Cortina Holdings posts 72.3% jump in H2 net profit on recovery from supply chain disruption

LUXURY watch retailer Cortina Holdings on Friday (May 27) posted a 72.3 per cent increase in net profit to S$43.3 million for its fiscal second half ended Mar 31 on the back of a recovery from the supply chain disruption which it faced.

The recovery led to better sales mix and stock allocation, the company, which reported a net profit of S$25.2 million over the same period in the previous financial year, said in a filing on Friday (May 27).

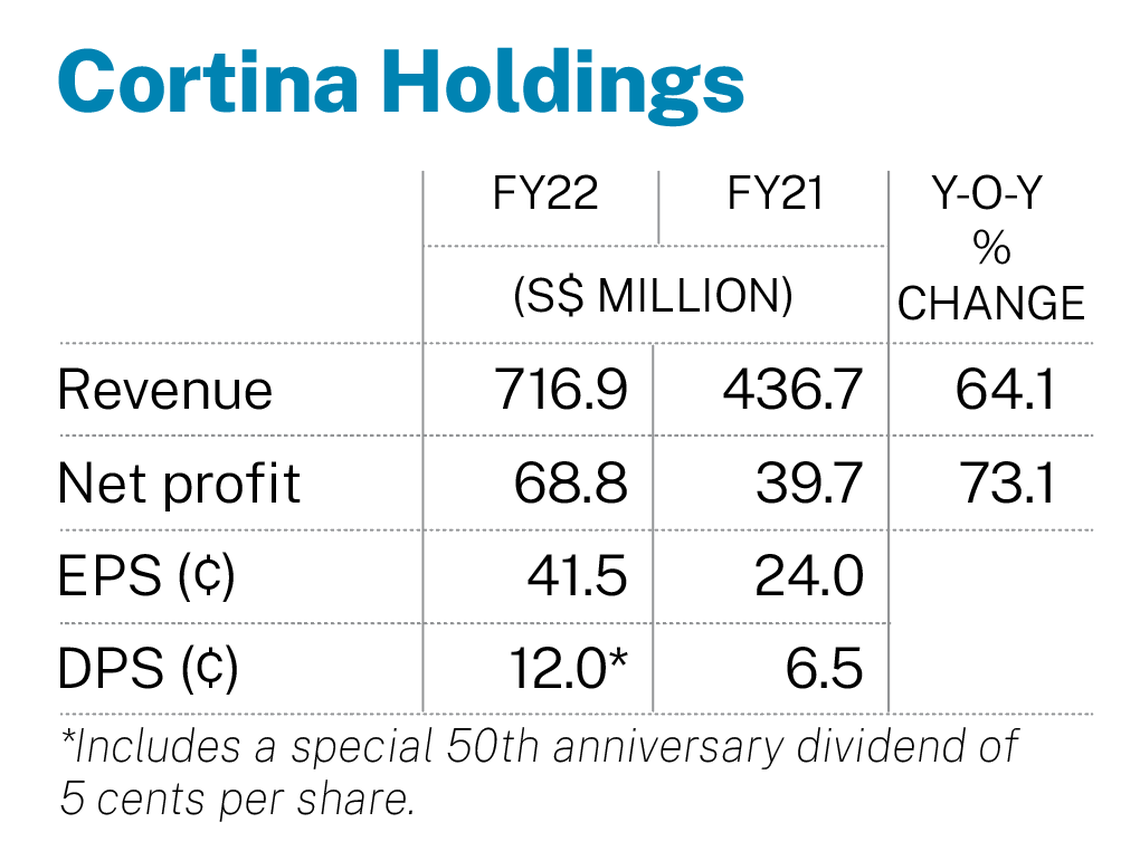

For the full year, earnings per ordinary share stood at 41.5 Singapore cents, compared to 24 cents in the year-ago period, as its net profit rose 73 per cent to S$68.8 million, from S$39.7 million a year ago.

With the results, the group proposed a final dividend of 2 Singapore cents per share, a special dividend of 5 cents per share, and a special 50th anniversary dividend of 5 cents per share for the financial year. A 2-cent final dividend and 4.5-cent special dividend were declared last year.

The proposed dividend, if approved by the shareholders at the annual general meeting to be held on Jul 29, will be paid on a date to be announced later.

Its latest financials also showed that its revenue grew by 49.2 per cent to S$392.2 million. This brought its full-year revenue to S$716.9 million, which is 64.5 per cent higher than the previous year.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Cortina attributed this to the easing of Covid-19 restrictions in South-east Asia, as well as additional revenue from the acquisition of Sincere Watch in March 2021 – a component that was absent in the previous financial year.

Sincere Watch, however, contributed to a 80.9 per cent increase in operating expenses to S$82.2 million in the second half. Other reasons for the expense rise include higher sales related expenses such as salesman commission and credit card commission, and higher marketing expenses for brand development, Cortina said.

Nevertheless, the group’s sales margin in the 6 months improved to 35.1 per cent, from 29.6 per cent in the previous corresponding period.

The company said this was mainly due to the management’s effort in pursuing a new strategic direction with vendors to reduce slow-moving stocks. Full year sales margin was at 32.9 per cent, up from 29.1 per cent a year ago.

The counter closed flat at S$4.30 on Friday.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Telegram messaging service to allow Tether stablecoin payments

Hong Kong regulator to probe PwC auditing role over Evergrande

US: S&P, Dow open flat as Middle East jitters ease, Netflix weighs on Nasdaq

DBS puts 46 retail units, HDB shops on market for S$210 million

China to facilitate Hong Kong IPOs and expand Stock Connect

Global equity funds see surge in outflows as rate cut hopes fade