💳 Pay up, Gen Zs

- Find out more and sign up for Thrive at bt.sg/thrive

💵 Bills, bills, bills

There are many reasons why young adults rack up sky-high spending levels or end up in debt, but they mainly stem from poor financial planning and bad budgeting practices.

“Some of them may be between jobs, and use their credit cards to pay for their living expenses,” Tan Huey Min, general manager at Credit Counselling Singapore, tells Thrive. “It becomes a problem when they can pay only the minimum amount per month and not the full bill, which results in interest fees and penalties charged as well.”

She adds: “There have been cases where some of their friends need money desperately, and they decide to draw money from their credit cards to help them.”

Some young adults might not be aware that the interest rate for credit card balances is usually above 25 per cent for those who do not pay their bills in full by the due date.

Tan also highlights that living a “lavish lifestyle” is common among young adults these days, resulting in high levels of spending and possible debt. “Eating out several times per week, many times at high-end restaurants, or buying a lot of clothes and gadgets online, are some things that accumulate on their credit card bills,” she says.

One such Gen Z who is familiar with these types of extravagant spending is Tricia (not her real name), a final-year student at a university in Singapore.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“My partner spends a lot on food, particularly at Michelin-starred restaurants, and uses ride-hailing services like Grab very often,” says the 21-year-old. “My friends in college also like to splurge on luxury goods like branded shoes that can cost up to S$2,000 per pair.”

As for herself, she enjoys purchasing fine jewellery, and is willing to spend S$500 to S$2,000 every two months on such items.

On the rationale behind her outsized spending on jewellery, Tricia says it’s because of the “sentimental value” attached to these items. “These are brands that offer solid gold that can last a lifetime. So whenever I make a jewellery investment, I always think that I’m not just buying this for today, or for this year – I’m buying this (so it can) be passed on,” she says.

🎵 Facing the music

Debt is a very real problem faced by young adults today. About a fifth (19 per cent) of the Gen Zs and Millennials surveyed by Etiqa found it difficult to pay off their debt.

In fresh data provided by Credit Counselling Singapore, about half of the people who sought help to manage debt in 2023 were under 40 years old.

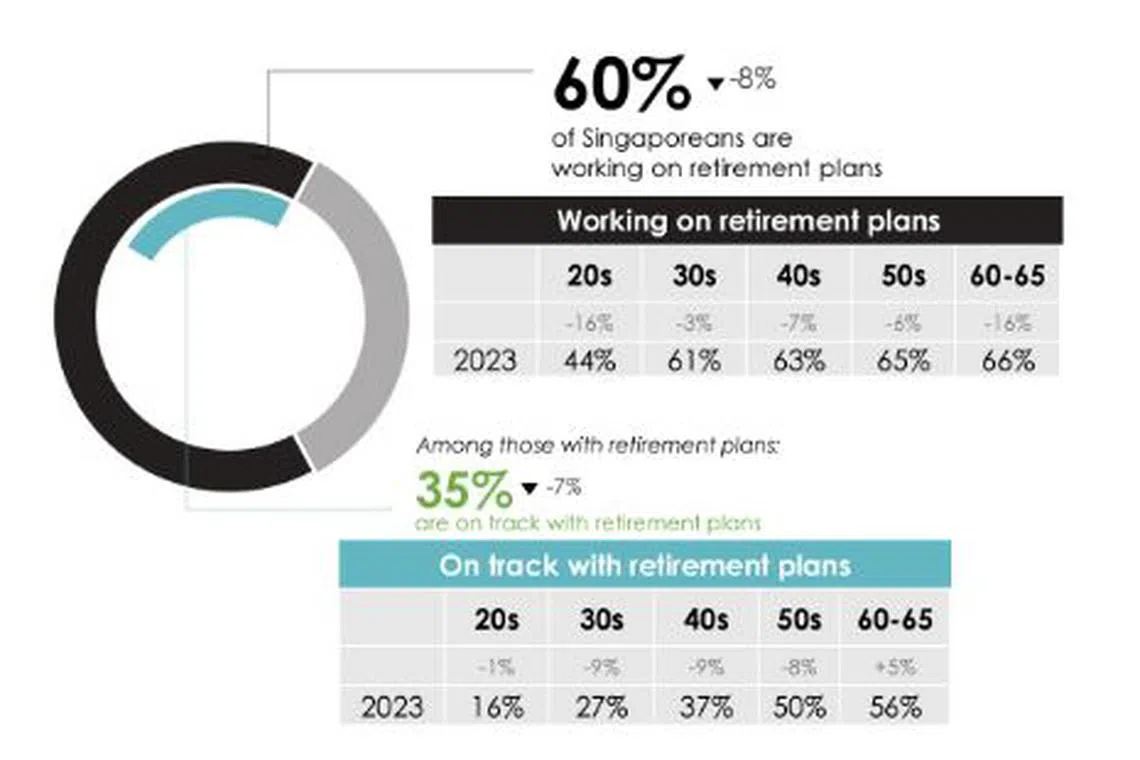

Being unable to pay off debt has repercussions on whether young adults can retire comfortably in the future. According to OCBC’s Financial Wellness Index this year, only 16 per cent of Singaporeans in their 20s and 27 per cent of those in their 30s are on track with their retirement plans – the lowest among all age groups.

Here are some consequences of building up debt as a young person:

- Affected credit score: Recurring late or missed payments can negatively impact your credit score. A lower credit score can make it challenging to qualify for housing loans, rent an apartment, or even secure certain jobs.

- Delay in achieving certain milestones in life: Having debt can delay your plans to buy a home, start a family, or pursue further education. It will be difficult for you to save for these major life events when you are in a financially inflexible situation.

- Legal consequences: In the event that an individual keeps defaulting on their payments, banks will send a letter of demand and eventually take legal action. If your debt exceeds S$15,000 and you are unable to repay it, you could also be declared bankrupt, which comes with several restrictions and repercussions, such as limits on travelling out of the country.

These days, a method popular among young adults is to use “buy now, pay later” (BNPL) services such as Atome and ShopBack to pay for their purchases in monthly instalments. These payments have an interest-free period, which can be alluring to young adults who are waiting for just a few more pay cheques to pay for their purchases with no additional costs.

Tan, however, warns of the “false sense of affordability” that BNPL services offer. After all, it’s pay later, not never.

“In the end, users of BNPL services will still have to make the full payment at some point,” she says. “If consumers don’t exercise control over their purchases, all the instalments they accumulate could spiral out of control.”

In a bid to protect consumers from themselves, new guidelines announced late last year state that users will not be able to have more than S$2,000 in outstanding payments with a BNPL provider unless they jump certain hoops. They will also not be able to make further BNPL purchases once a payment is overdue.

🛣️ Back on track

Thankfully, there are several methods to get back on track if you find yourself overspending, or 🤯 close to debt:

- Create a personal budget and stick to it: Establish a realistic budget for yourself that outlines your income, expenses, and savings goals. In your budget, you may want to identify areas of your spending where you can cut back. Finally (and most importantly), remember to stick to this plan – or all your budgeting efforts would have come to nought!

- Set up an emergency fund: This will come in handy when you incur unexpected expenses, such as medical bills or car repair fees, so you won’t need to take on a loan or more debt. Typically, a good amount is about three to six times your monthly salary.

- Be responsible with your credit card management: Use credit cards wisely. Pay the full balance each month to avoid accruing interest. Avoid taking on more credit cards if you have existing credit card bills to pay.

- Avoid lifestyle inflation: As your income increases over time, resist the urge to dramatically increase your spending. Instead, use the additional income to boost your savings and investments.

- Consider side hustles: This can be helpful in supplementing your primary source of income, as long as you can manage it with your existing responsibilities such as school or full-time work. (But remember to check with your employer that there is no conflict of interest when taking up a side hustle!)

Spending within one’s means is a good rule of thumb to follow when it comes to managing personal finances. For student Tricia, who we talked about earlier, she has made it a rule to only use money that she has earned from her internships and summer jobs to pay for her jewellery purchases. This has helped ensure that she doesn’t fall into the debt trap.

“I always pace my spending, and never exceed what I earn,” she says. “I feel motivated to earn more and do more to fund my purchases.”

Will you do the same to afford that luxury bag you’ve had your eyes on for months, or your next dream holiday to Hawaii 🏖️? Whatever your choice is, make sure all your day-to-day needs are accounted for first. And that credit card bill last month that you haven’t paid in full…😬

TL;DR

- Many Gen Zs and Millennials do not seem to have their financial priorities in check, resulting in elevated levels of spending and debt 😫

- A bad credit score from debt or defaulting on too many credit card payments can affect your ability to take a bank loan or secure a home in the future 😰

- Remember to stick to your personal budget if you want to have a healthy savings plan for yourself 😤

- Always pay your credit card bills in full – and don’t take on another card if you’re struggling to pay your existing bills!

Copyright SPH Media. All rights reserved.