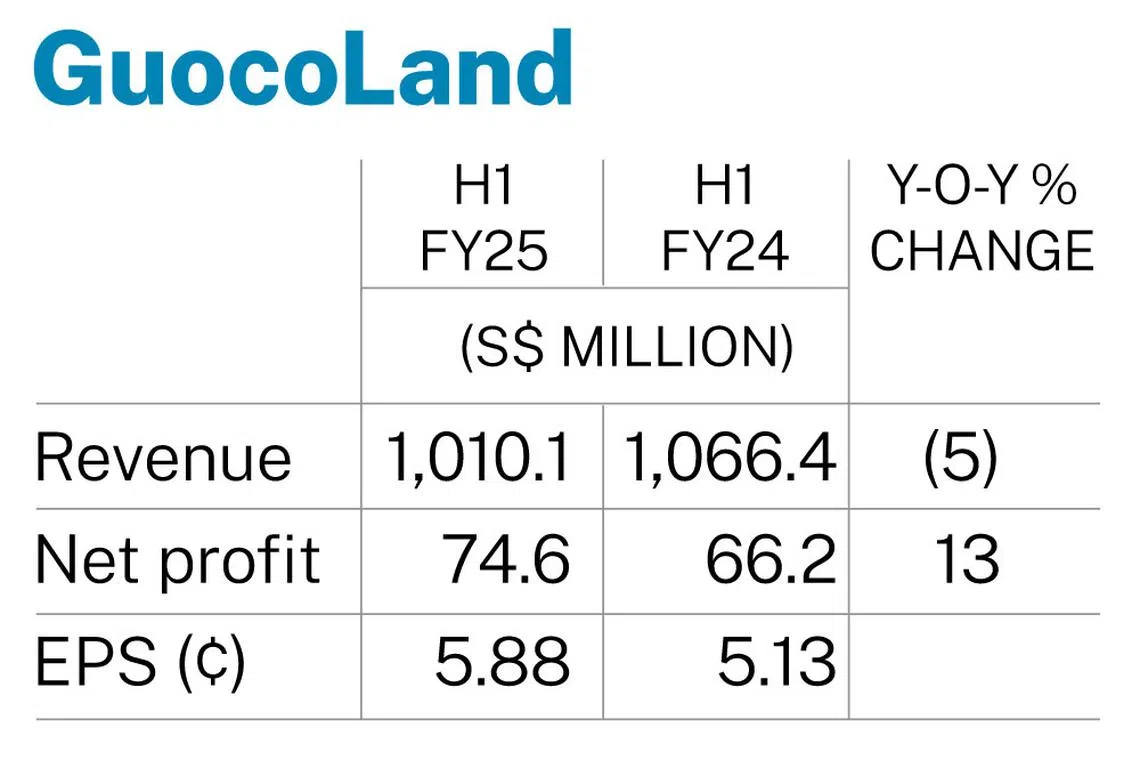

GuocoLand H1 profit up 13% at S$74.6 million

Revenue slips 5% to about S$1 billion, from S$1.1 billion in the corresponding year-ago period

PROPERTY developer GuocoLand reported a net profit of S$74.6 million for the first half ended Dec 31, 2024, up 13 per cent year on year from S$66.2 million.

Earnings per share for the half-year period rose to S$0.0588, from S$0.0513 previously.

Revenue dipped 5 per cent to about S$1 billion, from about S$1.1 billion in the corresponding period in the prior year, the group said in a bourse filing on Monday (Feb 10).

This was due to the timing of progressive revenue recognition from the property development business in Singapore, together with lower sales from China.

The improvement in earnings was attributed to the progress of construction and higher contributions from investment properties.

The cost of sales dropped 11 per cent to S$762.2 million, which helped to improve profit.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Cheng Hsing Yao, group chief executive officer of GuocoLand, said that the group’s main business engines – property investment and property development – performed well.

He added that steady sales was “driven by sustained demand for well-located and high-quality projects”, as well as rental revenue from the group’s Grade A investment properties, which “provided a stable and recurring income stream”.

The company’s Midtown Modern (558 units) and Lentor Modern (605 units) developments were fully sold as at Dec 31, 2024, and Jan 27, 2025, respectively.

SEE ALSO

Meanwhile, as at Dec 31, 2024, Lentor Hills Residences (598 units) and Lentor Mansion (533 units) were 99 and 91 per cent sold, respectively.

The sales of residential units at Guoco 18T in Chongqing, China, progressed at a slower pace, with the group noting that China’s market continues to be a “challenging one due to the economic challenges there”.

It noted that Singapore contributed more than 80 per cent of group revenue for the half-year period.

In the first half, the group’s property investment revenue grew 19 per cent to S$130.6 million over the previous corresponding period, thanks to higher recurring rental revenue from Guoco Tower and Guoco Midtown.

It said that its commercial assets in Singapore maintained high occupancy rates, healthy weighted average lease expiry and positive rental reversions.

Looking ahead, the group said that Urban Redevelopment Authority statistics for the fourth quarter of 2024 indicated that the overall private residential price index increased by 2.3 per cent, which may indicate improved market sentiment for non-landed private homes.

It noted that commercial rental rates are expected to remain relatively flat for 2025, with lower vacancies in certain new office stock and most tenants not looking to move due to high fit-out costs.

It added that the China real estate market has seen downward momentum for the third year in a row in 2024, recording double-digit declines in both real estate sales and investment.

While it has been “mildly responsive” to stimulus policies, a full recovery is contingent on overall economic performance and consumer confidence improving significantly.

Shares of GuocoLand closed flat at S$1.44 on Monday, before the update.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.