Growth, profit hopes power Asia shares to new highs

But concerns loom about how long the party will last

Singapore

BETTER days ahead are expected for regional equity markets, which are now on a roll, hitting fresh highs on the back of optimism in global growth and positive earnings conditions, as investors shrug off looming concerns.

Analysts say all signs point to an extension in the regional rally, even if investors choose to take profits in the sessions ahead.

IG analyst Jingyi Pan believes the dips in regional indices have so far "proven to be shallow", as market sentiments are buoyed by economic conditions that are "likely to fuel the further gains in the near term".

Phillip Securities Research's head of research Paul Chew told The Business Times that US consumer confidence is at 17-year highs. This robust economic activity, he says, is being reflected by strong corporate results, especially in the technology and electronics sector.

Asian equity markets are heading towards multi-year highs, with strong momentum and higher trading volumes, says Margaret Yang, analyst at CMC Markets Singapore.

"The rally seems unstoppable, amid improving fundamental elements and removal of uncertainties surrounding central bank policies," she said, adding that investors' confidence has been reinvigorated by favourable third-quarter earnings globally and the ample liquidity environment.

The bullish outlook followed a banner session across Asian indices on Tuesday, which powered up amid a rally in oil prices driven up by tensions in the Middle East, as well as previous fresh highs on Wall Street.

So strong is this momentum that Asian investors shrugged off concerns that US President Donald Trump's two-day visit to South Korea would likely raise tensions with North Korea or trigger further nuclear tests by Pyongyang.

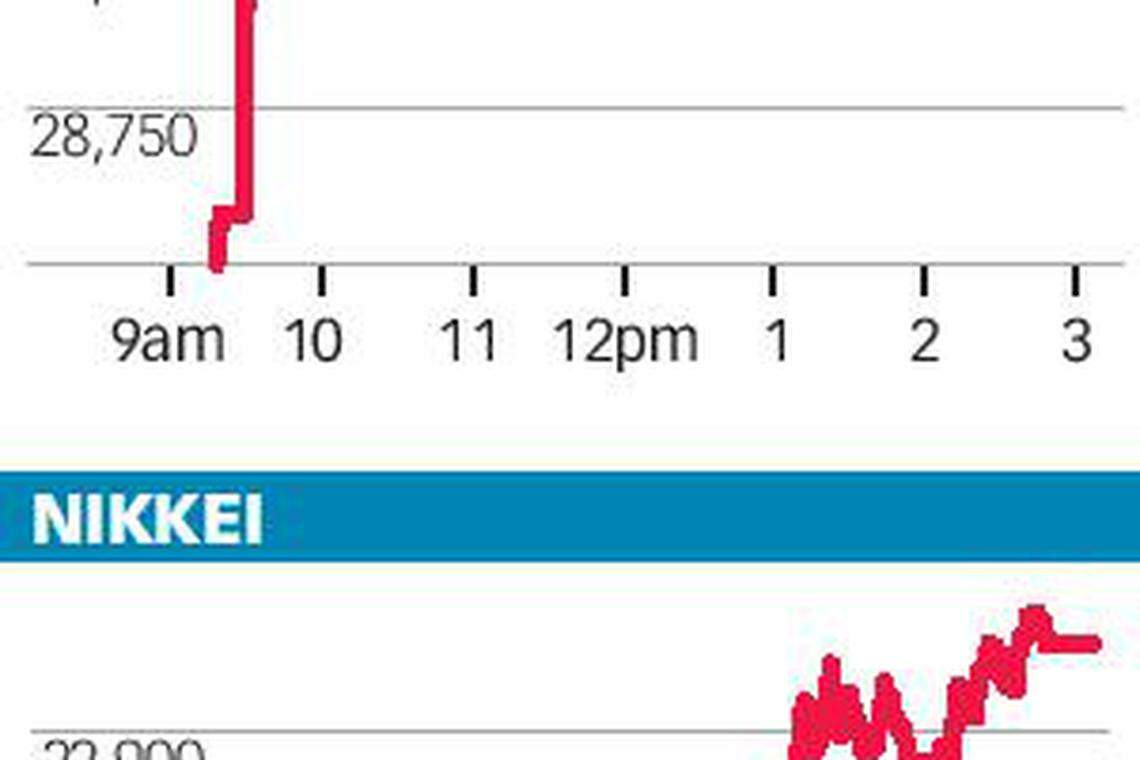

Hong Kong's Hang Seng closed up almost 400 points or 1.4 per cent to 28,994.34, its highest in a decade; Tokyo's benchmark Nikkei added 389 points or 1.7 per cent to close at 22,937.60, its highest since January 1992.

Ms Pan said: "Underpinning the take off for both the Nikkei and Hang Seng had been a rally in the energy sector, supported by the strong run in crude prices, while gains in the US market continue to inspire regional markets.

Specifically for the Hang Seng, Tencent's latest surge from its China Literature initial public offering (IPO) propelled its IT sector to outshine even the energy group," said Ms Pan.

CMC Markets' Ms Yang said the Hang Seng has broken through its key resistance level of 28,900 points, and that and its next milestone would be the key psychological level of 30,000 points.

On Tuesday, Australian shares blew past 6,000 points for the first time since the global financial crisis. The benchmark S&P/ASX 200 gained 1 per cent or more than 60 points to end at 6,014.30.

Tracking this rally, China's blue-chip index closed at a two-year high on Tuesday. The Shanghai Composite Index closed up 0.7 per cent at 3,413.57 points.

At home, the Straits Times Index (STI) rode high on gains clocked by the banking stocks, moving up 31.25 points or 0.92 per cent to close at 3,413.10 - a record in 2 ½years.

As bullish as the outlook may be, Vasu Menon, senior investment strategist for wealth management Singapore at OCBC, warned investors that while the rally in the equities markets may have garnered momentum for now, this may not be sustainable as "there's a great deal of complacency".

"We are a bit cautious as we feel markets have moved up ahead quite quickly. We think Asia is still a pretty good long-term story... (but) the only problem is that valuations are not very attractive."

He said that inflation can pick up in the next six to nine months, and that the US Federal Reserve - which is currently not expected to act aggressively in the short-term - may tighten monetary policy, which will in turn affect the global stock markets.

James Cheo, investment strategist at Bank of Singapore, said solid growth can be expected towards the year end, but stretched valuations remain a key concern, among other things such as China's rising debt, the trade-war risk between China and the US, as well as an unprecedented unwinding of the global central bank. "On Asia investing, we advise diversification and rotating into lagging sectors that offer better value . . . Asian markets' valuations gap with developed markets is narrowing. This may potentially limit significant Asian market upside from here."

For now, investors here are assessing whether the STI can continue on the upward trajectory, says Mr Chew. "The STI lacks a technology component; as a result, to break new highs, we will need to rely on a much stronger domestic economy and this is what local investors are looking at - for more clues that the domestic economy is gaining strength."

He added that all eyes here will now be on the results of firms in the property and telco sectors in the days ahead.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Netflix handily beats subscriber targets, misses on revenue forecast

Meta releases early versions of its Llama 3 AI model

Seatrium unit ordered to pay US$108 million in arbitration over equipment supply contracts

TSMC estimates losses of US$92.4 million due to Taiwan earthquake

Marina Bay Sands Q1 profit surges 51.5% to US$597 million on tourism boom

US: Wall St opens higher as some chip stocks bounce back after selloff