🔐 CPF hacks you may not know about

- Find out more and sign up for Thrive at bt.sg/thrive

🧝 What rhymes with sleepy elf?

For younger workers like myself, it’s easy to ignore money in our CPF accounts because it’s locked away out of sight and mind.

Even if you’re against the idea of forced retirement savings, it’s good to include CPF in your regular financial planning.

After all, CPF accounts for a sizeable portion of the average Singaporean’s retirement funds. And if you don’t try to make the best of it, you risk losing the chance to maximise the growth of these savings.

Here are six ways you can use CPF to meet your financial goals before you turn 55.

1. Invest your CPF savings

a) Ordinary Account (OA)

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

You’re allowed to invest money that’s in your OA. To do this, you need to set aside at least S$20,000 in your OA and get a CPF Investment Account from any of the three local banks.

But a word of caution if you do so: investing in longer-term, riskier assets can be dangerous if you need your OA balance to pay for mortgage and the downpayment for your current or future home.

If you know you won’t need your OA savings anytime soon or have excess funds after paying off your mortgage, it might be worth considering investing the balance into T-bills.

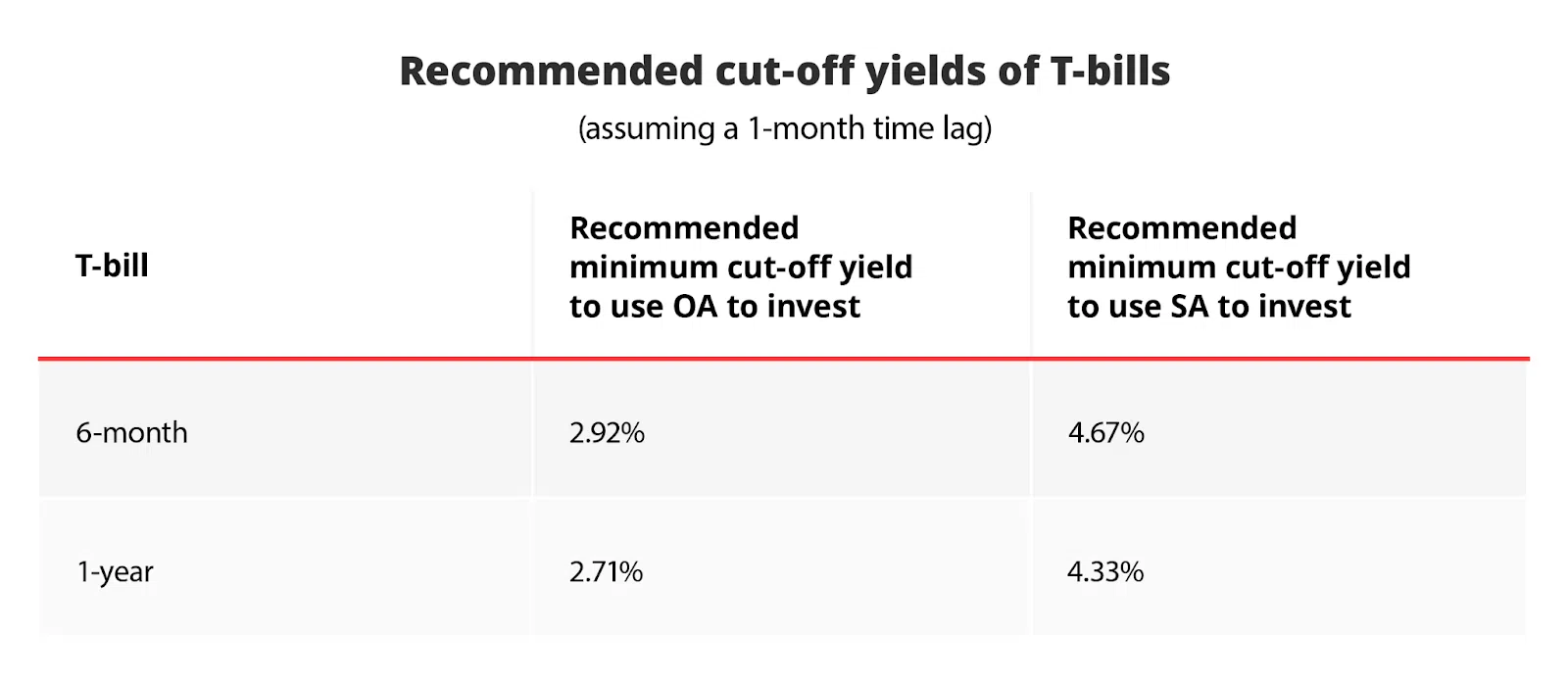

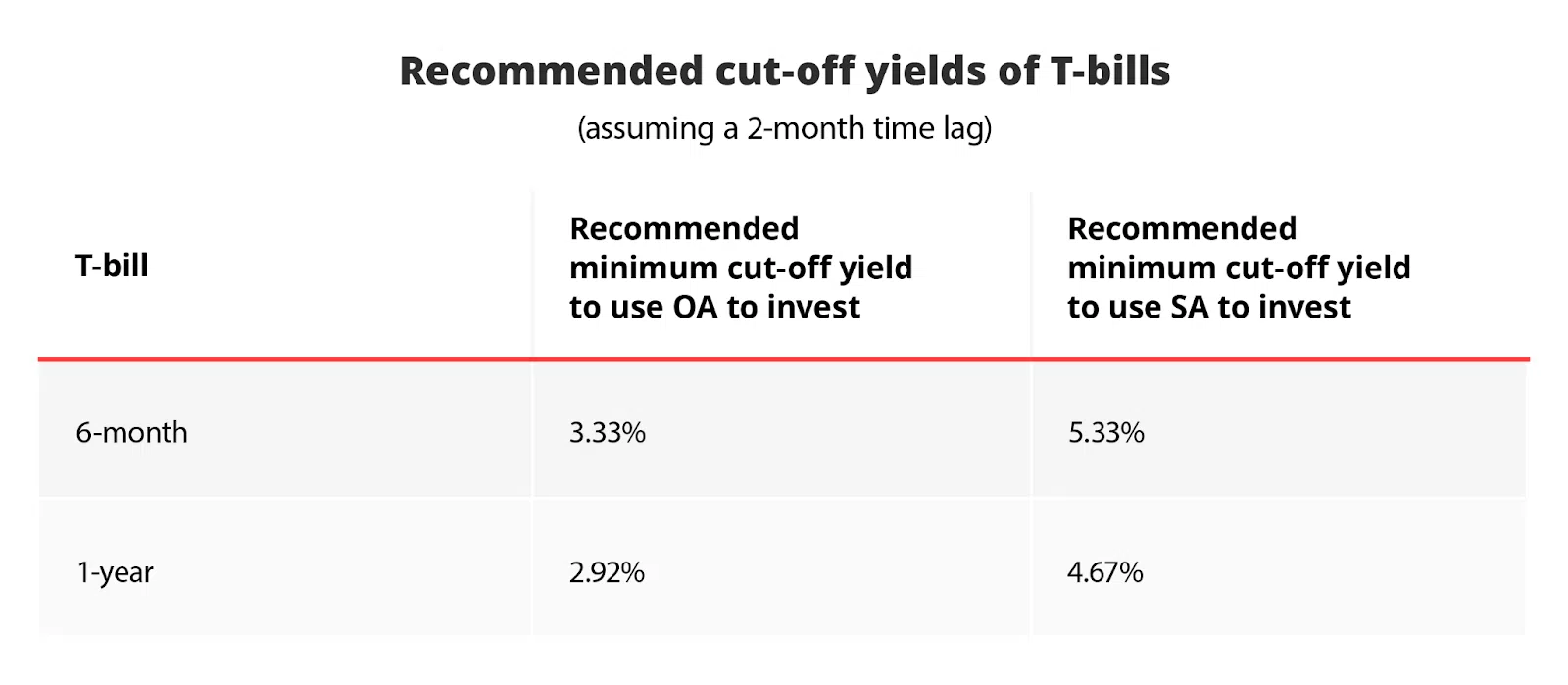

With the latest cut-off yield at close to 4 per cent, these low-risk government bonds with maturities of six months or a year could net you higher returns than the 2.5 per cent interest rate you get for leaving your money uninvested. (CPF pays an extra 1 per cent on the first S$60,000 across your CPF accounts, which is capped at S$20,000 for the OA which you have to set aside anyway.)

💡 Bear in mind though that because of the way CPF computes interest rates, you might lose up to two months of CPF interest depending on when the deduction is done from your CPF account.

b) Special Account (SA)

You can invest your SA balance as well, after setting aside S$40,000 in your SA. But since the SA pays a higher interest rate at 4.04 per cent, leaving your money in your SA will probably earn you more than investing them in T-bills. (The SA is meant for retirement savings and investments, giving you a higher interest rate, and that’s why its usage is limited.)

Based on DBS’ calculations, these are the minimum T-bill cut-off yields that will net you a higher return.

2. Don’t wipe out your OA paying for your home

When using your CPF OA to pay for your HDB housing loan, you can choose to retain up to S$20,000 in your OA. If you’re taking a bank loan, you can choose to retain any amount.

The idea behind not wiping out your OA is to maintain S$60,000 across your CPF accounts to capture the additional 1 percentage point interest, which gets credited to your SA (or Retirement Account (RA) when you turn 55).

Having some money left in your OA also provides a margin of safety, ensuring you can continue paying your monthly mortgage bills during emergencies such as being out of a job.

3. Top up your CPF for tax relief

Every calendar year, you get a dollar-for-dollar tax relief of up to S$8,000 when you make cash top-ups to your CPF SA or MediSave Account (MA).

The SA and MA pay a 4.04 per cent yearly interest rate. Topping up those accounts, even if you’re not in need of tax relief, can also be a good idea to grow your retirement pot especially if you don’t invest regularly.

Note that top-ups are irreversible, so only top up cash you are prepared to set aside for retirement.

4. Give your parents allowance through CPF

If you’re already giving your parents an allowance, why not consider topping up their CPF accounts instead and cutting down on your tax bill at the same time?

On top of the S$8,000 tax relief limit for topping up your own CPF accounts, you can get an additional S$8,000 relief when you top up your loved one’s SA, MA or RA.

💡 The tax relief, however, is only eligible for top-ups up to the current Full Retirement Sum.

5. When you make your top-ups matter

Even though CPF only pays out interest once a year, the interest is computed monthly. So if you have idle funds sitting around that you intend to deposit into your CPF, you’ll enjoy higher returns when you top up in January compared with December.

6. Transfer OA funds you won’t need

If you have excess OA savings you won’t need for your mortgage payments, you can also transfer money from your OA to your SA or MA to capture the higher interest rates. (These transfers will not get you any tax reliefs.)

This has been what educator Jenson Chen, 34, had been doing for 6.5 years, to the point that he has reached the Full Retirement Sum without the need for any cash top-ups.

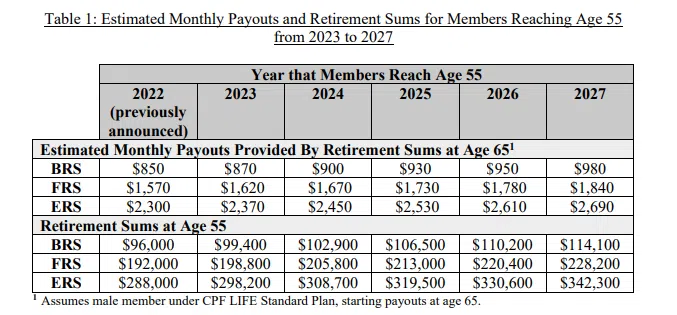

Chen tells Thrive he can now rest easy knowing that the interest he gets every year from his SA will beat the annual increases to the Full Retirement Sum. The Basic, Full and Enhanced Retirement Sums will go up by 3.5 per cent every year for the five cohorts of CPF members turning 55 from 2023 to 2027. This sum determines how much a person can withdraw from their CPF in retirement.

When many young Singaporeans think about growing their CPF savings, they think it’s a choice between topping up their CPF or putting that cash to work in equities, Chen notes.

“I hope my example shows that it’s possible to have the best of both worlds by transferring OA to SA, while keeping cash for equities,” he says.

TL;DR

- CPF funds shouldn’t be neglected when doing your retirement planning

- Excess OA funds you don’t need for housing can be used to buy short-term T-bills to earn higher interest

- Top up your CPF accounts, or your loved ones’, to get tax relief

- For OA funds you don’t need, consider transferring them to your SA or MA

Copyright SPH Media. All rights reserved.