iFAST's Q1 net profit falls 35% on lower revenue, higher expenses

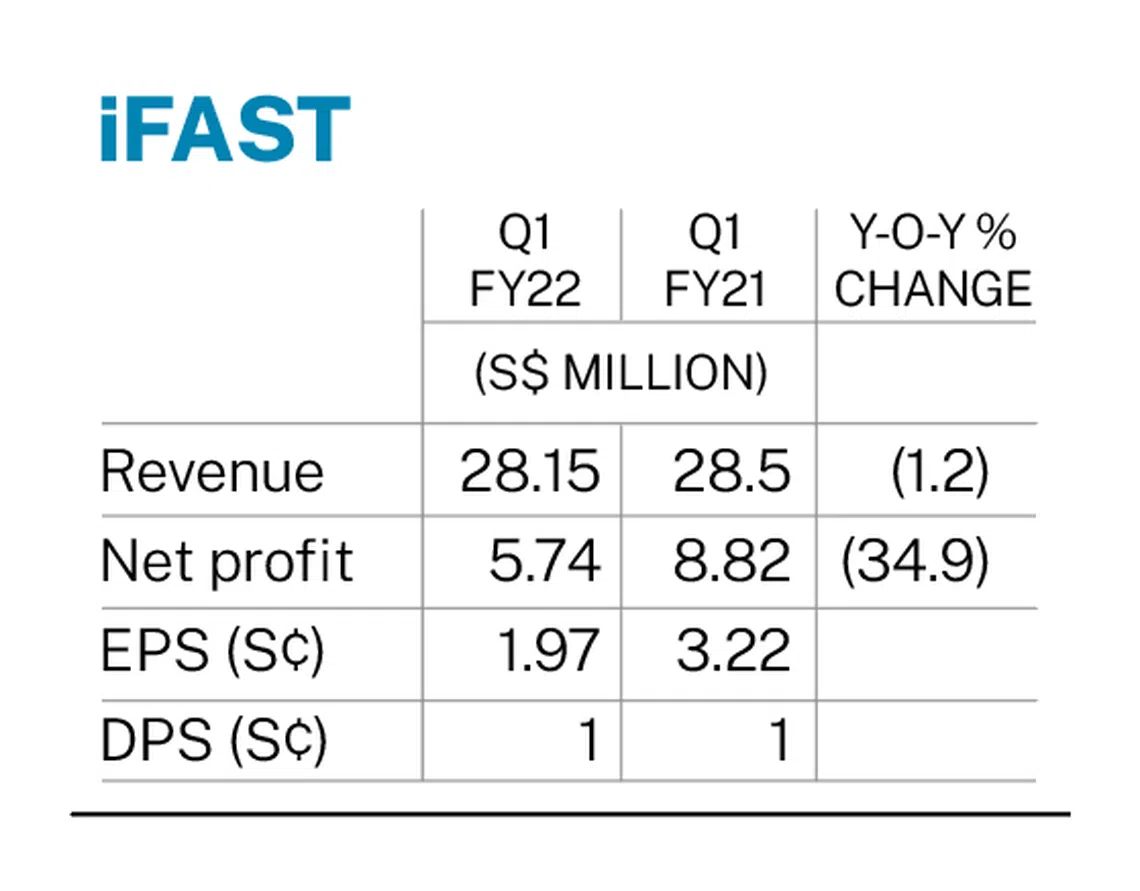

Fintech platform iFAST Corp posted a near 35 per cent year-on-year drop in net profit to S$5.74 million for the first 3 months ended Mar 31, 2022, as global stock market conditions turned sour.

The bottom line was lower in line with decreased revenue and higher operating expenses.

Net revenue for the quarter was 1.2 per cent lower at S$28.15 million as an 18.7 per cent decline in non-recurring net revenue offset an 8.8 per cent increase in recurring net revenue. Earnings per share for the quarter fell to 1.97 Singapore cents, down from 3.22 cents a year ago.

Operating expenses rose 10.4 per cent year-on-year to S$21.12 million in Q1 2022 as the group continues to invest in its next phase of growth.

“The wealth management platform business that the group is building has very strong long-term growth drivers, (but) in the short term, financial market conditions can cause interruptions in its growth path, and 2022 looks likely to be one of those years,” iFAST warned.

The group’s assets under administration (AUA) declined 2 per cent quarter-on-quarter to S$18.63 billion as at Mar 31, 2022, on the back of declines in stock and bond prices globally. When comparing year-on-year however, the group’s AUA was up 15.6 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

iFAST’s acquisition of UK-based BFC Bank was completed on Mar 28, and the bank has been renamed iFAST Global Bank. iFAST Global Bank is expected to contribute S$4 million in losses to the group in 2022, although the group expects it to achieve profitability from 2024. Beyond 2024, iFAST Global Bank is expected to become an “important growth driver” for the group.

iFAST said: “Overall, the group expects to see a moderate growth in net revenue in 2022 as a whole, but also expects to see some declines in profitability. The group however expects to see a robust ramp up in its profitability between 2023 to 2025 as its new ePension division in Hong Kong becomes a strong contributor.”

iFAST declared an interim dividend of one cent per share, similar to Q1 2021.

The counter closed at S$5.66 on Friday (Apr 22), up 11 Singapore cents or 1.98 per cent.

Copyright SPH Media. All rights reserved.