Bukit Sembawang Estates H1 earnings dip 25% after completion of two condo developments

Revenue from the company’s property development segment slid 61%

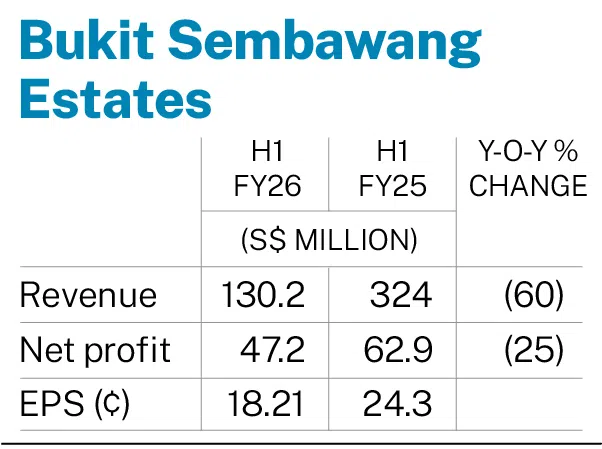

[SINGAPORE] Bukit Sembawang Estates’ net profit for the half-year ended September fell 25 per cent year on year to S$47.2 million, primarily due to a 61 per cent plunge in revenue from its property development segment.

The property group has business segments including development, investment holding and operating of serviced apartments. Its revenue plunged 60 per cent to S$130.2 million as a result of lower revenue in the development segment, based on its H1 FY2026 financial results published on Wednesday (Nov 5).

The decline of the segment’s revenue was primarily due to the absence of revenue from two condominium projects, The Atelier and LIV@MB, as they were completed, said Bukit Sembawang.

Meanwhile, the hospitality segment’s revenue fell 12 per cent to S$6.6 million, mainly due to lower average room rates and occupancy rates at the serviced apartments Fraser Residence Orchard, Singapore.

Earnings per share for the period stood at S$0.1821, lower than the S$0.243 posted for the corresponding period last year.

Net asset value per share was S$6.13 as at end-September, compared with S$6.15 as at end-March.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

No dividend was declared for the period.

The property group said that it is preparing to launch a new residential landed development, Pollen Collection II, and will continue to focus on the sales of condominium project 8@BT and the balance units at Pollen Collection, while progressing with planning for residential landed development Luxus Hills Phase 10.

Shares of Bukit Sembawang Estates closed 1 per cent or S$0.04 lower at S$4.16 on Wednesday, before the announcement.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.