HPH Trust’s H2 DPU down 9.7% at HK$0.065; braces for continued uncertainty over US-China tariffs

The trust warns of ‘gradual restructuring of shipping routes and cargo flows’ as trade remains volatile

[SINGAPORE] Hutchison Port Holdings Trust (HPH Trust) declared a distribution per unit (DPU) of HK$0.065 for the six months ended Dec 31, 2025, down 9.7 per cent from HK$0.072 for the year-ago period.

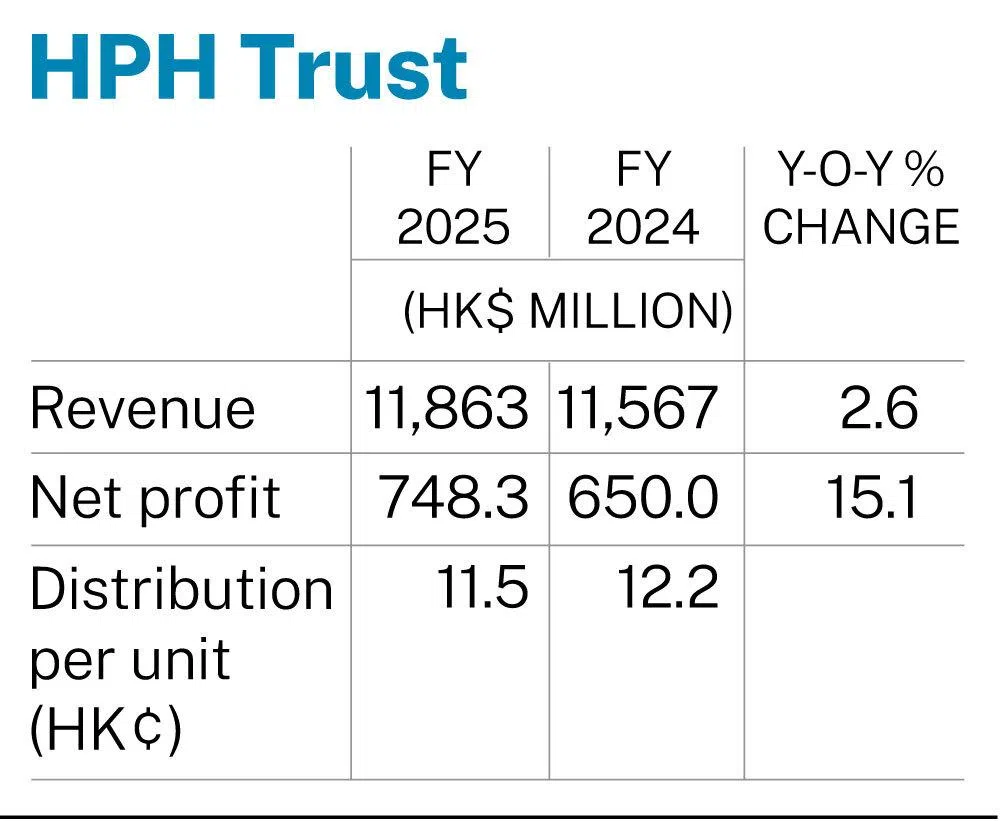

This brings the trust’s full-year DPU to HK$0.115, down from HKS$0.122 in FY2024.

The trust’s FY2025 revenue rose 2.6 per cent to HK$11.9 billion (S$1.9 billion), as container throughput at Yantian International Container Terminals (YICT) in Shenzhen, China increased by 7.1 per cent. This was due to more laden exports and inbound empty and transhipment cargoes.

However, combined container throughput at the Kwai Tsing terminals in Hong Kong fell 6.4 per cent with lower empty and transhipment cargo.

Meanwhile, other operating income rose 13.3 per cent to HK$68.5 million, due to gains from the revaluation of YICT’s yuan-denominated financial assets in 2025.

Overall, HPH Trust’s FY2025 net profit stood at HK$748.3 million, up 15.1 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Looking ahead, the trust noted that the port industry faces “a complex landscape marred by the constant shifting in trade and tariff policies”.

Notably, exports to the US from YICT dropped by 9 per cent in Q4 FY2025, as the ongoing uncertainty spurs companies to undertake a “China plus one” strategy – where they diversify supply chains outside of China.

“This could result in a gradual restructuring of shipping routes and cargo flows at HPH Trust,” the company said.

Further tariffs implemented this year are also expected to hit demand for Chinese products and add to volatility. The trust also expects growth in European markets to be subdued with geopolitical tensions.

HPH Trust ended Thursday at US$0.215, down by 2.3 per cent or US$0.005.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.