Macquarie initiates coverage on 11 S-Reits with top picks including data centre plays

Reits in these sectors can weather a climate of moderated rate cut expectations

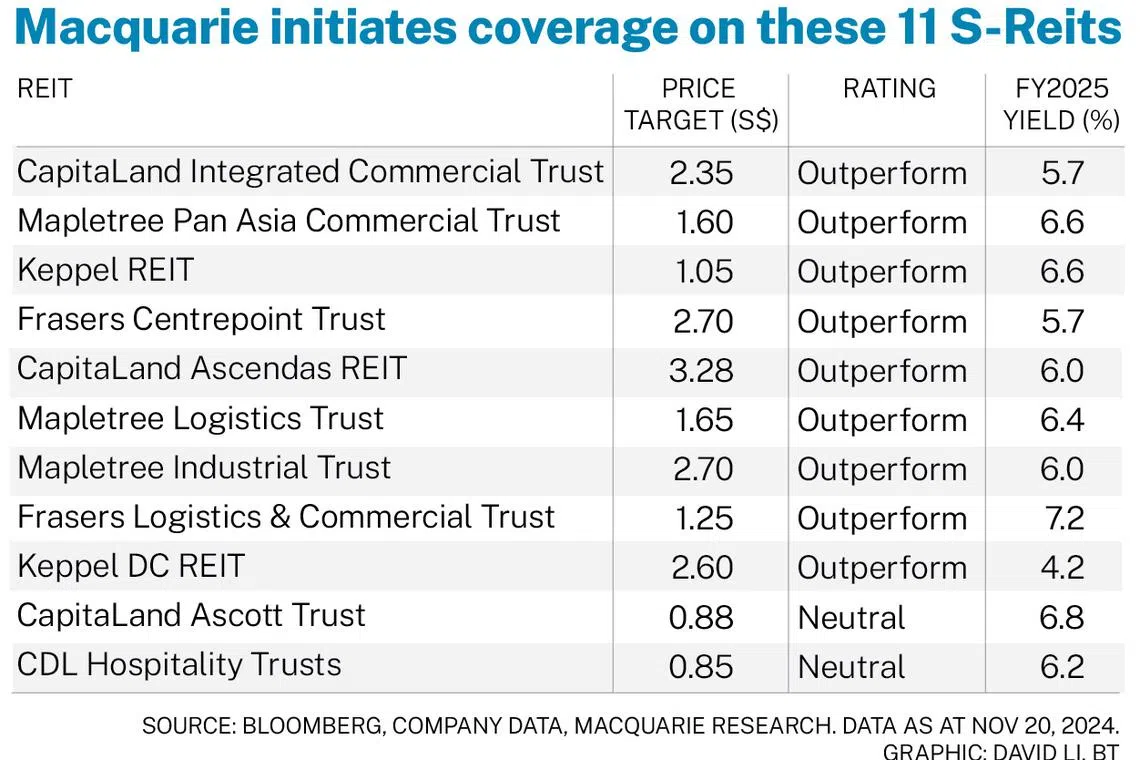

MACQUARIE Research initiated coverage on 11 Singapore real estate investment trusts (S-Reits) that it prefers amid a higher-for-longer interest rate environment.

It named top picks including data centre and industrial names, with an “outperform” rating on nine out of the 11 it listed.

S-Reits are trading at levels yielding around 6 per cent, close to the troughs seen before the US Federal Reserve cut interest rates. Macquarie said there is potential for an upside of around 20 to 60 per cent if the economic outlook improves.

Macquarie analysts Rachel Tan and Jayden Vantarakis said in a November report that the earnings of S-Reits are likely to bottom in fiscal 2025, indicating the same for their distributions per unit (DPU). And if the Fed cuts interest rates by another 25 basis points next month as widely expected, the impact to DPU could range between neutral and a positive 3 per cent.

The analysts are positive on Reits in the industrial and suburban retail sectors, as these can weather a climate of moderated rate cut expectations. A Trump administration is said to mean a slower pace of interest rate cuts.

“Given that rate cut expectations have moderated and a higher-for-longer interest rates scenario is back in play as the base case, our sector, in the order of preference are industrial, retail, office, and hospitality,” Macquarie analysts wrote.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“Industrial and suburban retail are less cyclical, and these segments typically have more conservative balance sheets that could shield some impact from higher-for-longer interest rates,” they said. Rising or higher interest rates are said to be more negative for most Reits, as it leads to higher borrowing costs.

Top picks

Macquarie named CapitaLand Ascendas Reit (Clar) and Keppel DC Reit as their top picks for data centre plays.

As Singapore’s largest-listed business space and industrial Reit, Macquarie said Clar had a diversified portfolio of new economy assets. The analysts said the counter is trading at an “attractive” level, with a yield of around 6 per cent to its FY2025 earnings.

They have an “outperform” call on Clar, with a target unit price of S$3.28.

Macquarie has the same rating on Keppel DC Reit, which it said is on the path of being a proxy to artificial intelligence (AI) development. The analysts added that the counter has a potential sponsor pipeline acquisitions of AI-ready data centres in the longer term. Its target unit price is S$2.60.

The analysts said the key risks to S-Reits’ outlook are the office and hospitality segments. They said office Reits are susceptible to interest rate movements, while those focused on hospitality face headwinds following two years of exponential growth.

Two other top picks Macquarie named are Mapletree Pan Asia Commercial Trust and Mapletree Logistics Trust, which it said are “laggards” that could benefit from a potential recovery in China.

Macquarie is the least positive on CapitaLand Ascott Trust and CDL Hospitality Trusts . Of the 11 S-Reits the broker initiated coverage on, these are the only two with a “neutral” call.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.