Mapletree Logistics Trust Q3 DPU falls 9.3% to S$0.01816

Amount distributable to unitholders declines 8.5% year on year to S$92.7 million in Q3

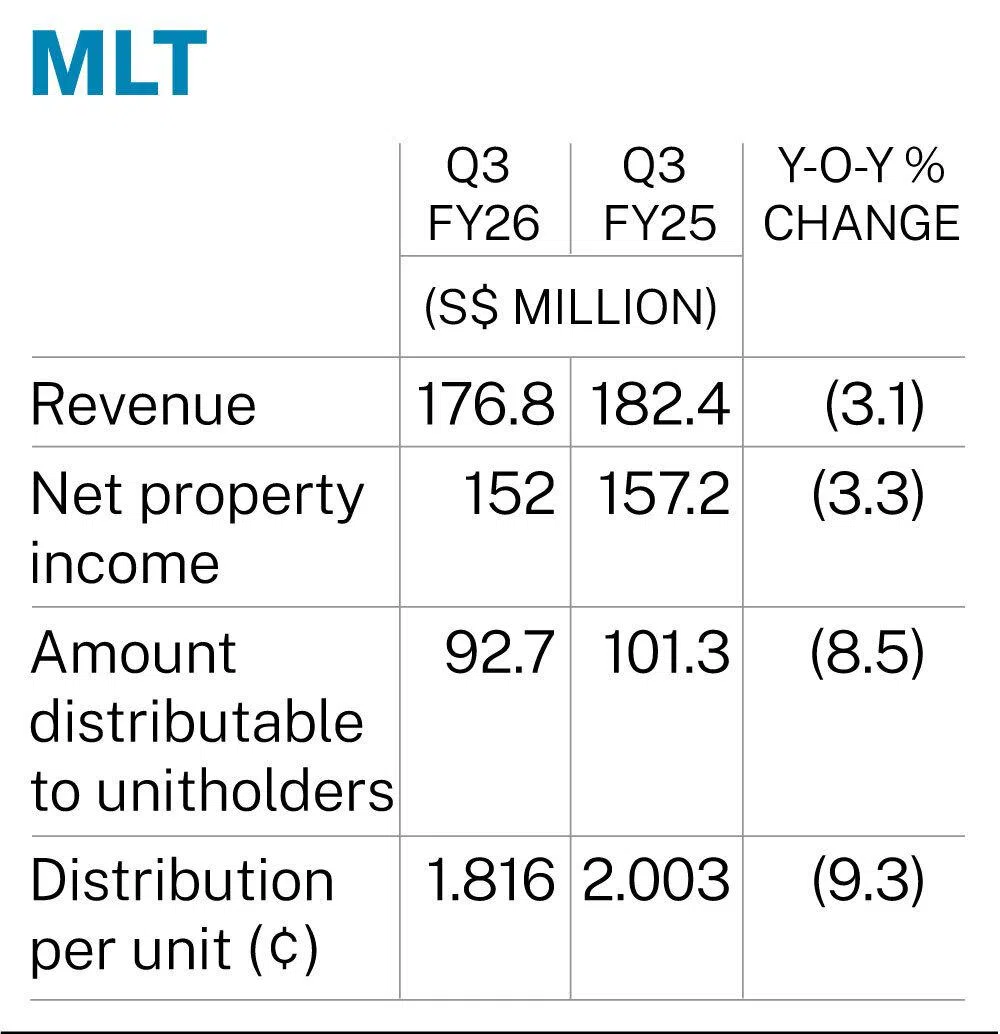

[SINGAPORE] Mapletree Logistics Trust (MLT) posted a distribution per unit (DPU) of S$0.01816 for the third quarter ended Dec 31.

This was a 9.3 per cent decline from the DPU of S$0.02003 in the corresponding year-ago period.

In a bourse filing on Monday (Jan 26), MLT’s manager reported a 3.1 per cent fall in revenue to S$176.8 million in Q3, from S$182.4 million in the year-ago period.

The decline in revenue came amid income loss from four divested properties and reduced contribution from China, mitigated by stronger performance from Singapore, the manager said.

Jean Kam, chief executive officer of MLT’s manager, said: “In Q3, we maintained a stable DPU quarter on quarter, underpinned by our geographically diversified portfolio. Despite ongoing macroeconomic and tariff-related uncertainties, the logistics sector in the region remains resilient, with structural trends that support long-term growth.

“We will continue to execute our portfolio rejuvenation strategy and grow our regional footprint to capture the growing demand for well-located, modern logistics space.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The amount distributable to unitholders declined 8.5 per cent to S$92.7 million in Q3, from S$101.3 million the year before.

Net property income (NPI) fell 3.3 per cent to S$152 million from S$157.2 million, while property expenses declined 1.5 per cent to S$24.8 million from S$25.2 million.

On a constant currency basis, revenue and NPI would have recorded smaller declines of 1.2 per cent and 1.5 per cent, respectively, largely due to the loss of contributions from 12 divested properties and a lower contribution from China, offset in part by higher contributions from MLT’s existing portfolio.

Lower debt, better rental reversions

Borrowing costs fell 4.3 per cent year on year to S$38.2 million, from S$39.9 million. Total debt outstanding decreased to S$5.46 billion due to repayment of loans during the quarter with divestment proceeds.

Portfolio occupancy stood at 96.4 per cent at the end of Q3, improving from 96.1 per cent in the second quarter. MLT’s portfolio had a weighted average lease expiry of 2.6 years.

For leases renewed or replaced in the third quarter, the average rental reversion achieved was 1.7 per cent excluding China. China’s rental reversion improved from minus 3 per cent in the previous quarter to minus 2.2 per cent in Q3, MLT’s manager said.

The global economy has shown resilience and is projected to expand at a modest rate in 2026, although the outlook remains tempered by geopolitical uncertainties, MLT’s manager said.

“The logistics space sector remains resilient, supported by structural trends like e-commerce expansion and global supply chain diversification into the region. Foreign currency volatility will likely continue to weigh on distributable income, while upward pressure on borrowing costs has abated to some extent.”

DBS Group Research analyst Derek Tan said: “MLT’s distributions were higher than our estimate but in line with consensus estimates. China remain on track of a basing out in terms of reversions, but overall diversified portfolio drives stability to overall returns.”

The DPU of S$0.01816 will be paid on Mar 18.

Units of MLT closed 0.7 per cent or S$0.01 lower at S$1.35 on Monday, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.