Markets turn cautious as Fed signals pause and trade truce offers limited lift

Weaker results from several US tech giant also weigh on sentiment

GLOBAL markets retreated late last week as investors weighed fresh central-bank decisions, renewed trade developments between the US and China, and mixed earnings from major technology firms.

Optimism that had previously driven equities to record highs waned as traders reassessed the outlook for monetary policy and global growth.

During the week of Oct 27, the Nasdaq-100 led markets lower, weighed down by weaker results from several “Magnificent Seven” members, including Meta.

The pullback followed the US Federal Reserve’s decision to cut its benchmark rate by 25 basis points to a range of 3.75 per cent to 4 per cent, in line with expectations. However, chair Jerome Powell’s cautious tone dampened sentiment after he signalled that a further reduction in December is “not a foregone conclusion”. Following his comments, investors are starting to scale back bets on additional easing. Market-implied odds of another cut fell sharply from 92 per cent to about 62 per cent.

Meanwhile, on the geopolitical front, a long-awaited meeting between US President Donald Trump and Chinese President Xi Jinping produced what analysts described as a one-year trade truce.

The US agreed to halve fentanyl-related tariffs on China, while Beijing pledged to suspend restrictions on rare-earth exports and resume purchases of American soybeans. Although the deal marks a temporary easing of tensions, investors remain cautious about its durability and broader impact on global trade.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

With the Fed adopting a data-dependent stance and labour-market indicators showing early signs of strain, upcoming US economic data will be critical in shaping expectations of policy direction into the year end.

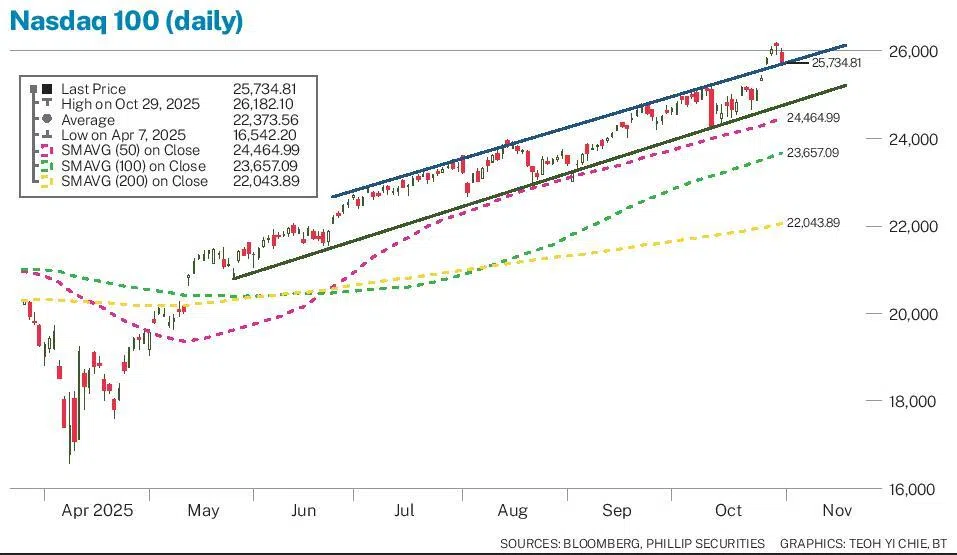

From a technical standpoint, the Nasdaq-100 recently broke above the upper boundary of its medium-term rising channel, signalling sustained bullish momentum. However, the index has since pulled back to retest this breakout level, a move that appears to be a healthy consolidation within the prevailing uptrend. Holding above this upper boundary would reinforce the breakout’s validity and could set the stage for a renewed advance towards higher highs. On the downside, initial support is seen around 25,200, followed by the lower boundary of its medium-term rising channel.

Overall, the medium-term trend remains bullish as long as the index maintains its position above the channel line.

The writer is equities specialist at Phillip Securities Research

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.