Great Eastern to offer 'bite-sized' insurance products to Samsung Pay users

GREAT Eastern has tied up with Samsung to offer "modular" or bite-sized insurance plans to Samsung Pay users, the insurance arm of OCBC Bank announced on Tuesday.

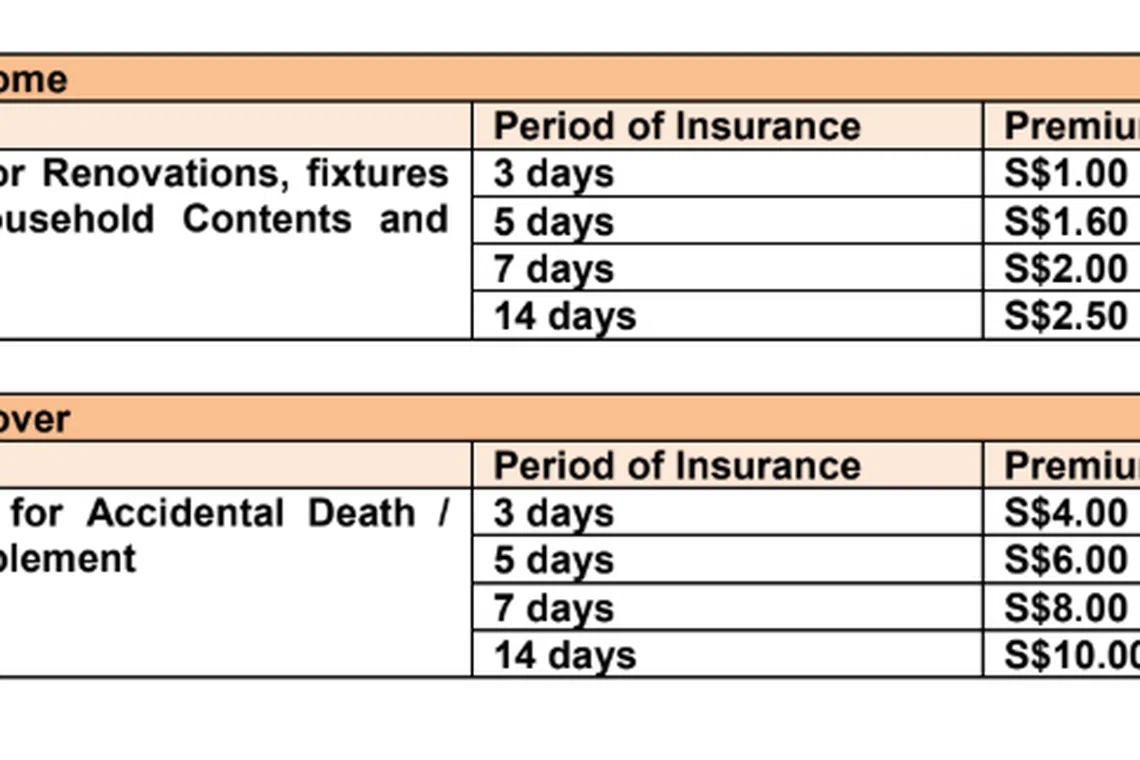

The products comprise a personal accident plan (Great Smart Cover), that offers up to S$50,000 coverage for death and permanent total disablement resulting from an accidental injury; as well as a home insurance plan (Great Smart Home) that protects home contents and personal effects against incidents such as fire, a burst water pipe or burglary, the company said.

Users will have the option to select the coverage period for each plan, ranging from three, five, seven or 14 days depending on their needs, and may purchase the plans directly via Samsung Pay.

To access these products, Samsung Pay users will have to launch the Samsung Pay application on their mobile phones, and click on the Great Eastern icon within the new 'Discover' tab.

Ryan Cheong, managing director of digital for business at Great Eastern, said: "Our goal is to offer everyday insurance solutions to new segments of customers more conveniently and seamlessly. Samsung Pay users can look forward to the availability of a wider range of lifestyle-related modular products in the coming months," Mr Cheong added.

As at 3.21pm on Tuesday, Great Eastern shares were trading unchanged at S$26 apiece.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Morgan Stanley Asia private equity unit to reorganise as CEO retires

Mercedes says it will continue to invest in China tie-ups

Xiaomi locks in over 75,000 orders for SU7 car, targets over 10,000 deliveries in June

Gold trades in tight range as market focuses on US economic data

TSMC says ‘A16’ chipmaking tech to arrive in 2026, setting up showdown with Intel

Battery firm LG Energy Solution Q1 profit plunges on weak EV sales