Gallant Venture, GHY Culture & Media expect net losses for FY2023

Megan Cheah

MAINBOARD-LISTED companies Gallant Venture and GHY Culture & Media on Monday (Feb 19) posted separate profit guidances for their full-year results.

Indonesia-focused utilities provider Gallant Venture said that upon preliminary review of the group’s draft financial performance for the full year ended Dec 31, 2023, it expects to report a net loss.

This is mainly due to higher finance costs and lower profit contributions from associated companies, the company said in a bourse filing.

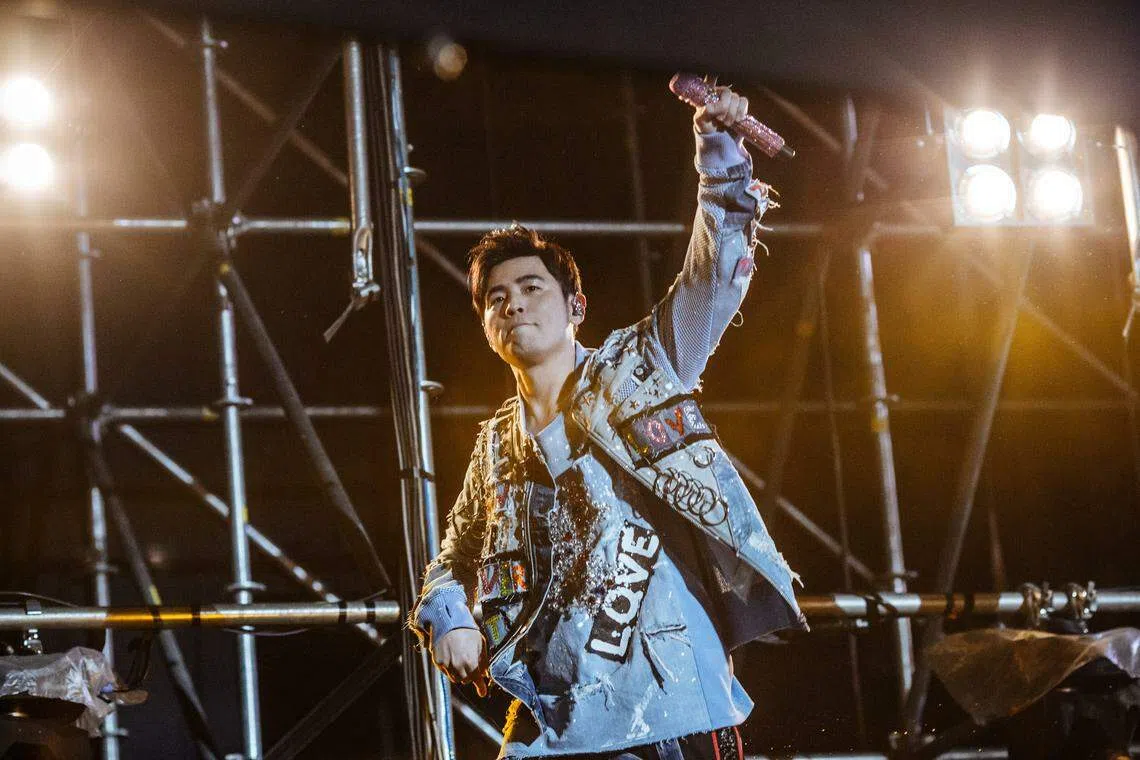

Meanwhile, concert organiser GHY Culture & Media also anticipates a net loss for the financial year ended Dec 31.

The net loss is attributed to foreign exchange losses due to the Singapore dollar appreciating against the yuan, which arose as the group’s intercompany balances of its “significant” Chinese operations are denominated in Singapore dollar.

The loss was also attributed to the recognition of credit loss allowance, said GHY Culture & Media in its filing.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This allowance was measured by referencing “past default experience of the debtors and an analysis of the debtors’ current financial position, adjusted for factors specific to the debtors”, it said.

The allowance also considered the general economic conditions of the industry in which the debtors operate, and the current and forward-looking macroeconomic factors affecting the ability of the customers to settle the receivables.

Both companies said further details will be disclosed when their financial results are announced.

Shares of Gallant Venture closed flat on Monday at S$0.132, before the announcement. GHY Culture & Media’s counter also ended unchanged on Monday at S$0.37, prior to the bourse filing.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.