Hwa Hong mired in intergenerational shareholding dispute

Tan Nai Lun

THE battle for property player Hwa Hong Corporation is an intergenerational dispute among the members of its controlling family, the Ong family.

According to a report by Lianhe Zaobao, the disputes within the Ong family date back over a decade, with the current battle centred on former group managing director Ong Choo Eng’s privatisation offer for the property company.

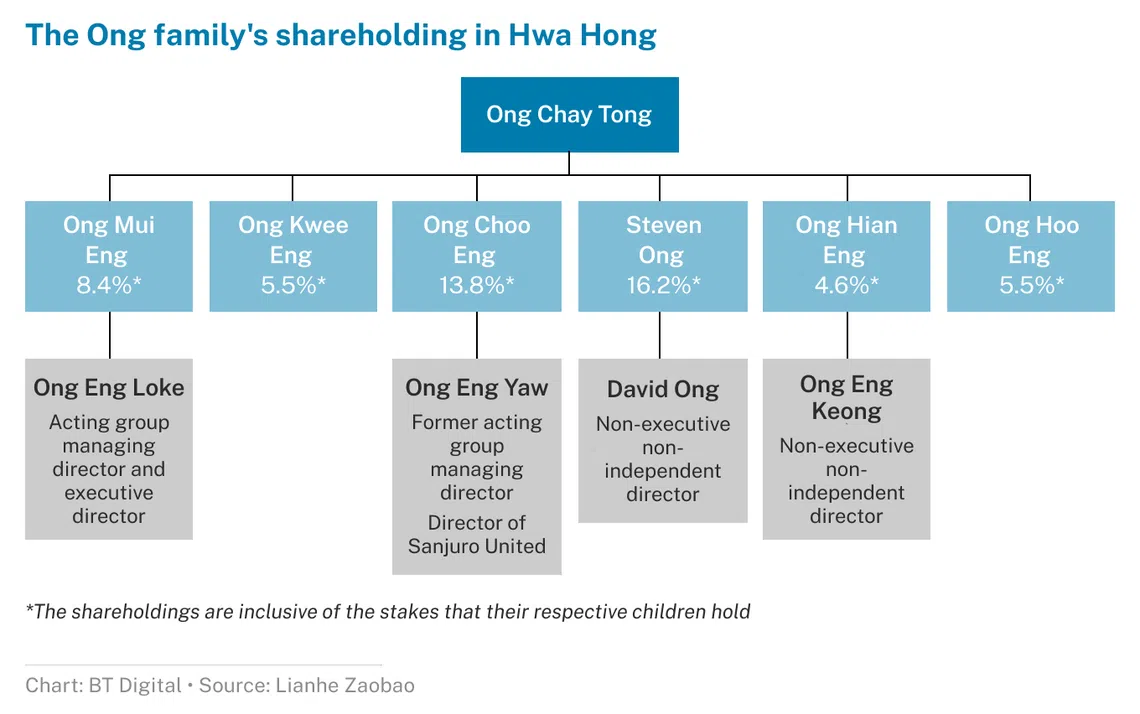

Hwa Hong founder Ong Chay Tong had 2 wives and 6 sons. His sons and their families are all shareholders of Hwa Hong, with their shareholdings as follows: Ong Mui Eng with an 8.4 per cent stake; Ong Kwee Eng with 5.5 per cent; Ong Choo Eng with 13.8 per cent; Steven Ong with 16.2 per cent, Ong Hian Eng with 4.6 per cent; and Ong Hoo Eng with 5.5 per cent.

Currently, the directors on Hwa Hong’s board include Ong Mui Eng’s son Ong Eng Loke, Steven Ong’s son David Ong, and Ong Hian Eng’s son Ong Eng Keong.

Ong Choo Eng, who was group managing director of Hwa Hong from 1989 to 2021, and his son Ong Eng Yaw, who joined Hwa Hong in 2008 and was acting group managing director from 2021 to 2022, are seen as old management of the company.

After the death of Ong Chay Tong, the sons began fighting over his assets. Below is a timeline of key events that led up to the dispute.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

2003: The Ong family went to court, after Steven Ong and his son David Ong alleged minority oppression against 8 other members of the Ong family, including then-group managing director Ong Choo Eng.

The father-and-son duo also presented a winding up petition against Ong Holdings – the Ong family’s holding company and then controlling shareholder of Hwa Hong – on the grounds that the working relationship among the company’s shareholders had broken down.

The conflict was later settled out of court.

SEE ALSO

2007: The Ong family met in court again over the rights of their ancestral property. The company controlled by the sons of the late Ong’s first wife claimed a stake in their half-brother Ong Hoo Eng's apartment. The company’s claim was dismissed by the court.

April 2021: At Hwa Hong’s annual general meeting (AGM), Ong Choo Eng stepped down from his role as director and managing director, a role he has held since 1989, and his son Ong Eng Yaw took over as executive director and acting managing director of Hwa Hong. Ong Eng Loke was appointed to the board of directors as his father Ong Mui Eng’s alternate director.

Soon after, David Ong was also appointed as director, while Ong Eng Keong was appointed as his father Ong Hian Eng’s alternate director.

September 2021: Then-majority shareholder Hong Leong Group cut its stake in Hwa Hong to 5.1 per cent from 18.9 per cent. Most of its shares were sold to 2 private equity funds that were part of Ong Choo Eng’s privatisation offer for Hwa Hong.

The shares were sold at S$0.37 each, which is the same as the offer price under the privatisation offer.

April 2022: Ong Eng Yaw resigned as the acting group managing director and executive director, citing personal reasons. At Hwa Hong’s AGM, 2 of its independent directors were not re-elected to its board, leaving Mak Lye Mun as its sole independent director.

Ong Eng Loke later took over the role of acting group managing director, and, together with the other board members, nominated 2 candidates to fill the vacancies with independent directors.

May 2022: Mak resigned from being Hwa Hong’s independent and non-executive director, which the company said was due to a “disagreement with certain board members on the selection and appointment process of 2 new independent directors”.

Hwa Hong was later served a notice of compliance by the Singapore Exchange Regulation (SGX RegCo), adding that it requires Hwa Hong to appoint an independent reviewer to review the company’s internal controls, processes and practices relating to the board nomination process.

Slightly over a week later, Sanjuro United – comprising Ong Choo Eng and his family, as well as other substantial shareholders of the company – launched a privatisation offer for Hwa Hong at S$0.37 per share, citing corporate governance issues and the notice of compliance as one of the reasons behind the acquisition.

On the same day, Hwa Hong appointed Evercore Asia as a financial adviser to solicit other potential offers following the Sanjuro United offer.

Sanjuro United’s offer price is 27.6 per cent over S$0.29, the counter’s closing price on its last full trading day prior to the offer announcement. The offer price also represents a premium of 29.8 per cent over the counter’s net asset value per share as at Dec 31, 2021.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.