Econ Healthcare posts H2 S$1.3m net loss after losing S$3.4m from selling Crosstec stake

CATALIST-LISTED nursing operator Econ Healthcare (Asia) sank into the red in the fiscal second half from a year ago after chalking up a S$3.4 million investment loss from selling all of its stake in Crosstec Group Holdings in January.

Econ Healthcare had invested around S$4 million of its idle working capital to buy 11.8 million shares in Crosstec, a Hong Kong-listed interior design company, but Crosstec shares nosedived 84 per cent soon after.

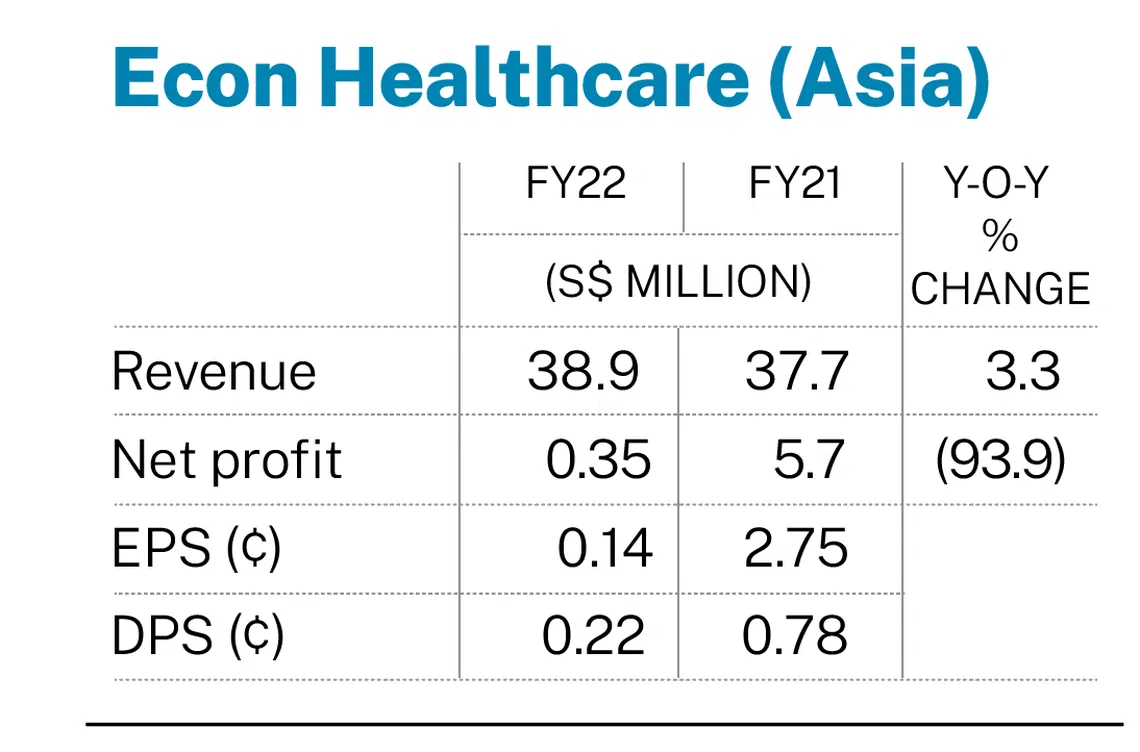

Net loss for the 6 months ended Mar 31, 2022 stood at S$1.26 million, reversing from a net profit of S$2 million posted in the same period a year ago, the company said in a filing on Friday (May 27).

The results translate to loss per share of 0.49 Singapore cent, against earnings per share of 0.99 Singapore cent.

With the results, the board did not propose a final dividend in respect of the latest financial year, but the group highlighted in a statement that it had paid an interim dividend of 0.22 Singapore cent per ordinary share last December.

Revenue was up 1.3 per cent to S$19.3 million, bringing full-year revenue up 3.3 per cent to S$38.9 million.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The group attributed this to a rise in revenue of S$1.5 million from medicare centres and nursing home fees, owing to a net increase in bed occupancy, fee adjustment and improvement to its homecare business in Singapore, among other factors.

Overall, its monthly average bed occupancy for the 2022 financial year went down to 1,037 beds, compared to the 1,117 beds in the preceding year.

Econ Healthcare, however, said this meant that overall occupancy rate rose as total bed capacity had fallen from 1,376 to 1,231 in the latest financial year.

The group, meanwhile, noted that its financial position remains healthy with cash and cash equivalents of S$26.1 million as at Mar 31, up from S$16.1 million a year ago.

The counter closed up 2 per cent or S$0.005 at S$0.26 before the results were released on Friday.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

China to facilitate Hong Kong IPOs and expand Stock Connect

Global equity funds see surge in outflows as rate cut hopes fade

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece

Global wave of consultancy layoffs has not hit Singapore

P&G raises annual core profit forecast on resilient demand, price hikes

American Express’ premium customers help it surpass profit expectations