PayNow banks raise default limit to S$5,000 for ad-hoc transactions

THE Association of Banks in Singapore (ABS) said on Monday that all nine participating PayNow banks will now allow ad-hoc transactions of S$5,000 or more, offering customers a wider scope of payments to merchants and friends.

The higher default limit applies to PayNow on both Internet banking and mobile application channels, ABS said in a press statement.

It also applies to scan-and-pay transactions, as well as transfers initiated by entering the recipient's NRIC, mobile number or Unique Entity Number, without the need to add the recipient as a payee.

Customers will need to enter their second factor authentication for transactions above S$1,000. They may also set their PayNow limit to a level they are comfortable with, said ABS.

As at end-August 2020, there are about 4.5 million registered PayNow users who collectively transferred nearly S$34 billion since the launch of the electronic fund transfer service in June 2017.

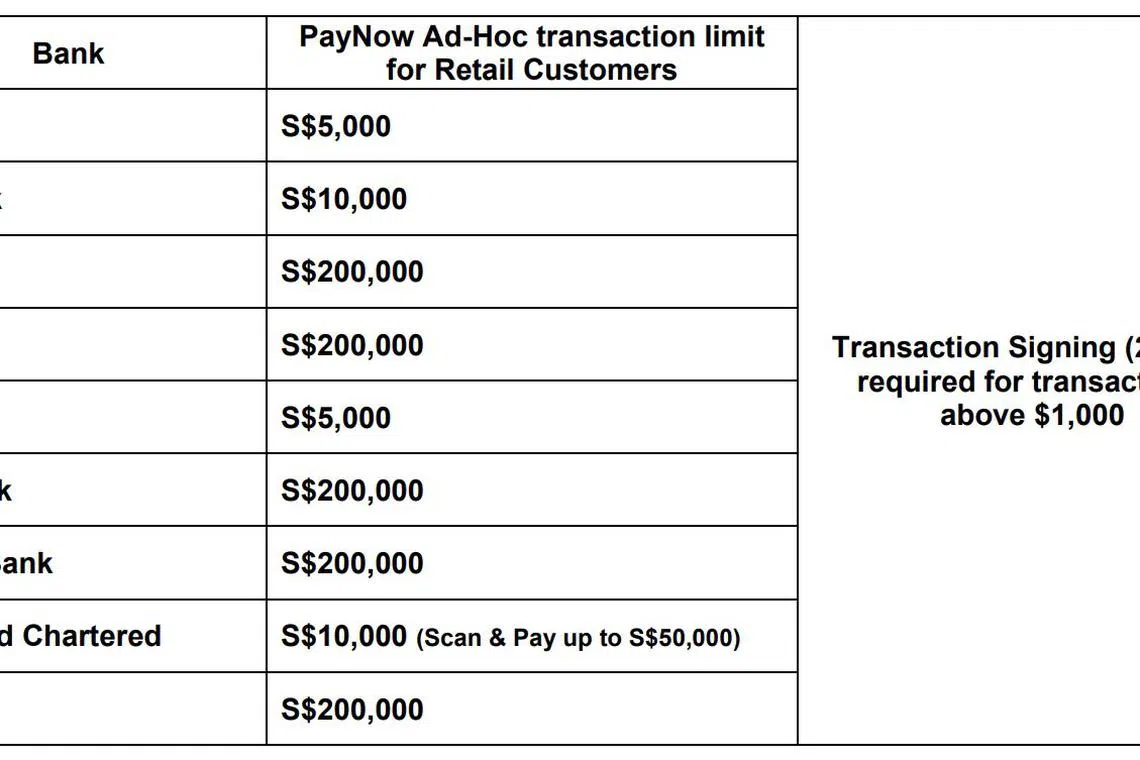

The nine PayNow banks are Bank of China, Citibank, DBS, HSBC, ICBC, Maybank, OCBC, Standard Chartered and UOB.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Transaction limits offered by each bank:

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.