OUE Reit H2 DPU up 10.6% at S$0.0125

However, revenue falls 4.2% due to no contributions from Lippo Plaza Shanghai, which the Reit had divested

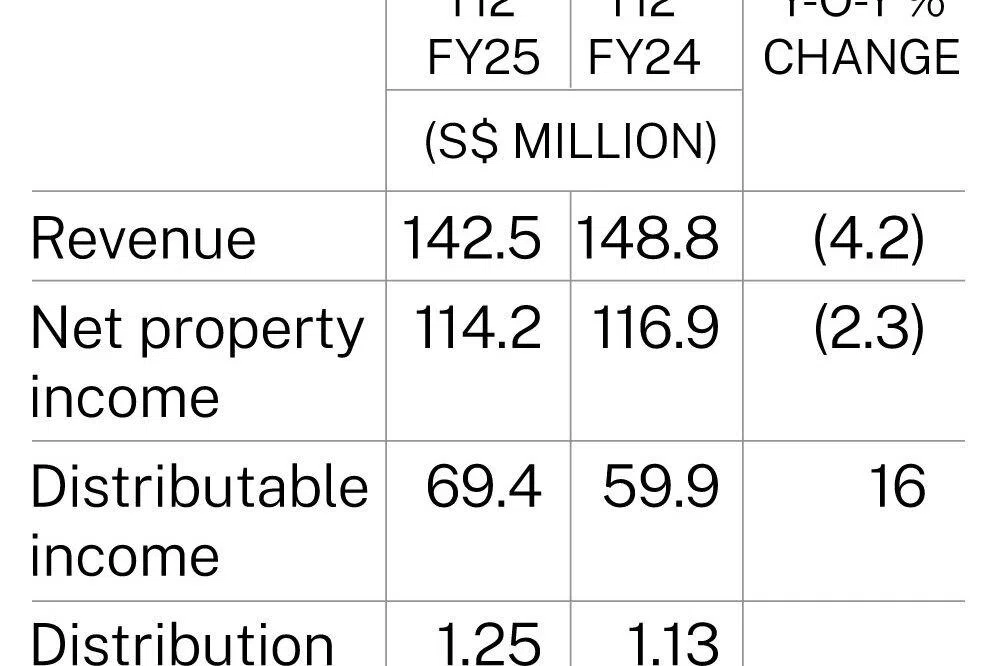

[SINGAPORE] The manager of OUE Real Estate Investment Trust (Reit) on Monday (Jan 26) posted a distribution per unit (DPU) of S$0.0125 for the second-half ended December, up 10.6 per cent year on year from S$0.0113.

The stronger performance came amid continued resilient operating performance across the Reit’s portfolio, alongside stronger capital structure, which allowed the trust to benefit from the lower interest-rate environment, said the manager.

The distribution for the period will be paid on Mar 10, after book closures on Feb 3.

Excluding the capital distribution from the divestment of 50 per cent of OUE Bayfront in 2021, DPU for the half-year period would have risen by 15.7 per cent year on year.

Revenue fell 4.2 per cent to S$142.5 million in H2 2025, from S$148.8 million in the corresponding year-ago period. Net property income (NPI) dropped 2.3 per cent to S$114.2 million.

The declines were mainly due to the absence of revenue from Lippo Plaza Shanghai, which OUE Reit divested in FY2024.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The amount available for distribution for H2 2025 grew 16 per cent on year to S$69.4 million.

Full-year results

For the full year, DPU rose 8.3 per cent to S$0.0223, from S$0.0206 in the year-ago period. The amount available for distribution grew 13.9 per cent on year to S$123.8 million.

FY2025 distribution yield stood at 6.2 per cent, based on the closing price of S$0.36 as at the last trading day of the financial year. This is down from the 7.2 per cent distribution yield for FY2024, based on the closing price of S$0.285 as at the last trading day of FY2024.

Revenue was down 7.4 per cent year on year at S$273.6 million, while NPI was 6.2 per cent lower at S$219.6 million.

As at end-December, the valuation of OUE Reit’s properties decreased by 1.2 per cent on year to S$5.1 billion. The decline was mainly due to lower valuations of hotels and retail assets, which were partially offset by higher valuations of office properties.

Consequently, the Reit’s net asset value per unit fell to S$0.56 as at Dec 31, 2025, from S$0.58 a year ago.

OUE Reit had S$2.2 billion of total debt as at Dec 31, and weighted average cost of debt stood at 3.9 per cent per annum. Its aggregate leverage was 38.5 per cent, down from 40.9 per cent as at Sep 30, 2025.

In H2, revenue and NPI for the commercial segment grew 4.2 per cent and 5.7 per cent on year to S$87.8 million and S$65.2 million, respectively. Growth was driven by higher average passing rents across all office assets.

For the full year, revenue was 3.9 per cent higher at S$173.9 million and NPI was 5.4 per cent higher at S$130.4 million.

Committed occupancy of the Reit’s Singapore office properties remained healthy at 95.4 per cent as at end-2025, with full-year positive rent reversion of 9.1 per cent. Average passing rent rose 0.6 per cent quarter on quarter to S$10.97 per square foot (psf) per month.

Citing CBRE forecasts, the manager noted that office rents will grow about 5 per cent on year in FY2026. It added that conditions for the office market are expected to turn “increasingly landlord-favourable, as large contiguous floor plates remain scarce, with Shaw Towers being the only major office completion scheduled”.

OUE Reit’s retail asset – Mandarin Gallery – had positive reversion of 12.4 per cent in FY2025. Its committed occupancy declined 1.7 percentage points on quarter to 95.7 per cent, representing a “cautious leasing environment and the ongoing redesignation of selected spaces for place-making initiatives”, said the manager. Average passing rent was S$22.45 psf per month.

It noted that the outlook for FY2026 “remains constructive, albeit with a moderation in growth”.

“While retailers continue to face headwinds from manpower constraints and elevated operating costs, new retail supply is expected to remain broadly in line with historical averages.”

Han Khim Siew, chief executive officer of the manager, said: “While volatility in the global outlook persists, we remain encouraged by the strong underlying fundamentals of the Singapore market.”

He added: “Looking ahead, we will continue to optimise asset performance and actively enhance our portfolio through disciplined capital recycling and selective deployment into prime gateway assets, including targeted opportunities in Sydney.”

Units of OUE Reit ended Monday 1.4 per cent or S$0.005 lower at S$0.365, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.