Del Monte Q2 net loss widens to US$22.2 million on subsidiary’s lower profit, higher interest expense

The unit’s gross profit falls to US$78.5 million, from US$94.4 million

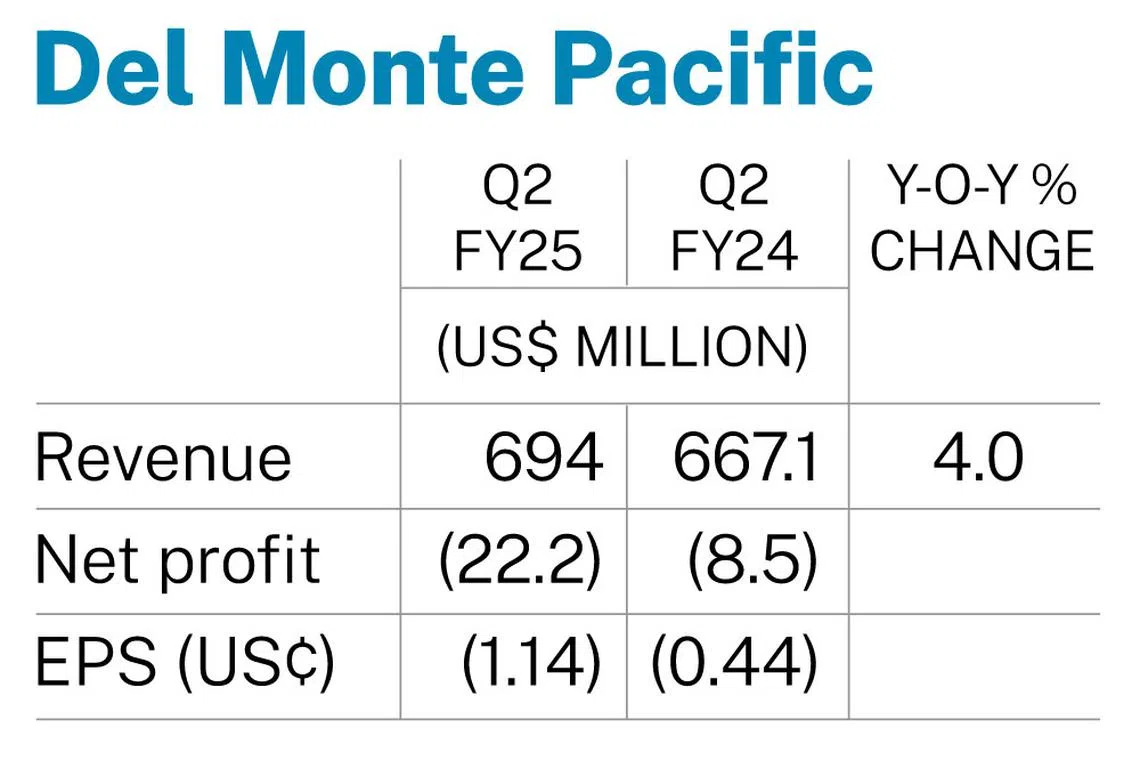

PHILIPPINE food-and-beverage manufacturer Del Monte Pacific on Wednesday (Dec 11) posted a net loss of US$22.2 million for the second quarter ended Oct 31, deeper than its loss of US$8.5 million in the previous corresponding quarter.

In a bourse filing on Wednesday (December 11), the company attributed the performance to a decrease in profit and higher costs from its US subsidiary, Del Monte Foods, as well as increased interest expense.

Del Monte Foods’ gross profit declined to US$78.5 million, from US$94.4 million on higher manufacturing overheads, warehousing and distribution costs from higher inventory. It accounts for 69 per cent of the group’s revenue.

Interest expenses rose 35.2 per cent to US$66.6 million from US$49.2 million, driven by higher interest rates.

Net loss per share for the quarter was US$0.0114, widening from US$0.0044 in the year before.

Revenue rose 4 per cent to US$694 million from US$667.1 million, on higher exports of fresh and packaged pineapple products. Higher sales in the Philippines, up 5.3 per cent at US$113.5 million, also contributed to the higher turnover.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

For the half year, the group’s net loss widened to US$56.3 million, from US$21.6 million. Its revenue for the first half rose 4 per cent to US$1.23 billion, from US$1.18 billion in the corresponding period a year ago.

The group expects to incur a net loss in FY2025. It aims to “actively restore” gross margins by reducing inventory, consolidation of underused assets, and reducing warehousing, distribution and operating costs.

With this, the group expects a gradual improvement in FY2026, and continuing into FY2027.

Shares of the counter ended trading on Wednesday flat at S$0.08, before the update.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.