One prospectus, two markets: SGX-Nasdaq dual-listing highway to debut in 2026

It is open to companies with a market capitalisation of S$2 billion and above

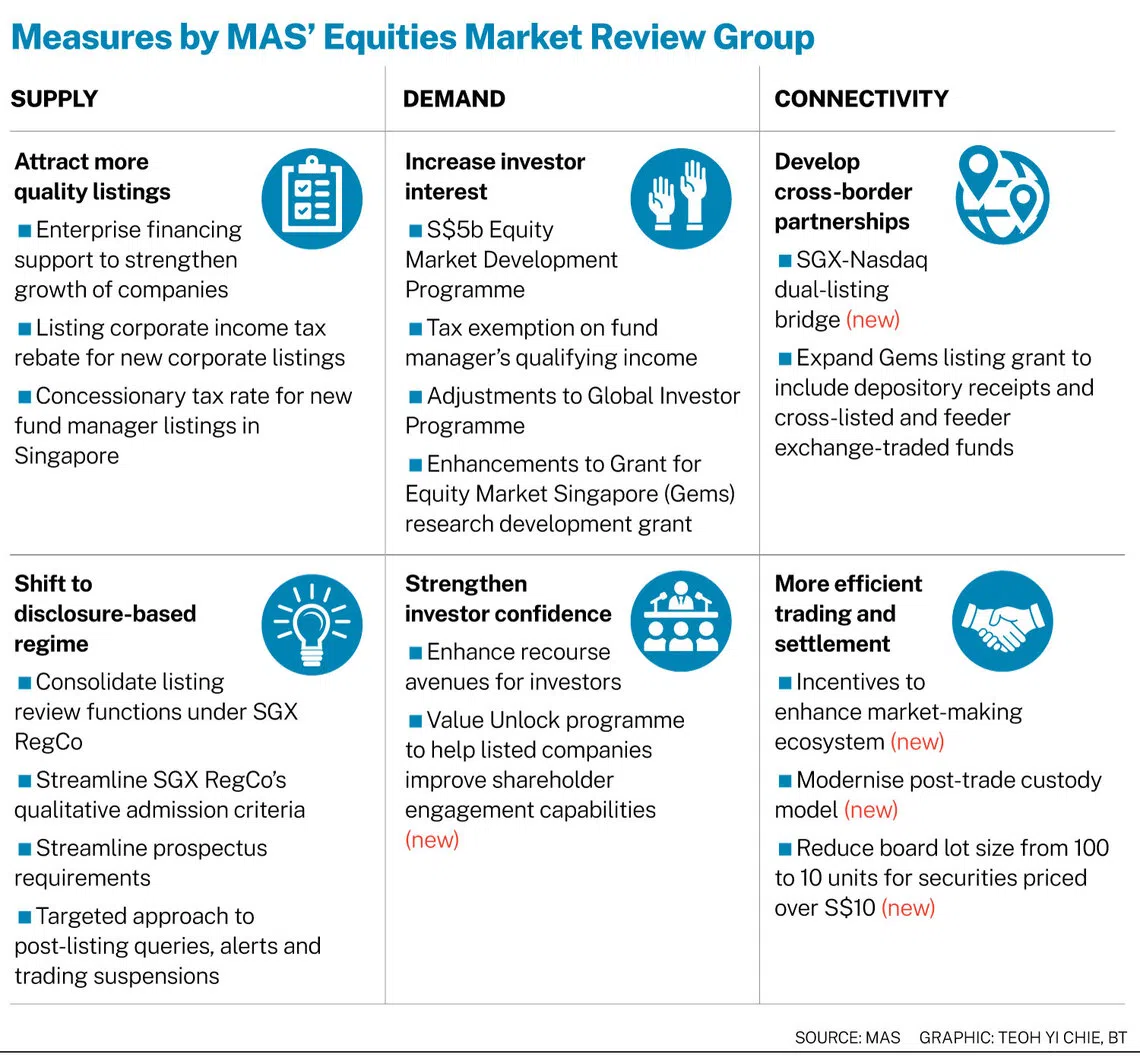

[SINGAPORE] From next year, companies will be able to list on both the Singapore Exchange (SGX) and Nasdaq using a single set of listing documents, under a new “dual-listing bridge” proposed by the Monetary Authority of Singapore (MAS) Equities Market Review Group.

This is “a bridge that will enable issuers and investors alike to access liquidity simultaneously across both markets”, said National Development Minister and MAS review group chair Chee Hong Tat.

The key difference from existing dual-listing arrangements is that companies will only need to submit one prospectus to both bourses, he noted.

The minister, who is also deputy chairman of MAS, was speaking at a press conference on Wednesday (Nov 19) to mark the unveiling of the group’s final report after more than a year’s work.

Open only to companies with a market capitalisation of S$2 billion and above, the dual-listing bridge is expected to be launched in mid-2026, subject to regulatory approvals.

To operationalise the bridge, a new Global Listings board will be launched to complement the SGX mainboard and Catalist board.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Companies listing on this board can choose to denominate their shares in US dollars or Singapore dollars. Trading will take place on both SGX and Nasdaq, with the latter’s hours running from 10.30 pm to 5 am Singapore time.

MAS will work with SGX on a regulatory framework with disclosure standards comparable to those in the US. This will enable issuers to rely on a single set of offering documents, “cutting regulatory friction and costs”, the regulator said.

Industry players welcomed the new dual-listing bridge, though the S$2 billion threshold means many aspiring issuers will not qualify.

“It’s certainly not for everyone, but the fact that it’s there – especially if you’re big and growing – will elicit interest,” said Paul Santos, co-founder and managing partner of venture capital firm Wavemaker Partners.

Even if they meet the requirement, some companies may still choose not to pursue US equity fundraising.

This could be the case for firms in sensitive sectors such as semiconductors, or for those that are “firmly entrenched in the US” and see no need to diversify, noted Clifford Lee, managing director and global head of investment banking at DBS.

Separately, Chee announced a new Value Unlock programme by MAS and SGX, to help listed companies strengthen investor engagement and sharpen their focus on shareholder value creation.

The programme has three pillars:

- S$30 million in funding for two grants to build capabilities in corporate strategy, capital optimisation and investor relations;

- support for firms to communicate their strategic plans more proactively; and

- partnerships with ecosystem players to encourage peer learning and collaboration.

The Value Unlock programme “will help issuers articulate their value more clearly and build deeper confidence with shareholders”, said Kainoa Blaisdell, lead for Sandpiper Communication’s financial practice.

“In time, this effort will hopefully raise the overall quality of corporate engagement and, ultimately, enhance market resilience,” Blaisdell said.

Chee also said that the next tranche of funding – S$2.85 billion under the S$5 billion Equity Market Development Programme – has been allocated to six asset managers.

They are Amova Asset Management, AR Capital, BlackRock, Eastspring Investments (Singapore), Lion Global Investors and Manulife Investment Management (Singapore).

This brings total allocations to S$3.95 billion, including July’s S$1.1 billion tranche. The next round is slated for the second quarter of 2026.

A series of market infrastructure enhancements was also announced.

New incentives and grants will be introduced to strengthen market makers’ capabilities, particularly for newly listed companies and small and mid-cap counters outside the benchmark Straits Times Index. More details will be released in Q1 2026.

SGX will also encourage wider adoption of broker custody accounts for local shares. While investors can already hold SGX-listed securities through their brokers, many retail investors continue to default to central depository accounts for domestic equities.

The new push aims to narrow this gap by encouraging investors to hold both foreign and local stocks in the same broker platform – which in turn allows brokers to bundle a wider suite of services, such as managed portfolios, fractional trading and robo-advisory offerings.

To lower minimum investment amounts and widen retail participation, SGX will also reduce the board lot size for securities priced above S$10 from 100 units to 10 units.

From measures to results

The review group, comprising market professionals and various industry players, was formed in August 2024 to take a comprehensive look at Singapore’s equity market. It has since introduced a slew of wide-ranging recommendations.

These include February and July’s measures, such as the S$5 billion liquidity injection for the local market and tweaks to the Global Investor Programme, which grants permanent residency to eligible foreign investors.

MAS said “encouraging early signs” point to rising market activity. Average daily turnover in Q3 climbed 16 per cent year on year to S$1.53 billion – the highest since Q1 2021.

Turnover in small and mid-cap stocks grew 88 per cent quarter on quarter, with net institutional inflows rising for nine straight months since the unveiling of the group’s first measures. Initial public offerings have also picked up; more than S$2 billion has so far been raised this year.

With the review group concluding its work, implementation now becomes the focus.

To that end, an Equity Market Implementation Committee – co-chaired by MAS managing director Chia Der Jiun and SGX chief executive officer Loh Boon Chye – will be set up. Details will be announced in Q1 2026.

Said Chee: “If there are additional ideas that we want to explore – if there are new initiatives that we want to do – this is an ongoing process, and the implementation committee will take a look at some of these initiatives and ideas.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.