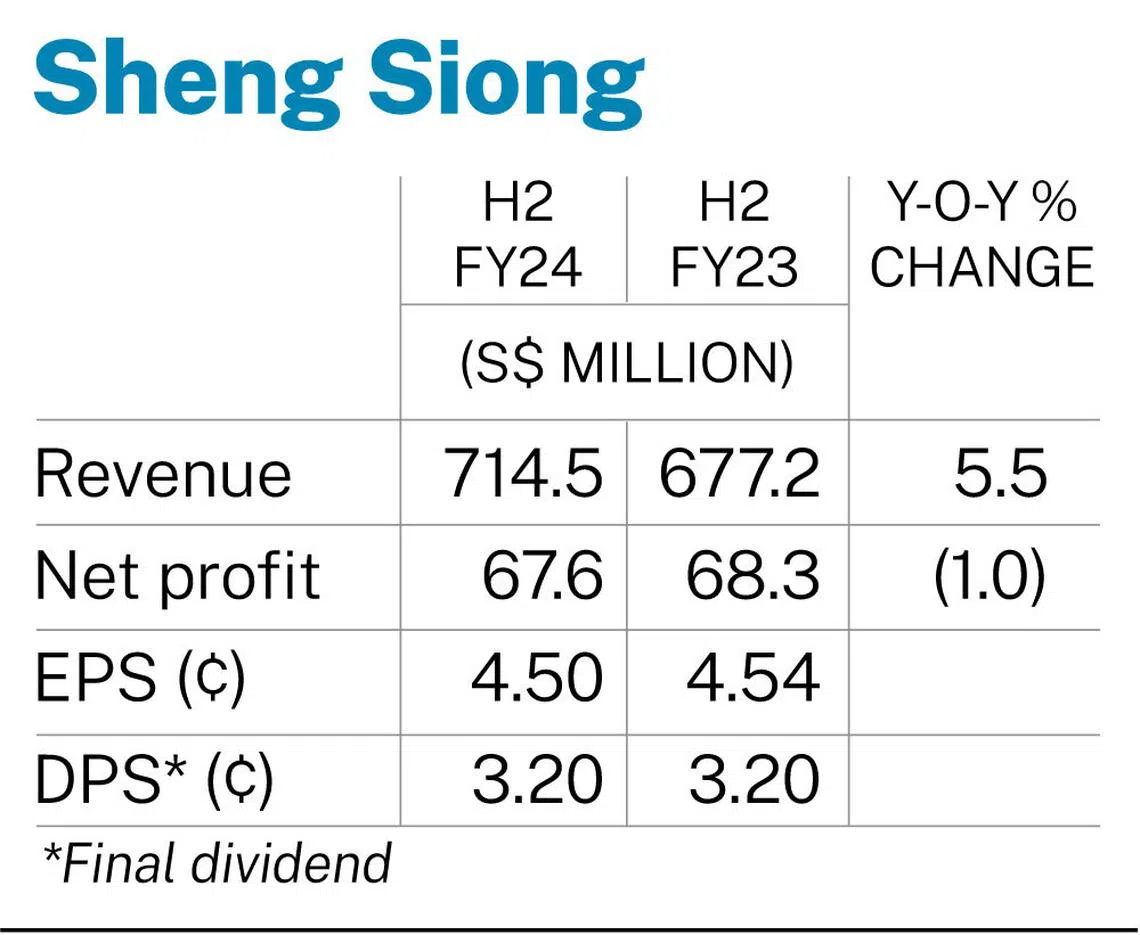

Sheng Siong delivers 1% lower net profit for H2 as higher expenses bite

An increase in staff costs is primary driver of rise in administrative and selling and distribution expenses

KEY POINTS

H2 FY2024

- Revenue: S$714.5 million (+5.5%)

- Net profit: S$67.6 million ( -1%)

- Final dividend: S$0.032 per share

SUPERMARKET operator Sheng Siong delivered a 1 per cent lower year-on-year net profit of S$67.6 million for the second half of the 2024 financial year ended December, as increases in finance and administrative expenses outstripped the rise in revenue.

In the financial results published on Thursday (Feb 27), the operator posted a revenue of S$714.5 million for H2, up 5.5 per cent on year.

But administrative expenses, selling and distribution expenses, as well as finance expenses recorded higher increases during the period.

Administrative expenses surged 21.6 per cent to S$30.6 million, and selling and distribution expenses were 10.1 per cent higher at S$123 million.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It attributed these higher expenses to higher staff costs resulting from higher variable bonuses due to better financial performance, enhanced employment benefits, and an increased number of employees because of more stores.

Earnings per share stood at S$0.045, lower than the S$0.0454 for the same period in the prior year.

A final dividend per share of S$0.032 was recommended – unchanged from FY2023. It will be paid out on May 16, if shareholders approve.

The total dividend, inclusive of the interim dividend of S$0.032, is S$0.064, marginally higher than the S$0.0625 for FY2023.

The net asset value per share was S$0.3558 as at Dec 31, 2024, compared with S$0.3284 as at the end of FY2023.

For FY2024, revenue was 4.5 per cent higher at S$1.4 billion, primarily driven by the opening of six new stores in FY2024 and two in FY2023 in Singapore, as well as the improved performance of the existing stores.

The net profit for the full year increased by 2.9 per cent to S$137.5 million.

More in store

From the beginning of FY2024 to date, the operator has opened eight new stores in Singapore and a sixth in Kunming, China.

As at the end of 2024, it had a total of 75 stores in Singapore, and aims to open at least three new stores every year.

Meanwhile, the tender results for another eight stores from the Housing and Development Board are pending.

Sheng Siong noted that consumers in Singapore are becoming more value-conscious as the market evolves, seeking greater affordability and quality in their purchases, which bodes well for its “budget-friendly” products as well as house brands.

It added that it will exercise care in opening new stores in China, given the competitive landscape, and will focus on improving the performance of existing stores.

The counter was 1.2 per cent or S$0.02 higher at S$1.65 on Thursday, before the financial results were published.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.