📃 (Legal) ways to pay less in taxes

- Find out more and sign up for Thrive at bt.sg/thrive

👷 Tax hacks

Tax season is not until next year, but the year’s end is a great time to start looking at how much you might have to fork out.

That’s because taxes are calculated based on the preceding calendar year. In other words, you’ll need to take advantage of tax savings schemes by Dec 31 this year to cut your bill for Year of Assessment 2024. If you want to get a tax deduction for charity donations, for example, you’ll have to make those donations before New Year’s for them to count towards the tax bill you receive the next year.

Course fees, work-from-home expenses and even those pesky membership subscription fees that doctors, lawyers, accountants and engineers pay to professional institutes or societies could all go towards lowering your bill.

⛑️ Reliefs

These are the reliefs on the Inland Revenue Authority of Singapore’s (IRAS) website that tax residents (including non-citizens who are in Singapore for more than 183 days in a year) may be eligible for.

“One of the most attractive is the Working Mother’s Child Relief (WMCR),” says Wong Sook Ling, executive director of tax advisory at tax and accounting firm BDO Singapore.

Under the WMCR, working mothers with Singaporean children can claim 15 per cent to 25 per cent of their earned income as tax relief for each child, depending on how many children they have.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

These can be added together, which means a mother with multiple children can potentially claim reliefs of up to 100 per cent of their income (up to a personal income tax relief cap of S$80,000 that everyone is allowed to claim).

That said, with effect from the Year of Assessment 2025, this will be changed from a percentage of an eligible working mother’s annual earned income to a fixed dollar tax relief.

“Another thing people do is open an SRS account,” adds Wong.

Wong is referring to the Supplementary Retirement Scheme, a voluntary savings scheme to get people to set aside money for retirement, over and above their CPF contributions.

After opening an SRS account with any of the three local banks, you’ll be able to contribute a yearly maximum of S$15,300 (for Singaporeans and permanent residents). When you get your tax bill the next year, you’ll get a tax relief equivalent to the amount you contributed.

The money in your SRS account can be put towards government-approved investments, which include shares, exchange-traded funds and Singapore Savings Bonds.

While you’re allowed to withdraw from your SRS account before the statutory retirement age, doing so will incur a 5 per cent penalty and the withdrawal sum will be taxed. So, be sure that whatever you put in is money you won’t need until retirement.

Other reliefs you may be eligible for include the following:

Course Fees Relief (up to S$5,500): If you attended courses, seminars or conferences that are either relevant to your current employment, or lead to an approved academic, professional or vocational qualification. The fees have to be paid for by yourself.

Parent/Handicapped Parent Relief (up to S$9,000 per dependant, or S$14,000 per handicapped parent): The amount depends on whether you stay with the dependant. The dependant must also not have an annual income exceeding S$4,000.

CPF Cash Top-up Relief (up to S$16,000 – S$8,000 for yourself and $8,000 for family members): If you made cash top-ups to your CPF Special, Retirement or MediSave account, or to your family members’ accounts.

Again, the total personal income tax relief that can be claimed each year is capped at S$80,000.

When you’re doing the sums, one useful resource is IRAS’ spreadsheet calculator, which can help you figure out how much tax you’ll need to pay after reliefs.

Something to watch out for is that gains from exercising employee stock options are taxable. This could mean a hefty tax bill for workers from companies whose share prices have rallied recently.

💳 Deductions

On top of tax relief schemes, there are also deductions for items such as expenses incurred in your employment (but not reimbursed by employer) or running your own business.

For example, if your employer requires you to work from home, you may be able to claim the resulting electricity and telco charges as a tax deductible.

To do so, you may need to submit your bill statements before and after working from home to show how much more you’re paying. That amount can then be claimed as a deduction.

Other examples of allowable expenses include:

- Entertainment expenses incurred in entertaining clients. Your share of the entertainment expenses must be excluded from the claim

- Mosque building fund, zakat fitrah or any other religious dues authorised by law

- Subscriptions paid to professional bodies or society for professional updates, knowledge and networking

- Travelling expenses incurred on public transport, such as buses, trains, taxi (excluding to and from home and office)

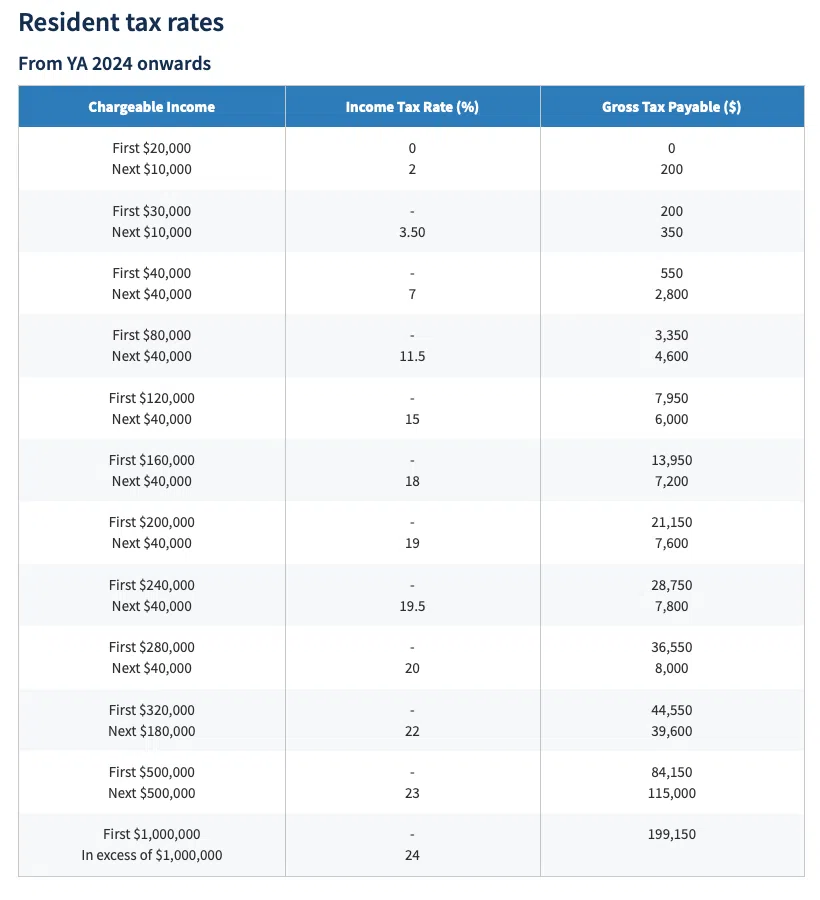

For donations to the Community Chest or any approved charity, you can also get a tax deduction of 2.5 times the qualifying donation amount. Often, when you’re trying to bring your taxable income down to a lower bracket, donations can be the thing that brings you under the limit.

🔧 Doing it on your own

For the self-employed, calculating your business expenses and tax deductions will take more effort 😵💫.

“You need to start taking care of your accounts,” says Wong. “What is your revenue? What is the cost you incurred to buy the goods to sell? What are the expenses you incurred to rent your office or employ your staff?”

And if you’re claiming any expenses, including as an employee, remember to hold on to the receipts, she advises. Keep track of when you met that client, who that client was and the purpose of the meeting. These records must be kept for five years.

Although you won’t need to provide receipts for these expenses when you file your tax returns next year, IRAS may require you to present them when they come knocking during their regular compliance checks.

TL;DR

- Tax reliefs and deductions allow you to reduce your tax bill

- Examples include course fees, work-from-home expenses as well as CPF and SRS top-ups

- These expenses and top-ups must be performed by Dec 31 for them to count towards next year’s tax bill

- Donations to approved charities can get you 2.5 times the donation amount in tax deductions

Copyright SPH Media. All rights reserved.