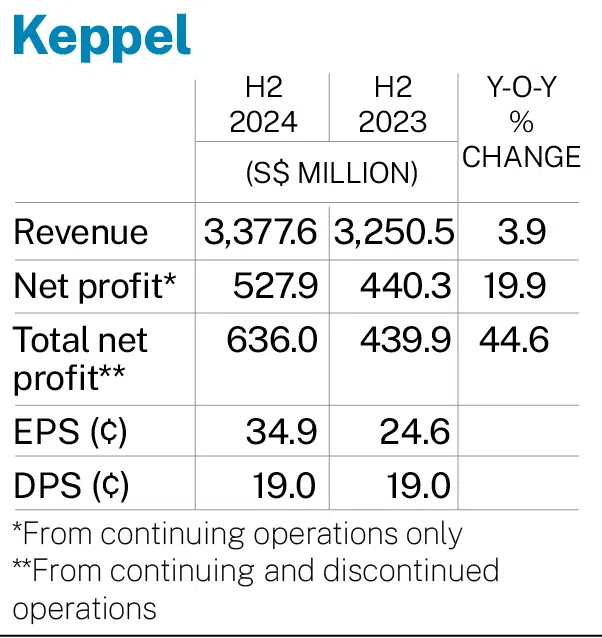

Keppel H2 profit from continuing operations up 19.9% at S$527.9 million

Revenue for the period rises 3.9% to S$3.4 billion from S$3.3 billion

KEPPEL recorded a profit from continuing operations of S$527.9 million for its second half ended Dec 31, up 19.9 per cent from S$440.3 million in the year-earlier period.

Including profit from discontinued operations, this brings its total profit to S$636 million for its second half, up 44.6 per cent from S$439.9 million from the same period the year before, it said on Wednesday (Feb 5).

This translates to a basic earnings per share (EPS) of S$0.349, a 41.9 per cent increase from S$0.246 previously. EPS from continuing operations was S$0.29, up 17.9 per cent from S$0.246 in the previous corresponding period.

The group attributed its higher earnings in H2 to profit growth from its real estate and connectivity segment, which registered increases in net profit year on year. Its infrastructure segment recorded lower net profit than in the year-ago period.

Revenue for H2 rose 3.9 per cent to S$3.4 billion from S$3.3 billion in the previous corresponding period, driven largely by growth from its real estate segment.

This segment registered a 46.4 per cent rise in H2 revenue to S$339.3 million from S$231.7 million in the year-earlier period. This was attributed to property trading projects in Singapore and Indonesia, but was partly offset by lower revenue from property trading projects in China, the group said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Revenue from its infrastructure segment grew marginally by 1 per cent, while its connectivity segment’s revenue was “comparable” to the previous corresponding period, the group said.

The asset manager proposed a final cash dividend of S$0.19 per share for FY2024, unchanged from that in the previous corresponding period. The proposed final dividend will be paid on May 9 if it is approved by shareholders at the next annual general meeting scheduled for Apr 21.

Together with an interim dividend of S$0.15 per share, paid to shareholders in August 2024, this brings the total cash dividend for FY2024 to S$0.34 per share.

Its full-year profit from continuing operations fell 6 per cent to S$832 million from S$885.2 million in the year-earlier period. Its profits from both discontinued and continuing operations for the full year declined 76.9 per cent to S$940.2 million, from S$4.1 billion in the previous corresponding period.

This translates to a basic EPS of S$0.516, down 77.3 per cent from S$2.276 previously. EPS from continuing operations was at S$0.457, down 7.7 per cent from S$0.495.

Revenue for the full year fell 5.2 per cent to S$6.6 billion from S$7 billion.

Opportunities, not threats

The recent announcement by the US to enforce a chip export quota, as well as the breakthrough DeepSeek made with its own artificial intelligence (AI) model, could be opportunities for Keppel.

It is still too early to comment on these developments, said Manjot Singh Mann, CEO of connectivity at Keppel. He added, however, that with the digitalisation and sustainability trend here to stay, he expects more companies to tap AI as efficiencies grow and costs drop.

“For large, medium-sized and small enterprises will look at AI innovation at a far more economic way than the world has seen so far… we do think this is more of an opportunity than a threat,” he said.

A drop in cost and increased efficiencies will boost demand for AI, which would be a positive trend for Keppel.

Monetising Asset Co

Keppel is looking to derisk Asset Co’s portfolio of 13 legacy rigs over time. The asset manager moved to take control of Asset Co back in November 2024.

Currently, all the jackup rigs are under bareboat charters, said Keppel chief executive Loh Chin Hua. There are some assets in certain markets that might have a favourable environment to be completed and put out on charters.

There are a number of ways Keppel could monetise Asset Co – selling the rigs, putting the assets into a fund, and bringing in outside limited partners or securitising Asset Co.

“The key is to create cashflow from these assets to have more optionality on how we monetise Asset Co,” said Loh.

Shares of Keppel closed up 0.8 per cent or S$0.05 at S$6.68 on Wednesday.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.