Keppel H2 profit from continuing operations rises 27.2% to S$645.4 million; proposes special dividend

Special dividend proposed given its strong progress in monetisation, says company

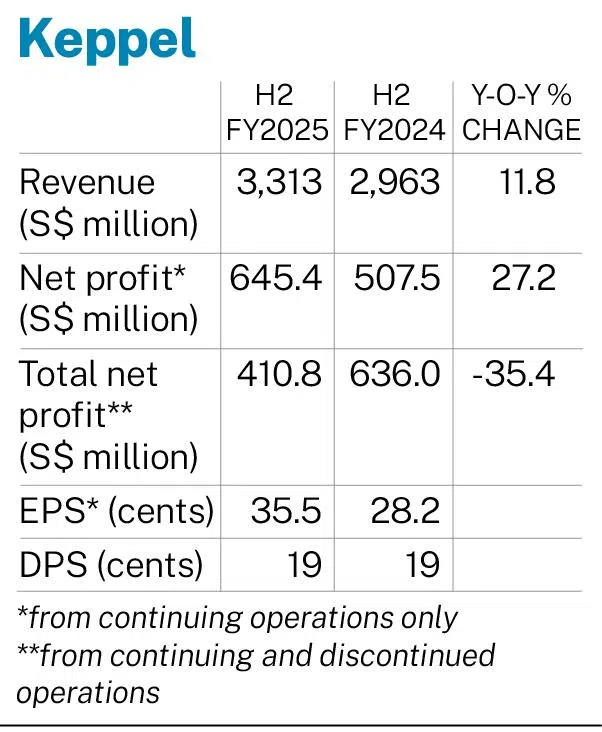

[SINGAPORE] Keppel posted a net profit of S$645.4 million from its continuing operations for the second half ended December, up 27.2 per cent from S$507.5 million the previous year, it said in a bourse filing on Thursday (Feb 5).

Including profit from discontinued operations, Keppel’s total profit for the second half fell to S$410.8 million, down 35.4 per cent from S$636 million.

For the full year, net profit – excluding non-core portfolio and discontinued operations – rose about 39 per cent to S$1.1 billion, from S$793 million in FY2024.

Keppel attributed its FY2025 performance to higher profits across all of its three business segments: infrastructure, real estate and connectivity.

Of the three, infrastructure saw the largest share of earnings, bolstered by resilient results in the integrated power business and stronger growth from decarbonisation and sustainability solutions.

However, when including the non-core portfolio and discontinued operations, the overall net profit for FY2025 was S$788.5 million, down 16.1 per cent from S$940.2 million a year earlier. Keppel attributed the fall mainly due to the accounting loss of S$222 million arising from the proposed sale of M1’s telco business, which is pending regulatory approval.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The results translated to H2 earnings per share for its continuing operations of S$0.355, up from S$0.282 in H2 FY2024.

Revenue from continuing operations for H2 was S$3.3 billion, up 11.8 per cent from a year earlier. For the full year, revenue rose 3.4 per cent to nearly S$6 billion.

The asset manager has proposed a final dividend of S$0.47 per share for FY2025.

SEE ALSO

The final dividend comprises ordinary cash dividends of S$0.34 per share, which includes a proposed final cash dividend of S$0.19 and interim cash dividend of S$0.15 per share paid in August 2025.

The final dividend also comprises a special dividend of S$0.13 per share proposed by the board. This includes S$0.02 per share in cash and one Keppel Reit unit for every nine Keppel shares held. The price is equivalent to about S$0.11 per share, based on Keppel Reit’s closing price of S$0.98 on Feb 3, 2026.

Keppel said that the special dividend was proposed given the strong progress in asset monetisation.

The company has raised a cumulative total of about S$14.5 billion since its asset monetisation programme began in October 2020. In 2025, transactions amounting to about S$1.6 billion in gross monetisation value were completed.

The total cash dividend translates to a yield of 4.3 per cent, based on Keppel’s Feb 4 closing price. The group plans to pay the final ordinary cash dividend on May 8.

Additionally, Keppel said it aims to pay out special dividends based on 10 to 15 per cent of the gross value of asset monetisation transactions completed in the financial year, until the company’s monetisation programme is complete.

The company said it remains focused on optimising the speed of divestment and exit value of assets in its non-core portfolio for divestment, which had a carrying value of S$13.5 billion as at end-2025.

Keppel shares closed at S$10.95 on Wednesday, up 0.6 per cent or S$0.06.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.