Mapletree Industrial Trust Q3 DPU falls 7% to S$0.0317

The manager remains committed to its divestment target of S$500 million to S$600 million in North America

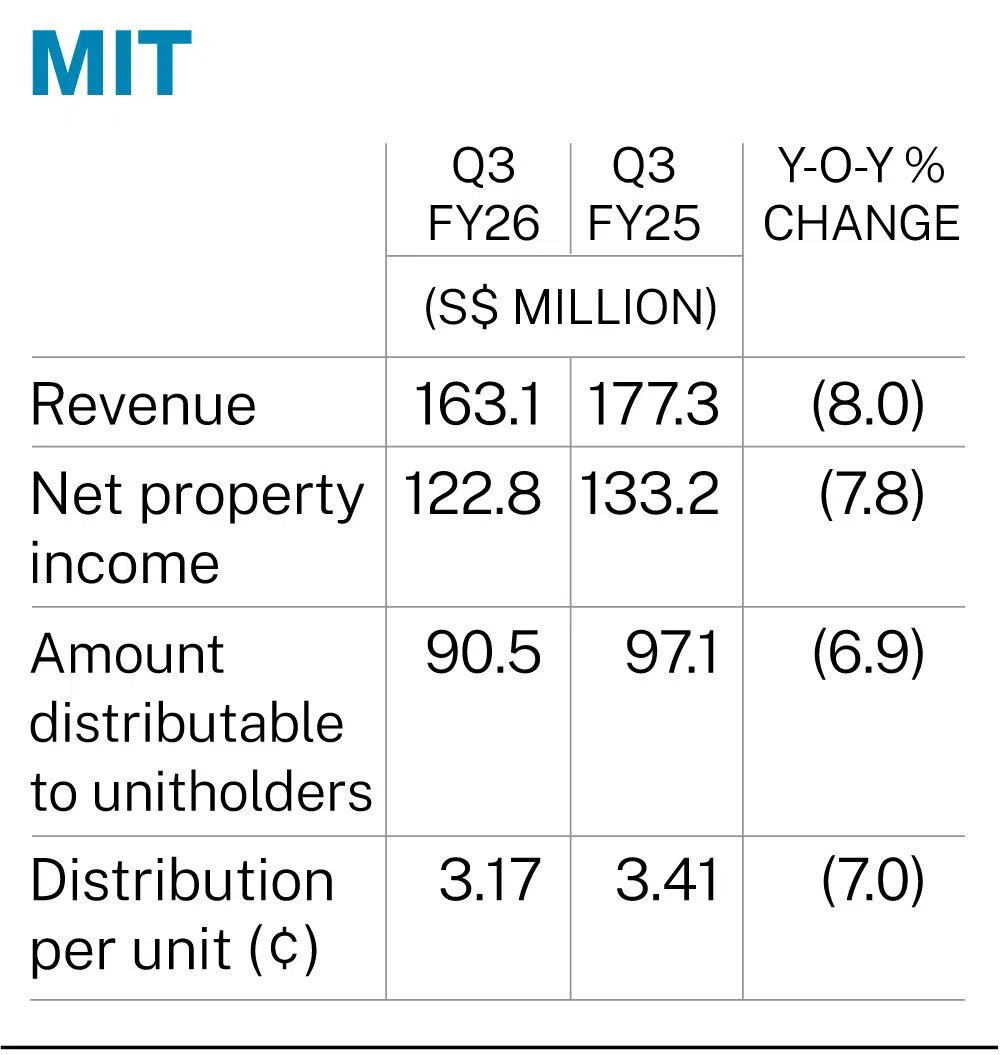

[SINGAPORE] Mapletree Industrial Trust (MIT) posted a distribution per unit (DPU) of S$0.0317 in the third quarter ended Dec 31. This was 7 per cent lower than the DPU of S$0.0341 in the corresponding year-ago period.

In a bourse filing on Wednesday (Jan 28), MIT’s manager reported that Q3 revenue fell 8 per cent to S$163.1 million from S$177.3 million the year before.

The amount distributable to unitholders declined 6.9 per cent to S$90.5 million from S$97.1 million, while property expenses fell 8.6 per cent to S$40.3 million from S$44.1 million.

Lily Ler, chief executive officer of MIT’s manager, said: “Our Singapore portfolio and Japan portfolio continued to provide a stable base for MIT’s performance, supported by resilient occupancies and positive rental reversions.

“In the near term, we remain focused on managing the impact of downtime from non-renewal of leases in the North American portfolio, while executing strategic divestments and acquisitions to strengthen portfolio quality and resilience.”

She added that the manager remains committed to its divestment target of S$500 million to S$600 million in North America.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“As we execute our portfolio rebalancing strategy, we may see near-term transitional effects, which are temporary and necessary to drive sustainable returns.”

Net property income decreased 7.8 per cent to S$122.8 million in Q3 from S$133.2 million in the year-ago period.

Total borrowings stood at around S$3.1 billion as at Dec 31, while MIT’s aggregate leverage ratio remained healthy at 37.2 per cent.

The average borrowing cost for Q3 rose to 3.1 per cent from 3 per cent in the prior quarter.

Average portfolio occupancy stood at 91.4 per cent in Q3, an improvement from 91.3 per cent in the second quarter.

Balancing risks and costs

In Singapore, MIT observed positive rental reversions for renewal leases across all property segments.

The weighted average rental reversion rate was 7.1 per cent, compared with 6.2 per cent in Q2.

The North American portfolio’s weighted average lease to expiry held steady at 6.2 years as at Dec 31.

The manager attributed this to long-term leases executed in the quarter that ranged from five to 13 years.

Since October 2025, leases totalling 217,062 square feet – or 3 per cent of the North American portfolio’s net lettable area – have been executed with a weighted average rental reversion rate of 3.1 per cent.

“Global growth is projected to moderate from 3.2 per cent in 2025 to 2.9 per cent in 2026, as higher tariffs in the United States and China raise business costs, reducing growth in trade and investment,” the manager said. “For 2027, a small rebound in growth is projected at 3.1 per cent, as the peak impact of higher tariffs passes and inflation declines. Intensifying downside risks, such as trade policy uncertainties, elevated trade restrictions and supply chain insecurities dominate the outlook.”

The manager added that it will continue its leasing efforts to improve occupancies, particularly in North America.

Active lease management, cost containment and prudent capital management remain its focus to balance the risks and costs in the uncertain macroeconomic environment, it said.

It will also keep undertaking selective divestments in North America and Singapore to enhance MIT’s financial flexibility, as well as redeploy capital into markets and assets that can provide sustainable growth.

The DPU of S$0.0317 will be paid out on Mar 12.

Units of MIT closed flat at S$2.11 on Wednesday, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.