DBS Q4 profit falls 9% on surge in allowances

CEO stays upbeat, expecting single-digit loan growth and double-digit profit growth in 2017

Singapore

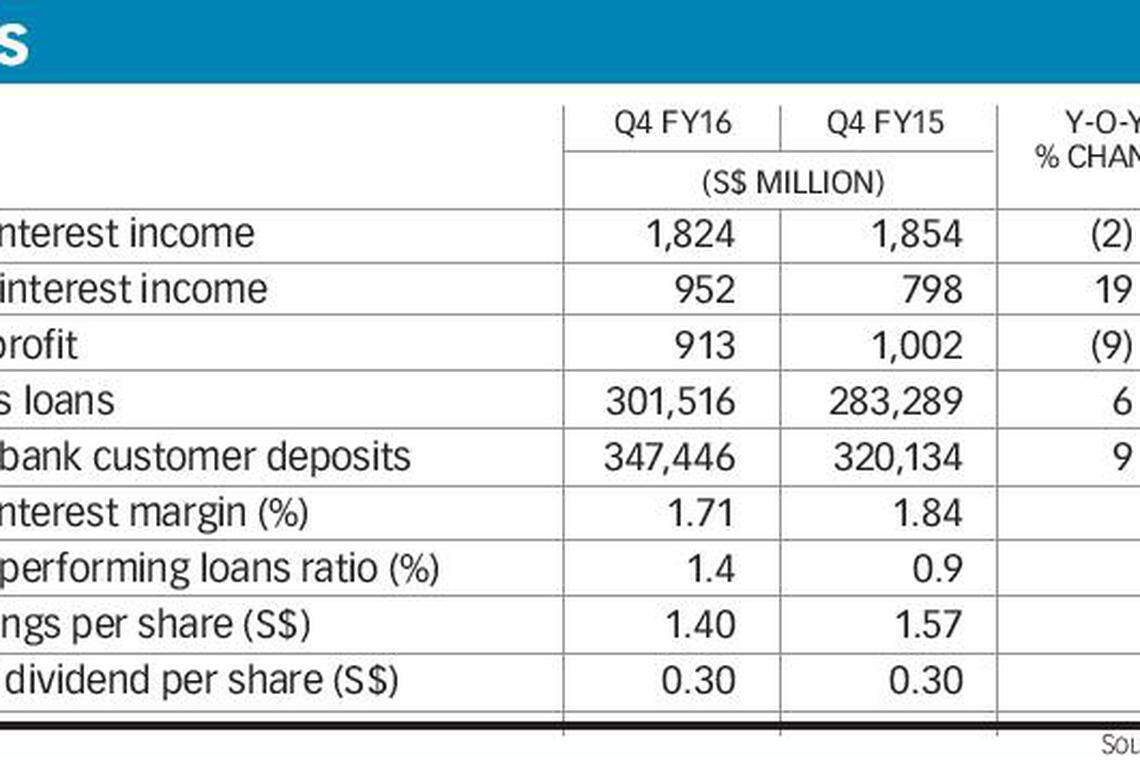

DBS Group Holdings on Thursday reported a 9 per cent fall to S$913 million in fourth-quarter earnings on a doubling of allowances due to stresses in its oil and gas exposure, bringing to a halt a six-year record profit streak.

Annualised earnings per share was S$1.40, down from S$1.57. The bank proposed a final dividend of 30 Singapore cents per share, making it 60 Singapore cents for the full year, unchanged from the preceding year.

For the 2016 full year, net profit - after 2016 allowances and a 2015 one-time gain - dropped 5 per cent to S$4.24 billion from S$4.45 billion. In 2015, it had a S$136 million gain from selling a property.

The full-year earnings of DBS, South-east Asia's largest bank, were below market expectations. Analysts polled by Reuters expected S$936 million and analysts polled by Bloomberg projected S$1.014 billion.

Chief executive Piyush Gupta remained bullish, painting a positive outlook of single-digit loan growth and double-digit profit growth in 2017 as its multiple businesses continue to perform.

Acknowledging that the bank's non-performing loan (NPL) rate had risen higher than expected to 1.4 per cent from 0.9 per cent a year ago, he sought to show that while the oil and gas sector is still challenging, new non-performing assets formation will be "substantially lower" than in 2016.

Total allowances rose 87 per cent in Q4 to $462 million from a year ago and 93 per cent to S$1.43 billion for FY2016. Profit before allowances was 10 per cent higher at S$1.55 billion for Q4 and also 10 per cent higher at S$6.52 billion for FY2016.

Mr Gupta said that the rest of the loan books was not showing much stress - not in commodities, not in retail, and not in Singapore and SMEs and around the region.

On the troubled oil and gas support services sector, he said that two-thirds of the fleets were still in use.

In addition, government lifeline support schemes are helpful, he said.

The challenge is that contracts are still being re-negotiated, and contracts also get cancelled, he said.

"Unfortunately, investments by the oil exploration companies are still not happening in a big way. I think oil prices have to stay circa US$60 per barrel for a longer period of time or go up sharply before investments start coming in... It's quite likely to see more slippage into NPLs," he said.

Giving an update on its support services portfolio, the segment which faces the most bad debts, he was confident about three companies with chunky loans. One belongs to a very strong conglomerate and is committed to the business, another was able to raise equity and has cash flow. DBS helped the third with refinancing and so far the cash flow is on track with the projections made at the time of refinancing, he said.

DBS's support services exposure of S$7 billion comprises about S$1.8 billion to government-linked shipyards and the remaining S$5.5 billion is made up of S$2.6 billion to five names and S$2.9 billion to 90 names.

Turning to the rest of the group's business, he noted that strong business momentum and productivity gains helped contain costs.

Total income in Q4 rose 5 per cent to S$2.78 billion as non-interest income growth more than offset the impact of a lower net interest margin. The productivity gains from digitalisation and cost management initiatives resulted in a 2 per cent decline in expenses, which contributed to a 10 per cent increase in profit before allowances to S$1.55 billion. The improved operating performance was more than offset by a doubling of total allowances.

Net interest income fell 2 per cent in Q4 to S$1.82 billion as a decline in net interest margin more than offset the impact of loan growth. Net interest margin fell 13 basis points to 1.71 per cent as Singapore-dollar interest rates were lower compared to a year ago. Loans in FY2016 were 6 per cent higher than in FY2015.

Non-interest income in Q4 increased 19 per cent to S$952 million. Of this, net fee and commission income rose 6 per cent to S$515 million, led by growth in wealth management and cards income. Other non-interest income grew 40 per cent to S$437 million from higher trading income and wealth management treasury customer sales. The 2 per cent fall in expenses stemming from productivity gains resulted in a near three percentage improvement in the cost-income ratio to 44 per cent.

Particularly strong was consumer banking and wealth management. Full-year income rose 21 per cent from higher loan and deposit volumes, bancassurance sales and cards income.

DBS is the number one player in Singapore mortgages with 29 per cent market share, bancassurance with 31-32 per cent market share and also in unsecured loans, he said.

DBS shares, which had fallen in tandem with other bank stocks following OCBC's posting of lower earnings, on Thursday recovered 31 Singapore cents to close at S$18.54. The stock is up 23 per cent since Donald Trump won the US presidential election in November.

To a question on DBS price rally, he said it was not related to the bank's performance but all due to Mr Trump.

"The valuation pickup in the banking sector in the last two months has nothing to do with any bank's underlying performance, it is to do with Mr Trump and this can be seen in the US banks, European banks, Japanese banks, Aussie banks and regional banks, so we're just going along with the sector," he said.

"I don't think you should read too much into a pickup in the stock price. It's a global sector shift towards banking; the underlying assumption is that an uptick in interest rates will help the banks. That is true for us."

For every one point rise in interest rates, DBS makes an extra S$6 million.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

UOB Kay Hian says ‘disadvantageous’ to reveal details of key management’s remuneration

Deutsche Bank has cut dozens in Asia private banking overhaul

Middle East violence heightens market fears of rate hikes, inflation

Tokyo's Nikkei drops more than 1,000 points, most in 3 years

Cordlife calls for trading halt after shares sink to all-time low, pending announcement

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece