Nursing home additions lift Parkway Life Reit’s H2 DPU by 3.5% to S$0.0764

The Singapore hospital portfolio also saw organic rental growth with step-up lease agreements

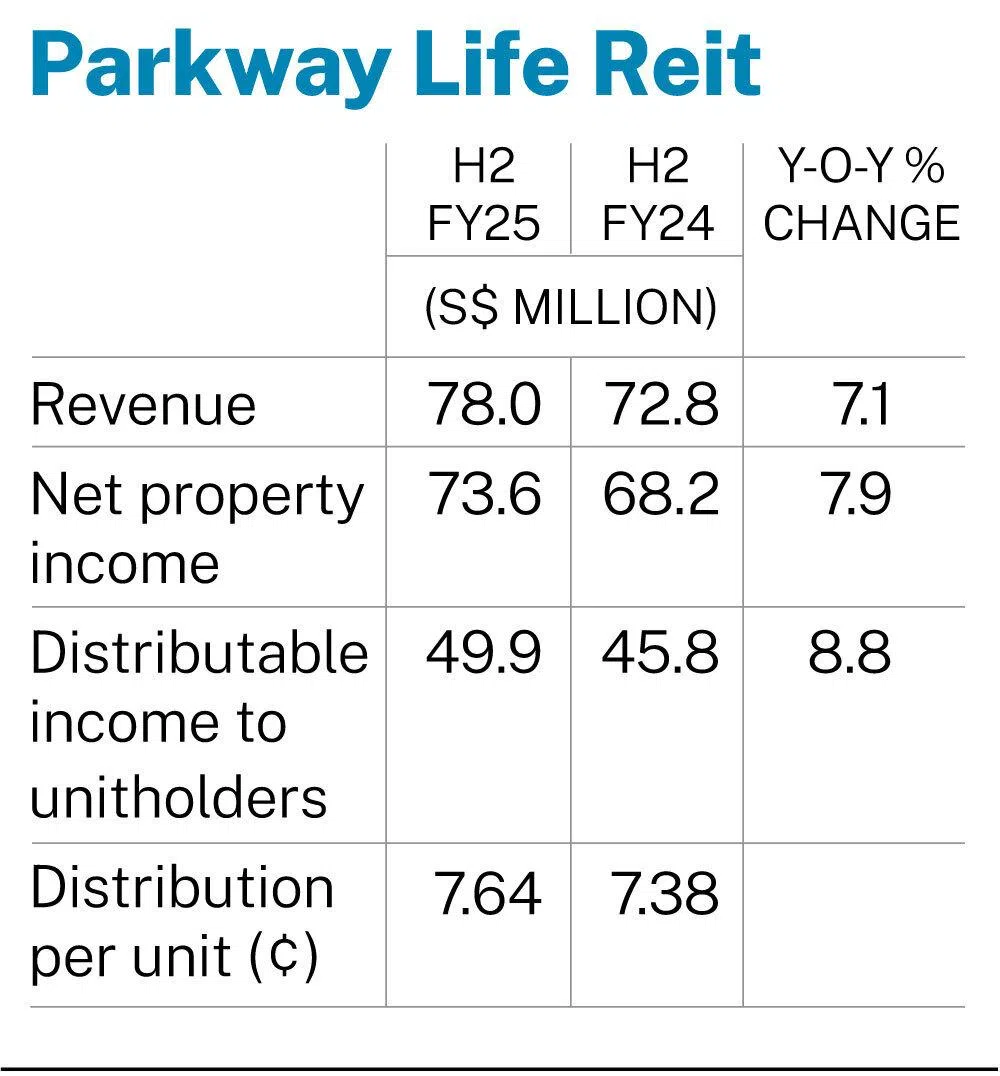

[SINGAPORE] Parkway Life Real Estate Investment Trust (PLife Reit) saw a 3.5 per cent rise in distribution per unit (DPU) to S$0.0764 for the second half of the year ended Dec 31, 2025.

The Reit, which owns 74 healthcare-related properties in Singapore, Japan and France, posted a 7.1 per cent rise in H2 gross revenue to S$78 million.

This was thanks to contributions from a nursing home acquired in Japan in August 2024, and 11 others acquired in France in December that year. The Reit also enjoyed “organic rental growth from the Singapore hospital portfolio with step-up lease agreements”, it said in its earnings release on Monday (Feb 2).

Topline growth was, however, offset by the depreciation of the yen in Japan – where PLife Reit has 60 nursing home assets – as well as a tenant default affecting two nursing home properties in the country.

PLife Reit nevertheless said that its foreign exchange exposure is “well-managed” with hedging strategies. Its yen-denominated assets are fully funded by borrowings in the same currency, while forex exposure of the French portfolio is managed with cross-currency swaps.

The Reit’s H2 net property income for the half-year was up 7.9 per cent at S$73.6 million, even as certain expenses rose.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Management fees for the half-year was up 7.2 per cent due to the enlarged deposited property value from 2024’s acquisitions, as well as valuation gains on the Singapore portfolio. Trust expenses were also higher due to higher professional fees for existing assets and acquisition-related costs for the France portfolio.

On a full-year basis, PLife Reit posted a 2.5 per cent rise in DPU to S$0.1529, as gross revenue increased by 7.6 per cent to S$156.3 million. Net property income was up 8 per cent at S$147.5 million.

The Reit’s gearing ratio stood at 33.4 per cent as at Dec 31, with an all-in cost of debt of about 1.6 per cent and an interest coverage ratio of 8.6 times. It has no long-term debt refinancing requirements until October. Weighted average lease expiry stands at about 14.5 years by gross revenue.

PLife Reit’s DPU growth comes amid a “volatile” macroeconomic environment, said the chief executive of the Reit’s manager, Yong Yean Chau.

“With long-term leases, strong operator relationships and a resilient balance sheet, we are well positioned to pursue disciplined, yield-accretive growth while continuing to deliver stable and sustainable returns for our unitholders,” added Yong.

PLife Reit ended Monday at S$4.07, down by S$0.01 or 0.3 per cent.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.