Frasers Property remains keen on Singapore housing development but is cautious over entry costs and margins

Its FY2024 net profit is up 19.2% at S$206.3 million

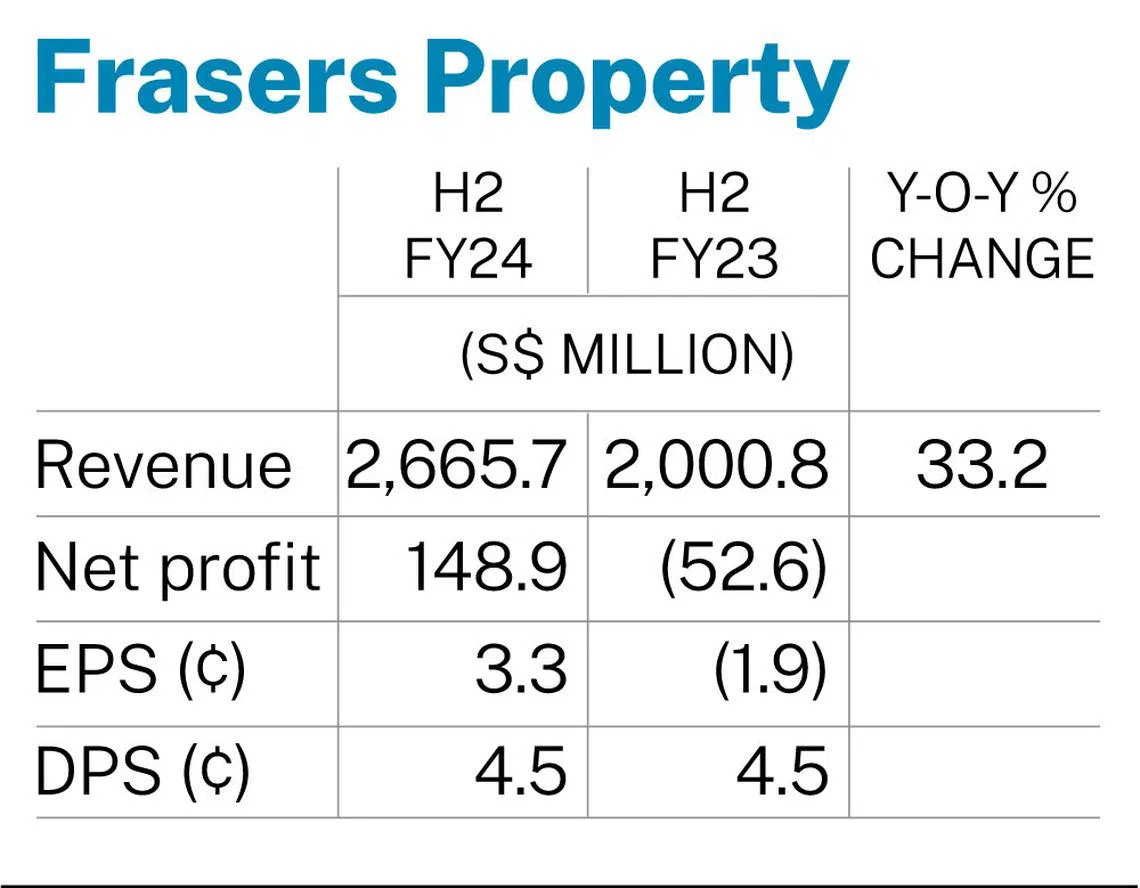

FRASERS Property posted a net profit of S$148.9 million for the second half of its financial year ended Sep 30, reversing losses of S$52.6 million in the same period the prior year.

This came as revenue for H2 FY2024 stood at S$2.7 billion, up 33.2 per cent from S$2 billion the previous year, it said on Wednesday (Nov 13).

At the company’s full-year results briefing on Wednesday, group chief executive Panote Sirivadhanabhakdi said a key focus for the group is to increase its development exposure in the residential segment, which will offer better risk-adjusted returns.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.