Genting Singapore Q1 net profit falls 5% on lower gaming revenue

It commits to revamping and expanding Resorts World Sentosa, with S$4.5 billion investment

Singapore

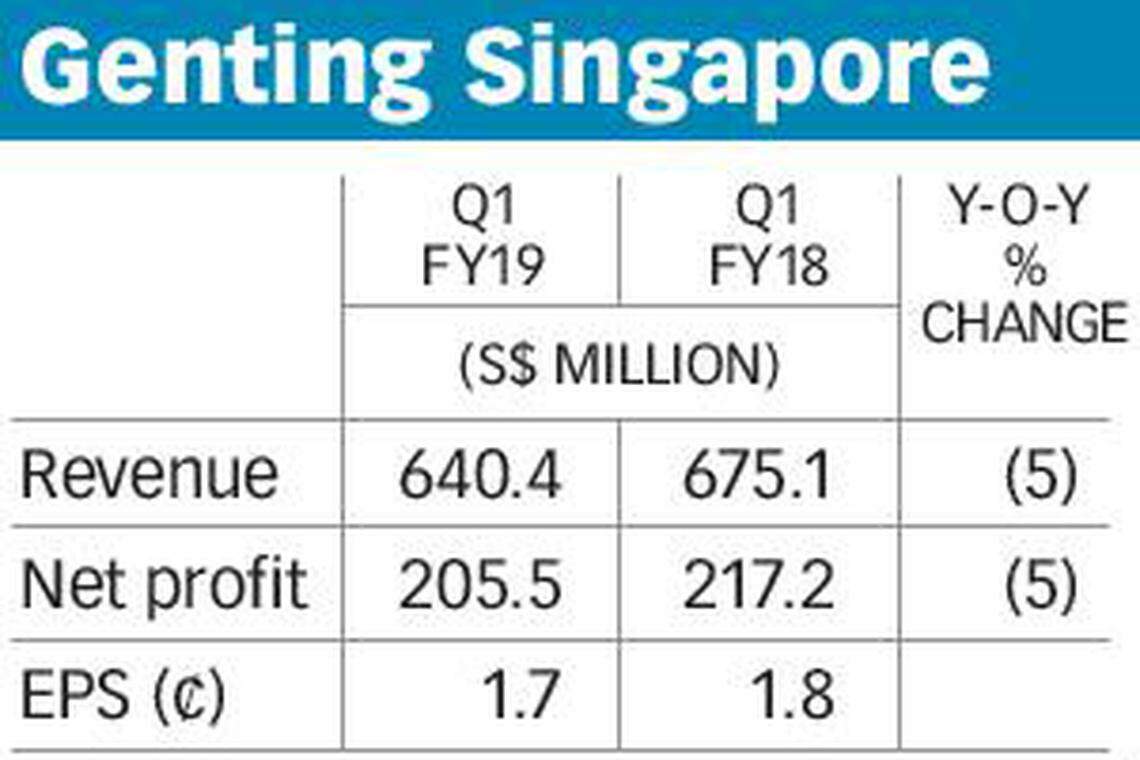

INTEGRATED resort operator Genting Singapore on Thursday posted a 5 per cent decline in first-quarter net profit to S$205.5 million as gaming revenue fell.

Earnings per share for the first quarter ended March 31 stood at 1.7 Singapore cents, down from 1.8 Singapore cents last year.

This came as first-quarter revenue dropped to S$640.4 million, down 5 per cent from the same period a year ago, alongside gaming revenue which tumbled 8 per cent to S$430.2 million.

Non-gaming revenue was up by 1 per cent at S$209.3 million with higher spend per visitor, said Genting, which operates Resorts World Sentosa (RWS) in Singapore.

According to Genting, its key attractions drew 19,000 visitors daily on average, while hotel occupancy clocked in at 93 per cent during the quarter.

Genting said that its S$4.5 billion investment to revamp and expand RWS "reinforces (its) commitment to make RWS the leading integrated resort destination in the world, and will shape the business model for the next stage of growth".

In April, the group announced a slew of developments to expand RWS over five years, including growing the Universal Studios Singapore theme park and adding up to 1,100 new hotel rooms. There will also be a new waterfront lifestyle complex that will house two hotels.

As part of the deal with the Singapore government for the expansion, the exclusivity period for the city-state's two casino-resorts was extended to 2030. However, the casino entry levies were also raised by 50 per cent to S$150 for a day and S$3,000 for an annual pass.

The moves were met with a flurry of analyst downgrades, with brokerages such as Maybank Kim Eng and RHB Research Institute cutting Genting's rating on concerns of higher-than-expected capital expenditure and levies weighing on short-term earnings.

On Thursday, Citi analyst George Choi maintained his "buy" call, with a target price lowered from S$1.28 to S$1.16.

Genting's revenue was largely in line with Citi's estimate of S$666 million, Mr Choi noted. However, the market share split between Marina Bay Sands (MBS) and RWS in the first quarter "normalised to about 59:41 in favour of MBS" versus about 56:44 in the previous quarter, he said.

According to the analyst, Genting's management also said on an earnings call that "two new rides at RWS are expected to open in 2021 and 2022, while the new hotel is expected to open in one go by end-2024".

Genting Singapore's shares closed unchanged at S$0.95 on Thursday before the results were announced.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Middle East violence heightens market fears of rate hikes, inflation

Tokyo's Nikkei drops more than 1,000 points, most in 3 years

Cordlife calls for trading halt after shares sink to all-time low, pending announcement

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece

Inside TSMC chairman Mark Liu's short but impactful reign

CSE Global bags US$36.5 million data centre contract extension