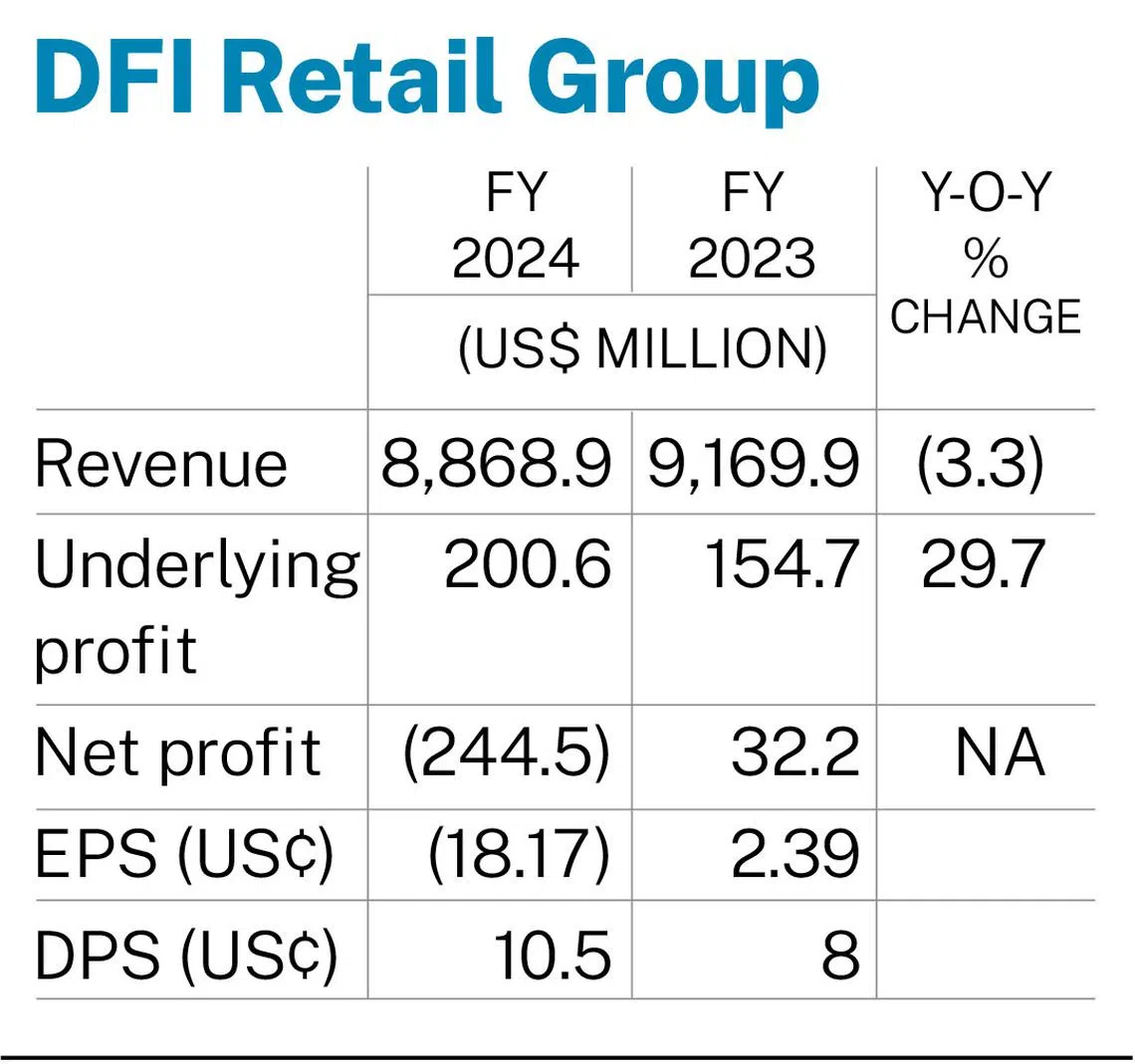

DFI Retail Group logs 29.7% growth in underlying profit to US$200.6 million, ups dividend

This comes even as full-year revenue falls 3.3% to US$8.9 billion from US$9.2 billion in the year-ago period

[SINGAPORE] Supermarket and retail store operator DFI Retail Group posted a 29.7 per cent rise in underlying profit to US$200.6 million for its full year ended Dec 31, 2024, from US$154.7 million in the previous corresponding period.

This comes even as full-year revenue fell 3.3 per cent to US$8.9 billion from US$9.2 billion in the year-ago period, said the group in a bourse filing on Monday (Mar 10).

DFI attributed profit growth to an improved showing in its food and convenience sector, supported by growth in digital channels.

But the group’s net loss – comprising its underlying business performance and non-trading items – for the year stood at US$244.5 million, down from a net profit of US$32.2 million in the prior year.

This was attributed to non-trading losses, predominantly that of US$114 million related to the divestment of Chinese supermarket operator Yonghui Superstores.

Other losses include a US$231 million impairment of interest in Robinsons Retail and US$133 million goodwill impairment of Macau and Cambodia food businesses, said DFI.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Loss per share stood at US$0.1817 for the period, down from earnings per share of US$0.0239 a year ago.

The group declared a final dividend of US$0.07 per share, from US$0.05 per share in the corresponding period in 2023. This will be paid on May 14, after books closure on Mar 21.

If approved by shareholders, this would bring the total dividend for the year to US$0.105 per share, up from US$0.08 per share in the year-ago period.

SEE ALSO

DFI noted that it expects underlying profit to be between US$230 million and US$270 million in 2025, boosted by an organic revenue growth of about 2 per cent.

The group said that it was “particularly optimistic” about the growth prospects for its health and beauty business, which make up some 55 per cent of its total operating profit.

Chairman John Witt added that DFI aims to consolidate its position in markets such as Hong Kong where it has a strong presence, while simultaneously achieving long-term growth by expanding key businesses, such as its convenience vertical.

DFI ended Monday flat at US$2.12.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.