Gain from NetLink Trust IPO masks fall in Singtel's Q2 underlying profit

Earnings triple to S$2.8b on S$2.3b bonanza from Netlink listing; underlying gain down 4.1% to S$929m

Singapore

JULY'S divestment of a majority stake in NetLink Trust propelled Singapore Telecommunications Ltd (Singtel) to a record net profit in the second quarter, the telco announced on Thursday.

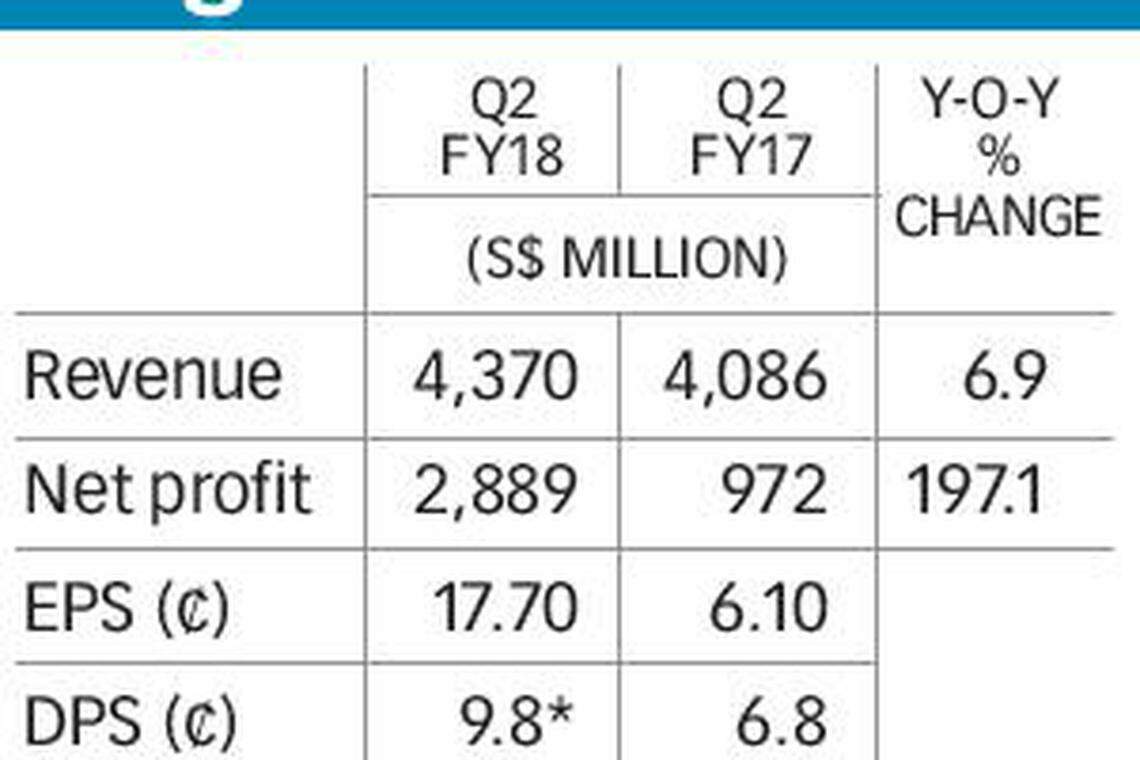

Earnings nearly tripled in the three months to Sept 30, ballooning to S$2.889 billion from S$972 million in the same period the year before.

This brought earnings per share up to S$0.177, from S$0.061 before.

Shareholders can look forward to a special dividend of S$0.03 a share - which is to come out of the S$2.3 billion bonanza from the NetLink Trust sale - on top of an interim ordinary dividend of S$0.068 a share.

But underlying profits in fact slipped by 4.1 per cent year on year, falling to S$929 million - no thanks to the hot competition in the Indian market, which dragged down the performance of regional associate Airtel.

The decline came in spite of a 6.9 per cent increase in revenue to S$4.37 billion, which was spread across a 2.3 per cent uptick in the consumer segment, a 5.5 per cent gain in the enterprise segment and an 88.6 per cent jump in the fledgling digital segment.

The turnover of Singapore consumer operations, which make up about a fifth of the telco's consumer business revenue, dipped by 2.1 per cent in the quarter to S$564 million.

The market here took hits from voice-to-data substitution, the ascendance of SIM-only plans, a sales drop from smartphones' launch timelines and a fall in the pre-paid customer base as the foreign workforce shrank.

Smartphone launch timings also hurt revenue in Singtel's large Australian consumer business. That amount stood at A$1.702 billion (S$1.78 billion), a 1 per cent slide.

Mr Yuen Kuan Moon, chief executive officer for the Singapore consumer business, told reporters at a briefing that he is looking to data consumption for growth, especially as cyclical phone launches push up data use.

Still, the group's overall revenue managed to rise on the back of contributions from digital marketing arm Amobee's recently acquired Turn, as well as growth in other digital and information communications technology (ICT) businesses such as cyber security services.

Digital and ICT revenue accounted for 25.1 per cent of turnover in the quarter, from 20.9 per cent in the same period the year before.

At the media briefing, group chief executive Chua Sock Koong called the units' performance "confirmation of the kind of momentum we are seeing in our digital efforts". These prospects would be further explored in the wake of the NetLink Trust sale, she added.

Ms Chua noted that S$500 million from the proceeds of the NetLink trust divestment would go towards the special dividend.

The rest could be ploughed back into Singtel's various operations: "Clearly, in the core business, continued investment in spectrum would be a key use of the funds.

"And we would continue to look also at some of the digital growth initiatives where we have invested."

As for Airtel's continued drag on earnings, Ms Chua was upbeat on expected consolidation in India's competitive telecommunication industry. She pointed to Airtel's merger last month with Tata Teleservices' consumer mobile business - a deal that also saw Airtel take over that unit's spectrum.

Singtel's underlying quarterly net profit would have ticked up by 2.5 per cent if not for Airtel's poor showing.

But Ms Chua noted in a statement that "regional markets remain attractive as our associates continue to drive customer growth and data consumption".

The telco's shares closed down by S$0.02, or 0.5 per cent, to S$3.76, after the results were announced.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Telcos, Media & Tech

Meta profits soar but costs of AI cause worry

IBM falls on weak consulting sales, overshadowing HashiCorp deal

TikTok suspends new app’s reward programme amid EU concerns

Nvidia agrees to acquire Israeli AI software provider Run:ai

China��’s Huawei launches new software brand for intelligent driving

China’s SenseTime soars 36% after unveiling beefier AI model