Digital Core Reit’s H2 DPU flat at US$0.018, seeks to maintain distributions in FY2026

Revenue for the second half is up 61.6% year on year at US$87.3 million

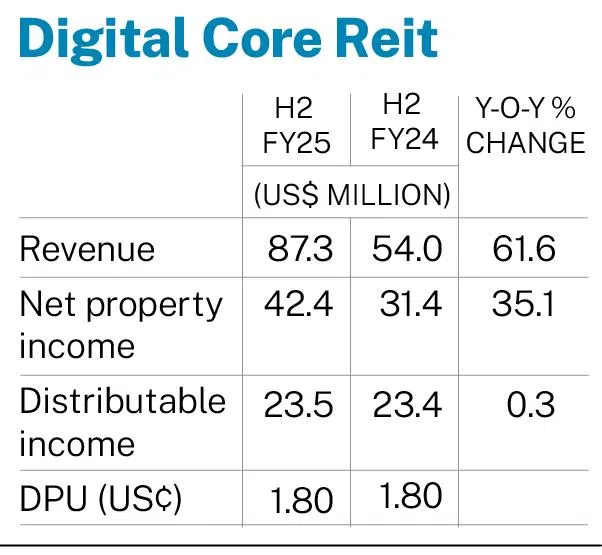

[SINGAPORE] Digital Core Real Estate Investment Trust (Reit) declared on Wednesday (Feb 4) a distribution per unit (DPU) of US$0.018 for the six months ended Dec 31, 2025, unchanged from the year-ago period.

The data centre-focused Reit owns 11 facilities across the US, Canada, Germany and Japan.

The flat DPU came even as H2 revenue rose 61.6 per cent to US$87.3 million. That increase followed its acquisition of an additional 15.1 per cent stake in a data centre in Frankfurt, Germany, in December 2024.

But with the acquisition, Digital Core Reit’s H2 property expenses for the half-year nearly doubled to US$44.8 million. Net property income thus increased by a smaller margin than revenue, by 35.1 per cent to US$42.4 million.

For the full year, the Reit’s DPU was also unchanged at US$0.036. Revenue was up 72.2 per cent at US$176.2 million.

Distributions held steady despite its Linton Hall facility in Northern Virginia remaining unoccupied since its previous tenant vacated the property in June 2025.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

While the manager announced in January that it had reached a 10-year agreement with an investment-grade global cloud-service provider, the deal will commence only in December.

“In 2025, we had six months of downtime. In 2026, we’ll have 11,” said John Stewart, chief executive manager of Digital Core Reit’s manager on Wednesday.

“The fact that we were able to keep the DPU flat… was a significant accomplishment,” he said.

He added that the Reit will aim to “hold the line” on distributions in the new financial year, but acknowledged that it will be challenging. “We have to hustle to make that happen.”

Stewart did not rule out capital recycling to fund the Linton Hall facility’s refurbishment.

During FY2025, Digital Core Reit repurchased 1.8 million of its units at an average price of US$0.565, resulting in a 0.1 per cent uplift to DPU. Stewart ruled out further buybacks in the near term, as the Reit manager continues to focus on “preserving the flexibility of the balance sheet”.

With FY2025 property expenses more than doubling, net property income stood at US$88.7 million, up 43.5 per cent from the year-ago period.

As the Reit manager seeks more ways to recycle its capital, Stewart did not rule out further divestments.

“Everything is for sale every day,” he said, adding that Digital Core Reit will evaluate capital recycling opportunities “at the right price”.

That said, he noted that its core properties – which involve facilities with “less than half a per cent” of vacancies – are “less likely candidates for disposition”, though he stopped short of ruling them out entirely.

Digital Core Reit had an in-service portfolio occupancy rate of 97 per cent as at Dec 31, 2025; its weighted average lease expiration stood at 4.6 years. The Reit had US$671 million of total debt outstanding – all of which is unsecured – and aggregate leverage of 37.1 per cent.

Units of Digital Core Reit ended Wednesday flat at US$0.53.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.