DBS to bring credit cost estimates closer to past crisis levels; Q1 earnings down 29% to S$1.1b

Dividend kept at 33 Singapore cents a share to be paid on May 26, along with deferred 2019 final quarterly dividend of 33 Singapore cents

Singapore

DBS has guided for credit costs over the next two years to be "comparable" to past crises levels, and disclosed that its oil-and-gas (O&G) portfolio makes up the largest chunk of its lending to industries made vulnerable by the Covid-19 pandemic.

This comes as the bank reported on Thursday a 29 per cent fall in first-quarter net profit from a year ago that brought its earnings to its lowest level since 2017, with DBS already setting aside a large allowance to prepare for hits from the global pandemic.

Shares of DBS closed 76 Singapore cents higher on Thursday at S$19.96.

The bank has identified eight industries more directly impacted by the slowdown in its Q1 update. They are: O&G, aviation, hotels, gaming/cruise ships, tourism, retail, food and beverage, as well as shipping. Of the bank's loan exposure to the "impacted industries", O&G makes up the single-largest sector with lending totalling S$23 billion.

The specific provisions of S$383 million taken by DBS reflect one loan to an oil trader that was recognised as a non-performing asset in the quarter. DBS did not identify the oil trader, but CEO Piyush Gupta said during a media briefing on Thursday that "everybody knows what that is".

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Singapore's oil trading giant Hin Leong has collapsed amid a staggering pile of debt. DBS, like its Singapore banking peers, is exposed.

Of the total S$5 billion loans to other oil traders, 50 per cent are backed by letters of credit from banks, DBS said. It also lends to global traders or state-owned companies.

In its lending to O&G support services, three-quarters of its loans - that is, S$3 billion out of S$4 billion - have been recognised as non-performing assets. The bank expects to take further specific provisions on its exposure to support services.

As it is, the bank took a conservative stance in the third quarter of 2017 to recognise soured exposure to support services, marking down collateral.

To be clear, while the bank's overall exposure to oil-related companies has gone up in the last few years, the bank now has bigger exposure to oil producers and processors, at 60 per cent of the S$23 billion O&G portfolio. Loans to O&G support services are at S$4 billion, or roughly 15 per cent.

DBS showed that of its loans of S$221 billion to large corporates, the S$46 billion lending to those in "impacted industries" stood at 20 per cent of that loan book.

It also has a S$6 billion lending exposure to the aviation sector, which has been hammered by the lockdown measures taken globally to curb the virus contagion. Of this, 70 per cent is split evenly between lending to national airlines that is backed by aircraft, as well as bank-related and international leasing companies. Another 15 per cent is to Singapore companies in the aviation industry.

Total specific allowances taken by DBS translate to 35 basis points (bps) of loans. It guided that credit costs are to rise to between S$3 billion and S$5 billion - reflecting 80-130 bps of loans - cumulatively over two years. It has guided for credit costs over two years to account for uncertainties on how various relief packages will impact souring assets or defaults by the end of 2020, said Mr Gupta.

Under the bank's existing stress tests, the impact on credit costs was comparable to the 2002-2003 Sars recession and that of the global financial crisis (GFC) in 2008-2009. Citi said the recession peaks on credit costs stood at 100bps in the GFC.

CGS-CIMB analyst Andrea Choong said in a flash note that the credit-cost guidance could mean an average of 67 bps of credit costs each year unless all are front-loaded.

Total provisions set aside by DBS stood at S$1.086 billion, comprising a S$703 million cushion under general allowances, and the remainder for specific accounts gone sour.

Of the S$46 billion loan exposure to "impacted industries", loans to Singapore Inc companies by DBS make up S$5 billion. The bank has a small and medium-sized enterprises (SMEs) loanbook of S$39 billion, 10 per cent of which is exposed to highly impacted industries such as hotels, food and beverage, and retailers. Most of its SME exposure is in Singapore and Hong Kong, with most of it secured against property, and exposure tightened over the past two years.

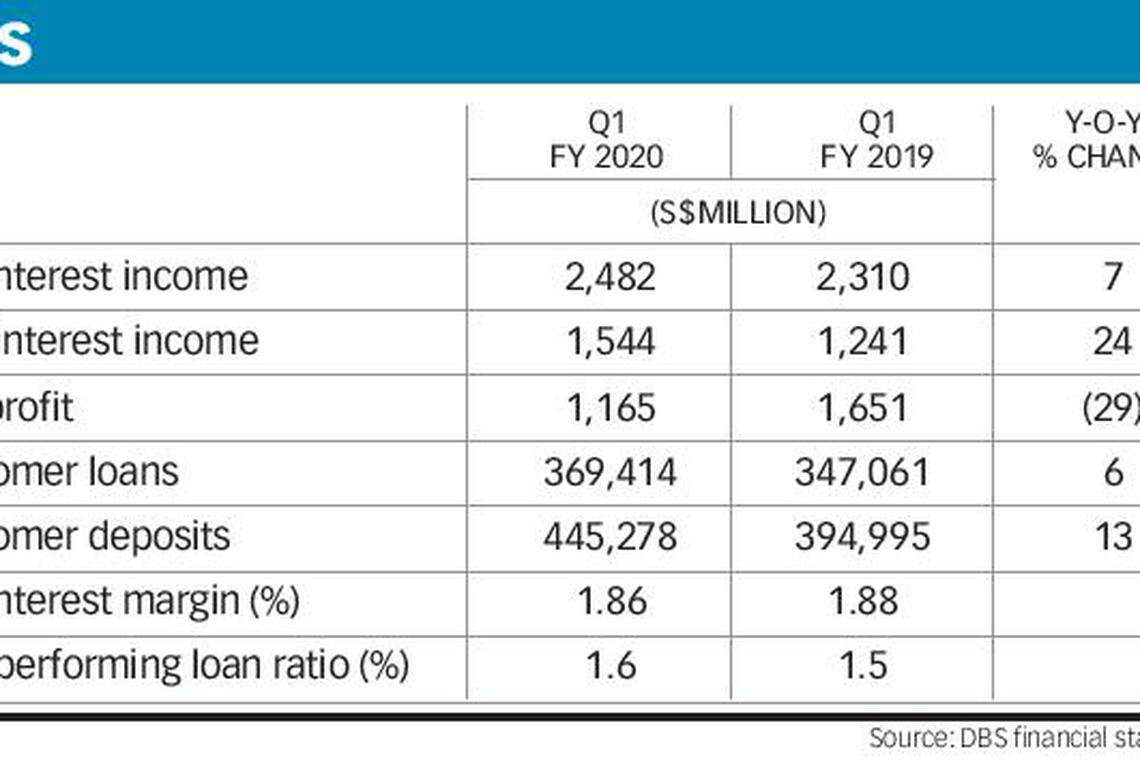

Its non-performing loan ratio ticked higher to 1.6 per cent, from 1.5 per cent.

In a note on Thursday, Jefferies analyst Krishna Guha said: "Capital buffer, earlier digitalisation efforts and ample system liquidity put the bank in good stead to face the crisis."

DBS kept its quarterly dividend payout at 33 Singapore cents per share, but the bank would "keep an open mind" on dividend policy, given current macroeconomic uncertainties, said Mr Gupta. This will be paid on May 26, together with the deferred 2019 final quarterly dividend of another 33 Singapore cents per share.

The bank's CET-1 ratio is expected to not dip significantly below the target operating range of 12.5-13.5 per cent, unless the macroeconomic environment worsens badly. DBS's CET-1 is now at 13.9 per cent, comfortably above regulatory requirements.

Its net profit for the first three months ended March 31, 2020 dropped to S$1.165 billion compared with S$1.651 billion from the same period a year ago. This is in line with an average estimate of S$1.13 billion from four analysts polled by Refinitiv, but is below the S$1.264 billion average estimate from four analysts polled by Bloomberg.

The bank guided that its full-year profit before allowances would be around 2019 levels after factoring in declines for the rest of year.

DBS's stress-test scenario offers a look at how lenders now see the crisis unfolding. The bank estimated as a base scenario that lockdowns in major economies continue until mid-2020, gradual recovery is seen in the second half of the year and continues through to muted growth in 2021, while financial markets correct by an overall 20 per cent this year.

The bank set its stress scenario by assuming that lockdowns in major economies continue through to the end of Q3, with economic activity in 2021 "still materially below" 2019 levels, and financial markets to correct by 50 per cent in 2020.

The bank has also offered loan moratoriums for more than 1,800 corporate facilities representing over S$3.4 billion in total loans outstanding. It has availed S$3.2 billion in loan facilities to Singapore SMEs under the government relief programme.

DBS said its mortgage book stood at S$75 billion in total, with minimal losses expected, as in past crises. Close to 8,000 mortgage principal and interest payment applications have been deferred, representing S$4.7 billion in loans outstanding.

Net interest margin (NIM) was 1.86 per cent for Q1, unchanged from a quarter ago, and down from 1.88 per cent a year ago. DBS flagged the lag effect, saying that the NIM in Q1 does not reflect impact of recent interest rate cuts. This will only be seen from the second quarter, with interest rates an "obvious pressure point", said Mr Gupta. Net interest income was up 7 per cent to S$2.48 billion.

Fee income rose 14 per cent from a year ago to S$832 million, while gains in investment securities boosted its income from other non-interest activities by 39 per cent to S$712 million.

Mr Gupta said the strong fee income from the wealth management business may not sustain through the next few quarters, but having a diversified fee portfolio could help.

DBS does not plan to cut jobs or pay, but will align bonuses to earnings. Expenses are due to stay flat, with cost-income ratio now at 39 per cent.

READ MORE: DBS chief Piyush Gupta to remain in his role 'for foreseeable future'

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Tesla cuts US prices by US$2,000 as sales slow, inventories swell

Volkswagen workers vote decisively to unionise in Tennessee

Sony deal for Paramount would draw added regulatory scrutiny

Bitcoin 'halving' has taken place: CoinGecko

Lululemon to shutter Washington distribution center, lay off 128 employees

Wall Street bonus rules return to regulatory agenda in third try