Maybank Q2 net profit up 3.9% on higher investment, trading income

The Malaysian lender declares a first interim full cash dividend of 30 sen per share, up from 29 sen per share for previous corresponding period

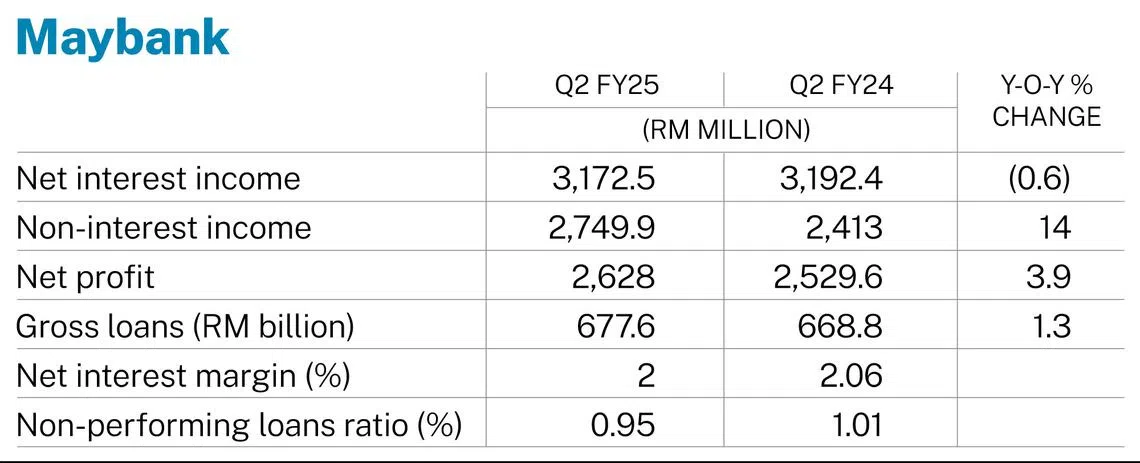

[SINGAPORE] Maybank posted on Tuesday (Aug 26) a 3.9 per cent increase in net profit to RM2.63 billion (S$802.2 million) for the three months ended Jun 30, 2025, from RM2.53 billion for the previous corresponding period.

This brought the lender’s first-half net profit to RM5.22 billion, up 4 per cent from the RM5.02 billion in the same period last year.

The performance was attributed to an increase in non-interest income on the back of improved investment and trading income, as well as moderation in net impairment provisions, said the bank in a press statement.

Earnings per share came in at 21.75 sen for the second quarter, up 3.8 per cent from 20.96 sen in the year-ago period.

A first interim full cash dividend of 30 sen per share for the period has been declared, up from 29 sen per share in the same period in 2024. This translates into a dividend payout ratio of 69.5 per cent, equivalent to RM3.62 billion, added the bank.

For Q2, net operating income grew 4.6 per cent to RM7.68 billion, driven by the 14 per cent increase in non-interest income to RM2.75 billion. Net fund-based income remained somewhat flat at RM4.93 billion.

For H1, the group’s net operating income grew 3.2 per cent to RM15.4 billion, driven by the 7 per cent year-on-year increase in non-interest income to RM5.51 billion.

Net interest margin dipped two basis points year on year, which the bank said was a reflection of the softer rate environment, particularly in Singapore.

Maybank’s Islamic banking business saw a 24 per cent jump in profit before tax to RM2.3 billion in H1 2025 from the same period last year, on the back of stable growth in total income.

As at Jun 30, Islamic financing accounted for 71.5 per cent of Maybank Malaysia’s total loans and financing, added the lender, noting that its assets under management for group Islamic wealth management increased 17.2 per cent year on year to RM98.65 billion in H1.

Across its key home markets, Maybank Singapore posted a 2.4 per cent dip in non-interest income to S$286.8 million as treasury income fell due to lower foreign-exchange-related income.

But this was mitigated by stronger wealth income from bancassurance commission and investment income and higher non-operating income contributed by gain from government bond sales as well as improved loans-related fees, said the bank.

Maybank Indonesia posted a 348.1 per cent surge in net profit to 576 billion rupiah (S$45.4 million), driven by higher operating income and lower loan-loss provision.

Its non-interest income was also up 19 per cent at 975 billion rupiah, lifted by Global Market transaction fees that more than trebled.

President and group chief executive Khairussaleh Ramli said: “Our first-half results reflect a resilient performance despite a challenging backdrop, registering a sustained growth in profitability.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.