DBS, UOB shares up on conservative provisions; OCBC rises ahead of results

Singapore

SHARES of local banking trio rose on Thursday, as investors found some cheer from conservative provisions set aside by DBS and UOB and an unchanged outlook guidance in their latest quarterly results released before market open.

DBS shares closed at S$20.40 on Thursday, up S$0.57 or 2.87 per cent, while UOB shares were up S$0.34 or 1.75 per cent at S$19.76. OCBC, which will announce its second-quarter results on Friday, had its shares up S$0.16 or 1.85 per cent, closing at S$8.80. The market was also largely trading higher on Thursday.

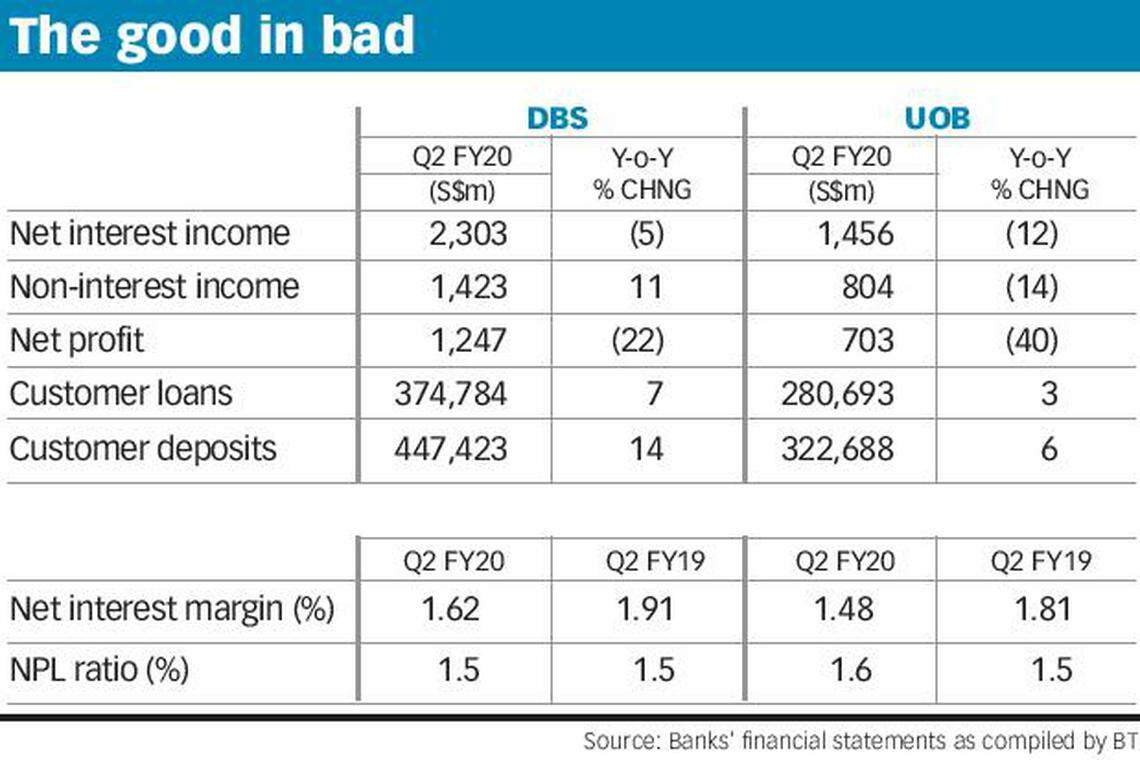

DBS reported a 22 per cent fall in second-quarter net profit to S$1.25 billion for the three months ended June 30, compared to the year-ago quarter. This is slightly under the consensus forecast of S$1.31 billion in net income from three analysts in a Bloomberg poll.

UOB posted a 40 per cent drop in second-quarter net profit to S$703 million compared with a year ago. Likewise, this was weaker than the consensus forecast of S$815 million in net income estimated by four analysts in a Bloomberg poll.

Eugene Tarzimanov, senior credit officer at Moody's Investors Service, said DBS and UOB have maintained very strong balance sheets in the second quarter of 2020.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

"We expect that they will maintain strong fundamentals in 2020-2021, despite some weakening in loan quality and profitability."

Analysts flagged in particular that higher provisions set aside by the two banks in their second-quarter results were guided largely the same as a quarter ago.

DBS's total general provisions as at the end of second quarter stood at S$3.8 billion, up from S$3.23 billion a quarter ago, with the bank's chief Piyush Gupta saying that the bank is building up a "substantial" general provision cushion because "nobody really knows what is going to be the extent of the damage once the (relief) programmes run out".

It kept its earlier guidance that credit costs are to rise to between S$3 billion and S$5 billion cumulatively over two years.

At UOB, total general provisions as at June 30 stood at S$2.39 billion, up 20 per cent from S$1.99 billion a quarter ago. The bank has guided for total provisions to remain between S$2 and S$3 billion for "the next few quarters".

UOB is one the largest users of Enterprise Singapore's risk-sharing loan facility to support the bank's small and medium-sized enterprise (SME) customers, CEO Wee Ee Cheong said. He told reporters and analysts on Thursday that only half of the loans accepted by SME customers has been drawn down, signalling that their liquidity concerns are manageable.

Analysts from brokerage CLSA considered it encouraging that DBS' guidance from last quarter remained unchanged.

"The tone from management doesn't seem to have deteriorated quarter on quarter, with signs of fee income returning in (the second half of the year) already seen," CLSA analysts said.

Jefferies equity analyst Krishna Guha noted that both banks saw margin drag, healthy trading gains and aggressive reserve builds in the quarter - all of which were in line with expectations.

"DBS fared better, in our view, on pre-provision operating profits due to revenue momentum and cost control," he wrote.

The analysts also noted a possible bottoming out of net interest margins (NIM) soon, with DBS's falling by 24 basis points (bps), and UOB's falling by 23 bps, from the first quarter of the year, as benchmark rates collapsed.

The one-month Sibor as at Wednesday stood at an all-time low of 0.25 per cent; the three-month Sibor of 0.438 per cent was at a level not seen since 2014.

DBS reported a 1.62 per cent NIM for the second quarter, and CGS-CIMB analysts Andrea Choong and Lim Siew Khee flagged the bank's forecast for full-year margin to hover around 1.6 per cent. Its NIM fell to 1.62 per cent from 1.91 per cent a year ago, and 1.86 per cent a quarter ago.

However, analysts across the board noted a strong showing from the bank's non-investment income, buoyed by investment gains. Total non-interest income was up 11 per cent to S$1.42 billion.

UOB's NIM for the quarter stood at 1.48 per cent, a sharp fall from the 1.81 per cent earned on loans a year ago, and the 1.71 per cent earned on loans a quarter ago.

Analysts from CLSA, CGS-CIMB and Jefferies also noted that the bank's net profit for the quarter was about 10 per cent weaker than consensus forecasts.

CLSA said this was largely due to higher provisions. They pointed out, however, that the bank's management appears "a touch more optimistic" about the second half of the year, with net interest margins expected to rise and as fees rebound.

READ MORE:

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

LVMH’s first quarter sales growth slips to 3% on luxury slowdown

AMD introduces AI chips for business laptops and desktops

Microsoft-backed Rubrik targets up to US$5.4 billion valuation in US IPO

BYD unveils two models in latest luxury sport utility push

US: Dow, S&P open higher as upbeat earnings obscure Mid-east jitters

J&J profit beats Wall Street estimates