Mapletree Logistics Trust posts 12.4% fall in Q1 DPU to S$0.01812

The decline is due to the absence of one-off divestment gains and the impact of weaker regional currencies

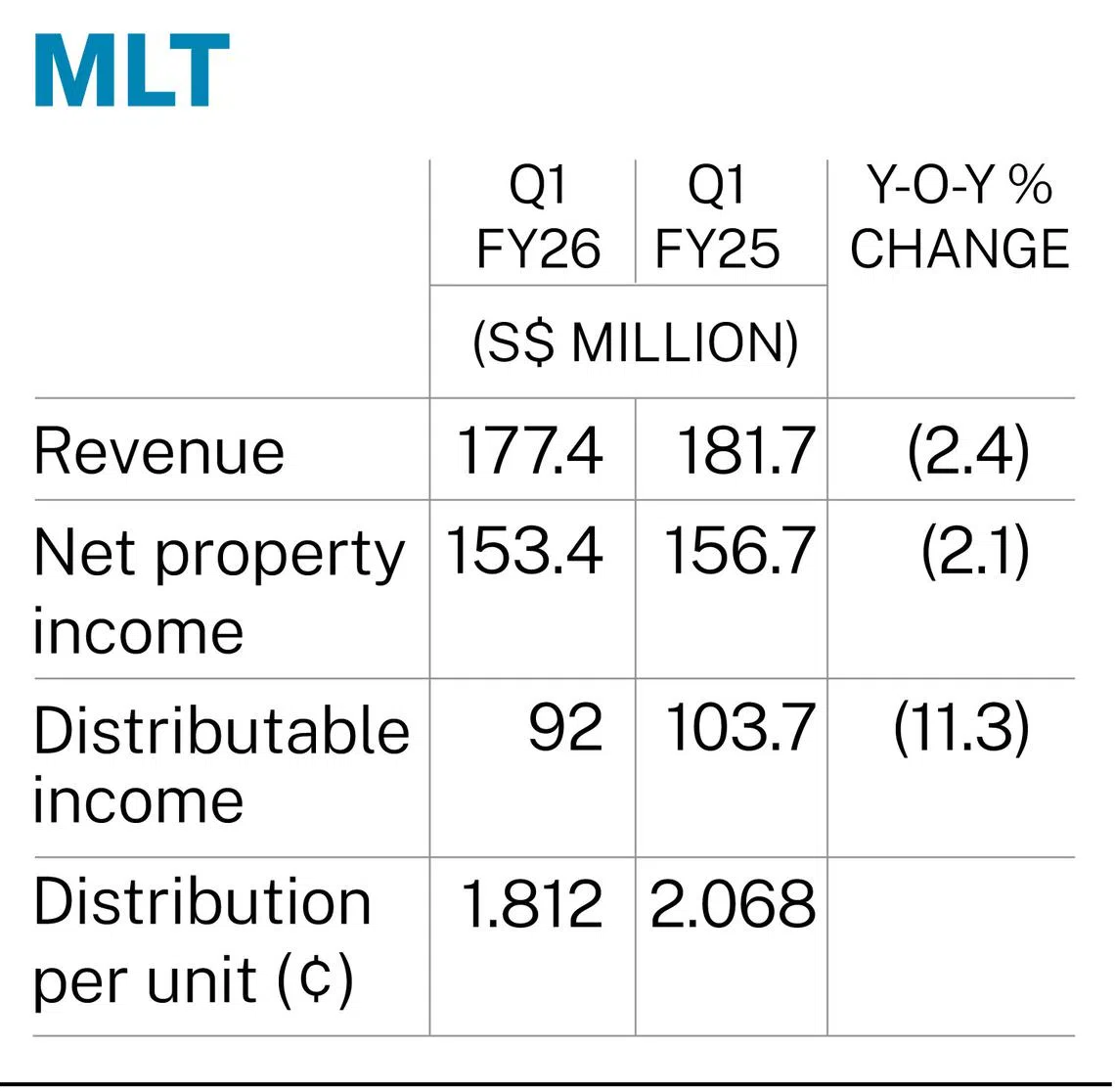

[SINGAPORE] Distribution per unit for Mapletree Logistics Trust (MLT) fell 12.4 per cent to S$0.01812 for the first quarter ended June, from S$0.02068 in the previous corresponding period.

The distribution will paid out on Sep 10, after the record date on Jul 31.

Distributable income declined 11.3 per cent to S$92 million in Q1, from S$103.7 million in the same period the year before.

The decrease comes amid higher borrowing costs, which rose 2.3 per cent on the year to S$39.4 million, as well as the absence of one-off divestment gains that contributed S$5.7 million in Q1 FY2025, said the manager on Wednesday (Jul 23).

However, excluding the one-off divestment gains, the distributable income would have fallen 6.2 per cent on the year from S$98 million. The DPU would have gone down 7.3 per cent from S$0.01954.

Gross revenue was down 2.4 per cent at S$177.4 million for the recorded period, from S$181.7 million in the same period a year ago.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Net property income (NPI) fell 2.1 per cent on the year to S$153.4 million for the quarter, from S$156.7 million previously.

The decline was mainly due to lower contribution from existing properties in China and the loss of income from 12 divested properties.

In FY2025, MLT divested 10 properties. These included three warehouses in Malaysia sold for RM157.5 million (S$47.7 million), two warehouse properties in Japan for S$37.5 million, and Mapletree Logistics Warehouse in Xian, China, for 70.5 million yuan (S$13.1 million).

In Q1 FY2026, the trust completed the sale of two properties: 1, Genting Lane in Singapore for S$12.3 million, and 8, Tuas View Square for S$11.2 million.

MLT had said previously that the divestments were in line with the manager’s strategy to rejuvenate its portfolio. Capital released from these disposals would yield greater financial flexibility to pursue investment opportunities in high-specification modern logistics facilities with higher growth potential, it noted.

The decline in top line and NPI also comes amid the depreciation of various regional currencies, including the South Korean won and Chinese yuan, against the Singapore dollar, said the manager.

That said, the impact of currency fluctuations was partially mitigated through the use of foreign currency forward contracts as a hedge against the foreign-sourced income distributions, it added.

The decrease in revenue was also moderated by higher contribution from existing properties in Singapore, Australia and Hong Kong, as well as income from Malaysia and Vietnam assets that were acquired in Q1 FY2025.

The book value of MLT’s portfolio of 178 assets was S$13 billion as at Jun 30. The weighted average lease expiry, by net lettable area, stood at 2.7 years, as at the end of the quarter. The occupancy rate was 95.7 per cent, and average rental reversion, about 2.1 per cent.

MLT’s gearing increased slightly to 41.2 per cent, mainly due to foreign currency impact from the weakening of regional currencies on overall portfolio asset value. Its weighted average borrowing cost remained at 2.7 per cent per annum for the quarter.

“Higher borrowing costs and regional currency depreciation against the Singapore dollar are expected to continue, weighing on MLT’s financial performance,” explained the manager.

To mitigate the impact, about three-quarters (74 per cent) of the trust’s income stream for the next 12 months has been hedged to the Singdollar, and about 84 per cent of total debt has been hedged to fixed rates, it added.

Jean Kam, chief executive officer of the manager, said: “Looking ahead, we are mindful that the ongoing trade tensions may reduce economic activities and demand for logistics space as the impact of tariffs starts to be felt.”

She added: “We will remain vigilant and focused on maintaining portfolio stability, managing our costs and capital prudently, while leveraging our network effect to capture opportunities and continuing to build up resilience in the portfolio.”

MLT’s manager also said that it would continue divesting older assets selectively, and recycle capital into modern properties to enhance the portfolio and support long-term growth.

Units of MLT ended Wednesday 0.8 per cent or S$0.01 higher at S$1.21, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.