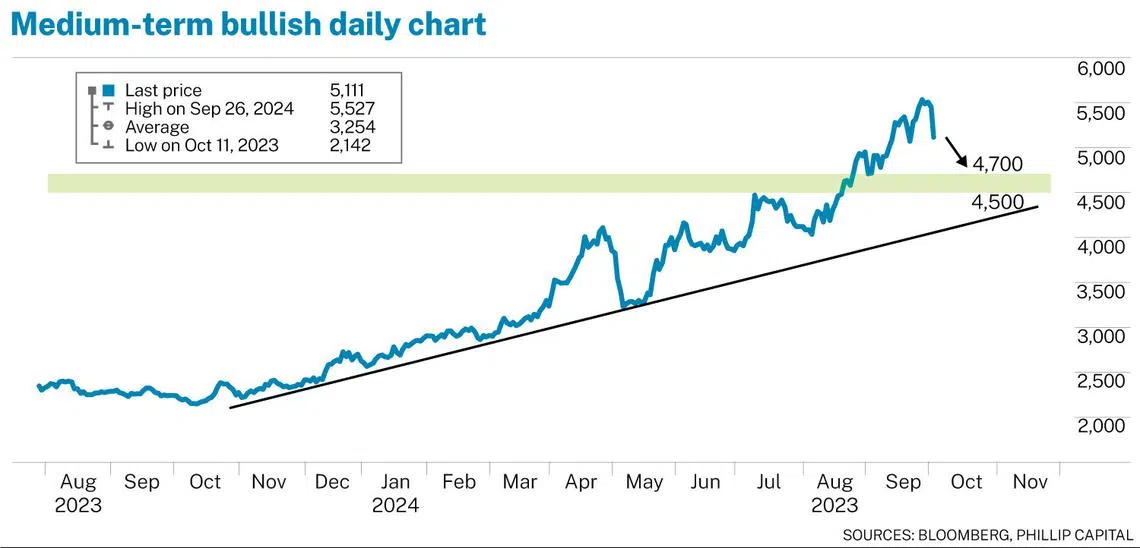

From a technical perspective, coffee prices have been on a constant rise with “higher highs and higher lows” throughout 2024. The necessary consolidation to sustain an 80 per cent surge is missing in the current upswing in coffee prices. It is usually difficult to forecast price projections when a commodity surges into uncharted territories. For now, if we plot an uptrending line (black) joining lows from November 2023 to the present, a technical pullback could be imminent, with immediate support around the 4,500 to 4,700 zone.

The focus in the coffee market is now shifting to production forecasts for 2025 and 2026. While the disruptive El Nino conditions are expected to soften, the months ahead are still likely to be hot and dry in Brazil’s key coffee-growing regions.

However, some analysts are optimistic, predicting a rebound in global coffee production by 2025. Arabica production is anticipated to reach nearly 100 million 60 kg bags, marking a significant recovery compared to the previous three seasons. Similarly, Robusta production is expected to recover to 76 million bags, bringing total global production to approximately 176 million bags, potentially matching the record output of the 2020/2021 season.

For major coffee chains such as Starbucks and Luckin Coffee, the rise in coffee prices presents a complex challenge. While the demand for premium coffee remains strong, driven by rising disposable incomes and a growing consumer preference for speciality drinks, businesses face mounting pressures from all sides.

Coffee price increases are just one piece of the puzzle; the costs of other key inputs such as sugar, milk and even disposable cups are also on the rise due to inflation and supply chain issues. There are also speculations around EU regulations as the magnitude of their impact, when they are fully enforced, on soft commodities such as coffee remains unclear.

As the world’s top two coffee producers struggle to recover from weather-induced crises, the outlook for the global coffee market remains uncertain. The combination of weather disruptions, logistics challenges and strong demand has created a volatile yet resilient market. Even with the anticipated recovery in production, the insatiable demand for coffee – especially from younger generations – could outpace supply, keeping prices elevated in the coming years.

The writer is senior market analyst, Phillip Nova

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.