Keppel DC Reit posts 12.8% rise in H1 DPU to S$0.05133

Distributable income is up 57.2% at S$127.1 million for the period

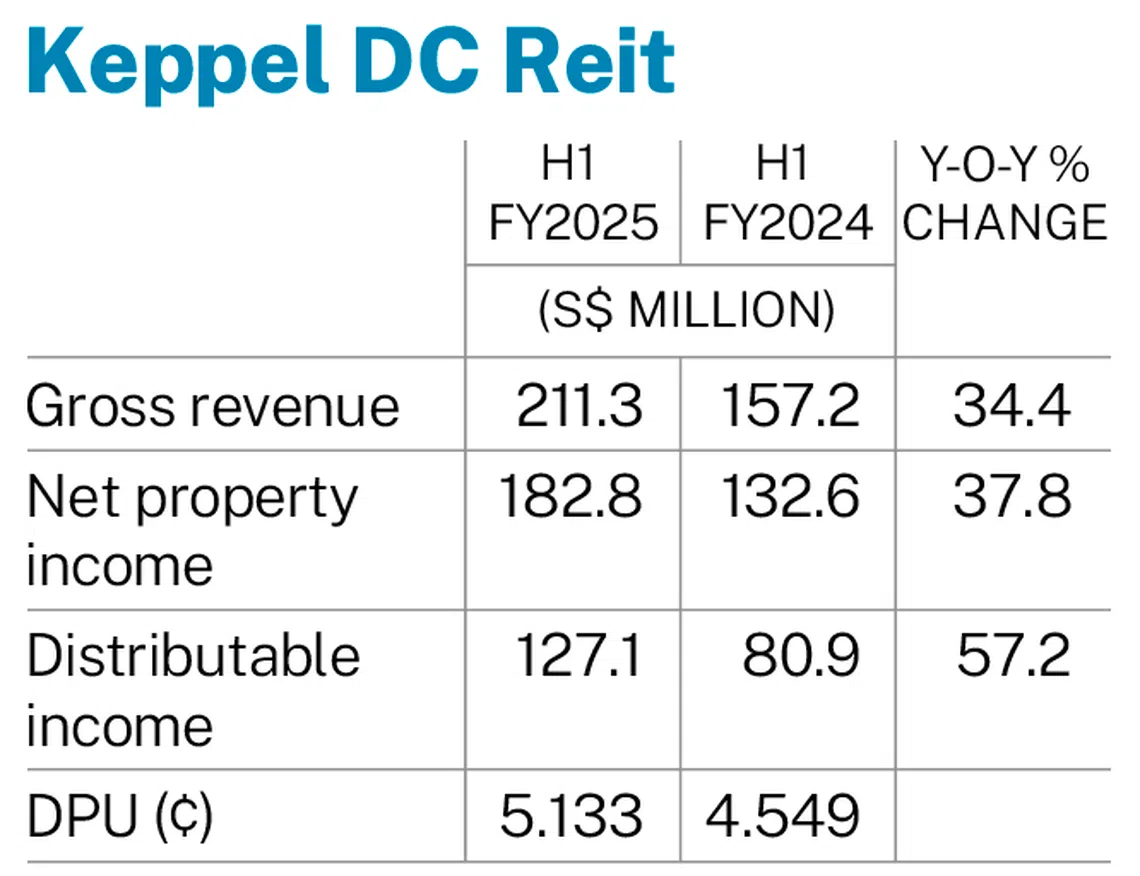

[SINGAPORE] Keppel DC Reit posted a 12.8 per cent increase in distribution per unit (DPU) to S$0.05133 for its first half of the financial year ended Jun 30, from S$0.04549 in the same year-ago period.

This was attributed mainly to contributions from the acquisition of data centre buildings Keppel DC Singapore (KDC SGP) 7 and 8 last November, and Tokyo Data Centre 1 in July 2024, and contract renewals and escalations.

The two hyperscale data centres KDC SGP 7 and 8 are located in Genting Lane in Singapore. The acquisition entitles the Reit to hold 99.49 per cent of the economic interest from these data centres. Tokyo Data Centre 1 was Keppel DC Reit’s first acquisition in Japan; the total purchase consideration of 23.4 billion yen (S$202.93 million) was a 2.5 per cent discount to the property’s valuation of 24 billion yen.

The distribution will be paid on Sep 15, after the record date on Aug 4.

Separately, Loh Hwee Long, chief executive officer of the manager of the real estate investment trust (Reit), said on Friday (Jul 25) that the Reit will focus on establishing a strategic foothold in its existing markets of Japan and Europe, as well as South Korea where it has no presence yet. This will be achieved through the acquisition of hyper-scale data centres which can process large amounts of data.

“Our focus is hyper-scale facilities, because that’s the segment in which we have very strong conviction will be in a sweet spot, given the developments in the sector in the years ahead,” said Loh, who was speaking at Keppel DC Reit’s financial results briefing.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The acquisitions have a target capitalisation rate of around 4 per cent in Japan, and around 6 per cent in Europe and South Korea, and the data centres are likely to have a power capacity of at least 20 megawatts, said Loh.

Revenue was up 34.4 per cent at S$211.3 million for the half year, from S$157.2 million in H1 FY2024, said the manager of the Reit in a bourse filing on Friday.

Distributable income rose 57.2 per cent to S$127.1 million from S$80.9 million, where the increase was partially offset by the divestment of Kelsterbach Data Centre in March 2025 for 50 million euros (S$75 million), and Intellicentre Campus, in addition to the absence of a one-off dispute settlement sum received in 2024.

Finance costs stood at S$24.5 million for H1, down 5.3 per cent year on year from S$25.9 million. Finance income rose to S$8 million for the period, up 45.7 per cent from S$5.5 million in H1 2024.

Net property income rose by 37.8 per cent to S$182.8 million from S$132.6 million.

As at Jun 30, aggregate leverage was at 30 per cent. Interest coverage ratio stood at 5.9 times.

The Reit recorded a portfolio reversion of around 51 per cent in H1 2025. Average cost of debt fell to 3 per cent for the period, from lower floating rates compared with the same period a year prior. Total borrowings stood at S$1.6 billion, with 76 per cent hedged through interest rate swaps as at Jun 30.

‘Immediate’ task to fill vacancies

Keppel DC Reit recorded a portfolio occupancy of 95.8 per cent, with portfolio weighted average lease by lettable area at 6.9 years.

Loh said that the manager’s “immediate task” is to fill the vacancies in its assets. One of its tenants in KDC SGP 1 vacated in Q2, while another tenant in its Cardiff data centre will leave by mid-2026.

He said that the manager is on track to conclude a 30-year land lease extension for KDC SGP 1, which will take effect from the end of September 2025.

“This extension will provide an opportune time for us to review our need for longer-term plans for the asset which is not a build-to-suit data centre,” said Loh. Such data centres are specifically designed for a tenant.

He added that the vacant space in SGP 1 is attractive to potential tenants as it is a contiguous space. As it is not a build-to-suit data centre, there is also an opportunity for the manager to transform the space for other uses in the medium term.

On how quickly vacancies could be filled, he said it will take time to find tenants for the Singapore data centres, as the manager must ensure they match the available power capacity.

The manager will also “keep its options open” to alternative uses for the space in its Cardiff data centre.

While global macroeconomic conditions look uncertain amid shifting trade policies, the possibility of higher tariffs and persistent geopolitical tensions, industry fundamentals such as the rapid commercialisation of generative artificial intelligence is favourable for Keppel DC Reit, as the industry is poised for “robust growth”, said the manager of the Reit.

Units of Keppel DC Reit closed 0.9 per cent or S$0.02 lower at S$2.26 on Thursday.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.