Keppel Infrastructure Trust H1 DPU up 1% at S$0.0197

Distributable income for first half-year rose 31.2% on the year to S$119.4 million, from S$91 million

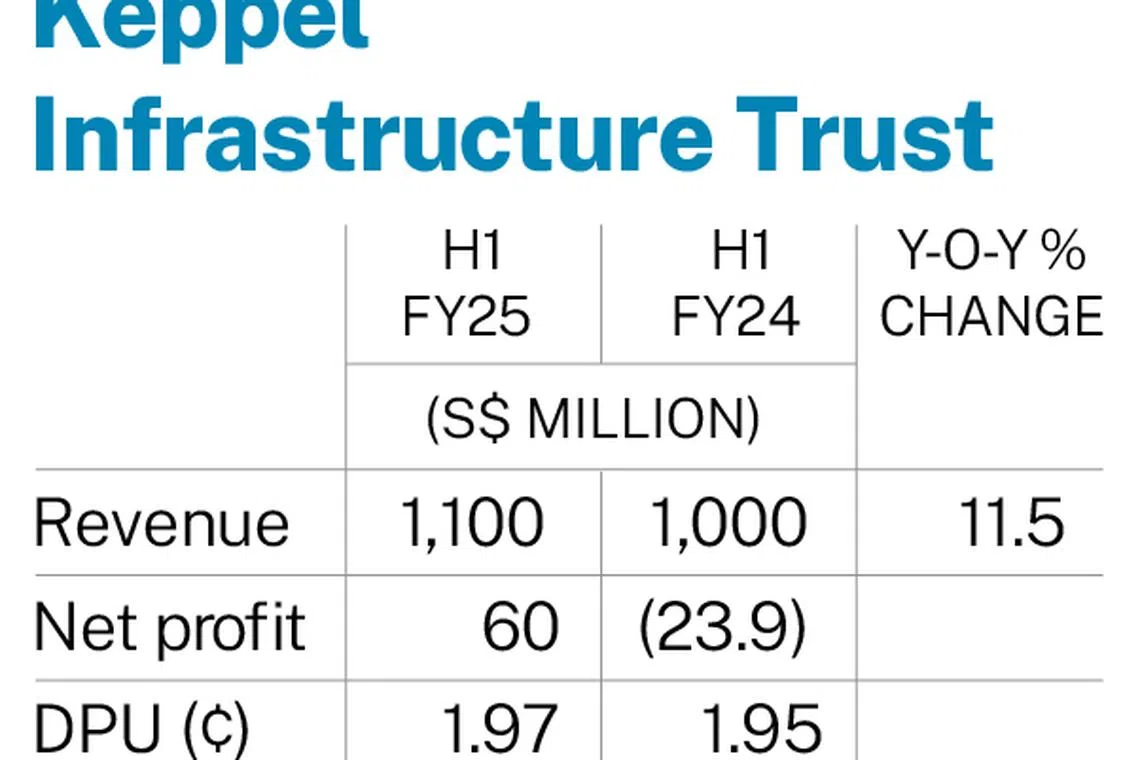

[SINGAPORE] Keppel Infrastructure Trust (KIT) on Tuesday (Jul 29) posted a distribution per unit of S$0.0197 for its first half ended Jun 30, a 1 per cent increase from S$0.0195 in the year-ago period.

The distribution will be paid on Aug 13, after the record date of Aug 6.

Distributable income for the six months stood at S$119.4 million, up 31.2 per cent from S$91 million in H1 2024. This increase was driven by City Energy, Ixom, new acquisitions and KIT’s divestment of its 50 per cent stake in Philippine Coastal Storage and Pipeline Corporation, which was completed on Mar 20, 2025.

For the half-year, the business trust swung back into the black with a net profit of around S$60 million, compared with a net loss of S$23.9 million in the prior corresponding period.

Revenue rose 11.5 per cent to S$1.1 billion from S$1 billion in the year-ago period.

The increase was mainly attributable to contributions from transport service provider and bus operator Ventura, which was acquired in June 2024, alongside higher revenue from City Energy and the Senoko waste-to-energy plant, KIT’s trustee-manager said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

However, it was partially offset by lower landfill revenue and waste volume from One Eco Group and lower distribution income from Aramco Gas Pipelines Company.

Its three segments of energy transition, environmental services, as well as distribution and storage, posted revenue growth on the year.

KIT’s assets under management was around S$8.7 billion as at Jun 30, 2025. By segment, 62 per cent of its portfolio comprised businesses and assets in energy transition, 28 per cent in distribution and storage, and 10 per cent in environmental services.

The trustee-manager said that, in H1 2025, it made strategic divestments to pave the way for more accretive acquisitions that would enable KIT to create value and strengthen its cash flow resilience.

The trust announced the proposed acquisition of subsea cable service provider Global Marine Group in April, as well as the partial divestment of Ventura for A$130 million (S$109.1 million) in June.

On Feb 28, the business trust also completed the fifth and final phase of its acquisition of the solar portfolio of German greentech company Enpal, which it committed to acquiring in 2023.

Units of KIT ended Tuesday 1.1 per cent or S$0.005 lower at S$0.44, after the announcement.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.