Aims Apac Reit posts 4.7% higher H2 DPU of S$0.0493 on steady portfolio performance

Its manager has completed deals for 25 new leases and 50 renewals in FY2025

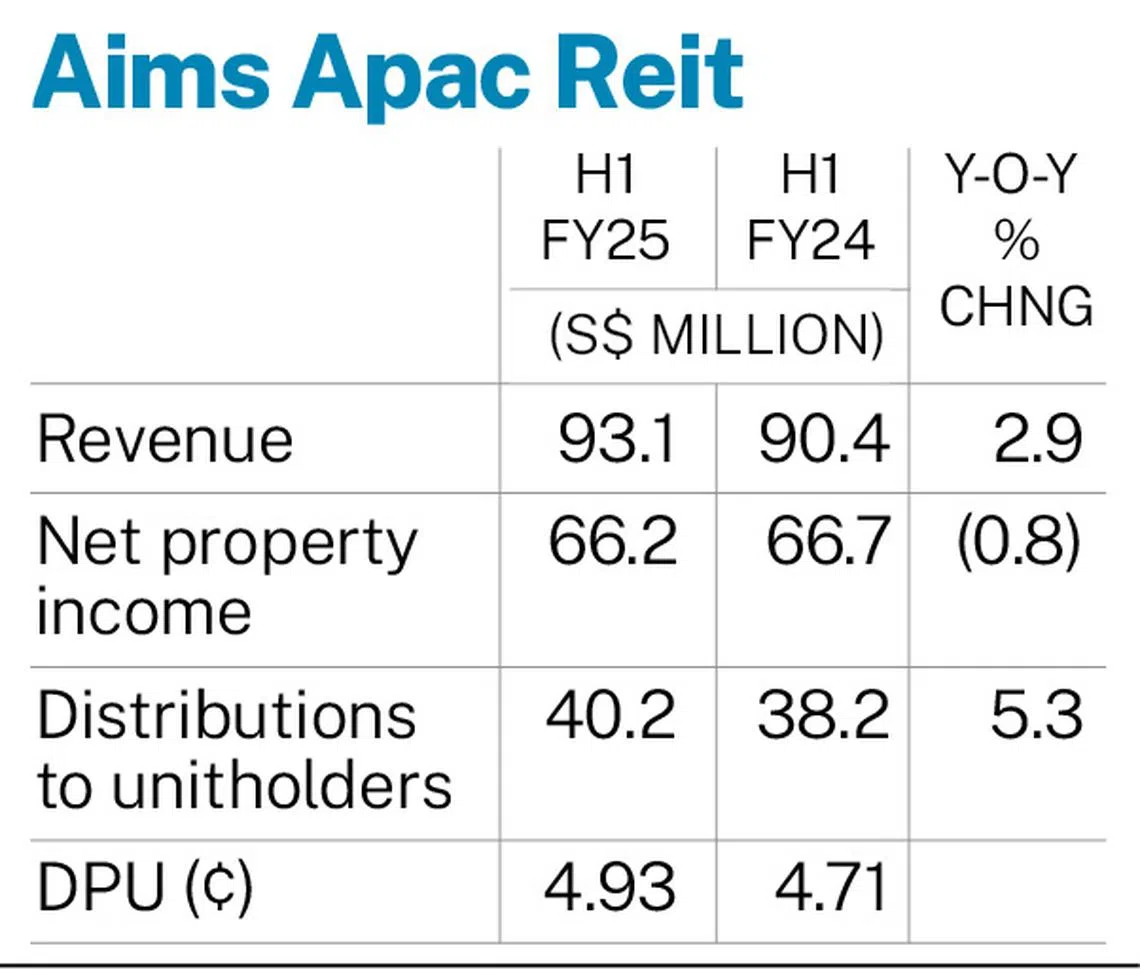

[SINGAPORE] The manager of Aims Apac Real Estate Investment Trust (AA Reit) reported a higher distribution per unit (DPU) of S$0.0493 for the second half ended Mar 31, up 4.7 per cent from S$0.0471 for the same period the year before, citing resilient operational performance.

The industrial and logistics Reit’s revenue for H2 rose to S$93.1 million on strong portfolio performance and rental reversions, up 2.9 per cent from S$90.4 million in the corresponding period of the 2024 financial year, said the manager on Wednesday (May 7).

The Reit’s manager completed deals for 25 new leases and 50 renewals in FY2025, representing 159,827 square metres or 20.6 per cent of its portfolio’s net lettable area, resulting in a positive rental reversion rate of 20 per cent.

Net property income (NPI) in H2 was down 0.8 per cent at S$66.2 million, from S$66.7 million in the corresponding year-ago period. The overall portfolio occupancy of the Reit stood at 93.6 per cent, while weighted average lease expiry by income was 4.4 years.

Excluding the impact of asset enhancement initiatives and transitory tenant movement, portfolio occupancy based on committed leases would be at 95.8 per cent.

The Reit also posted H2 distribution to unitholders of S$40.2 million, up 5.3 per cent from the previous corresponding period’s S$38.2 million.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

DPU for the full year was up 2.6 per cent, reaching S$0.096 from S$0.0936 in FY2024. Distributions to unitholders climbed from S$74.3 million to S$78.2 million, an increase of 5.2 per cent.

For the full year, NPI grew 2.1 per cent to reach S$133.7 million, from S$131 million in the previous year. Revenue increased 5.3 per cent, from S$177.3 million in FY2024 to S$186.6 million.

As at Mar 31, AA Reit’s aggregate leverage stood at 28.9 per cent with an interest coverage ratio of 2.4 times. There would be no debt refinancing until FY2027, the manager added.

The Reit’s portfolio comprises 28 properties worth about S$2.1 billion, of which 70.9 per cent or S$1.5 billion worth are investment properties in Singapore. The remaining 29.1 per cent or S$620 million are based in Australia, including a 49 per cent stake in Optus Centre in North Sydney. (*see amendment note)

The distribution will be paid out on Jun 25, after books closure on May 19.

Russell Ng, the manager’s chief executive, said: “Through disciplined execution of our strategies, we have continued to drive strong operational and financial performance that supports the delivery of sustainable growth for our unitholders.”

As part of its capital management strategy during the year, the manager issued S$125 million in perpetual securities at 4.7 per cent, down from 5.65 per cent. This strategy “enhances financial flexibility and secures competitive funding, providing headroom for growth”, AA Reit’s manager said.

The manager maintained confidence in the Reit’s business model amid global trade uncertainty, citing continued demand for the Singapore portfolio and quality tenants, as well as structural tailwinds in Australia, including the 2032 Olympic and Paralympic Games in Brisbane.

The portfolio is supported by 200 tenants across multiple sectors, the manager said, with 83.1 per cent of gross rental income stemming from defensive and resilient sectors.

“Industrial warehouses have shown resilience amidst uncertainties around the US administration’s approach to trade,” AA Reit’s manager said. However, it expected growth to moderate as industrial demand weakened against supply.

The counter was trading flat at S$1.27 on Wednesday at 10 am after the announcement.

*Amendment note: An earlier version of this article incorrectly referred to AA Reit’s stake in Optus Centre in Melbourne, instead of Optus Centre in North Sydney.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.