Ho Bee Land reports a turnaround in H2 financials, posts S$100.7 million in earnings

Improvement in net profit came partly from S$66.6 million in other gains and fair value changes, compared with a loss of S$10.3 million for this item in H2 FY2023

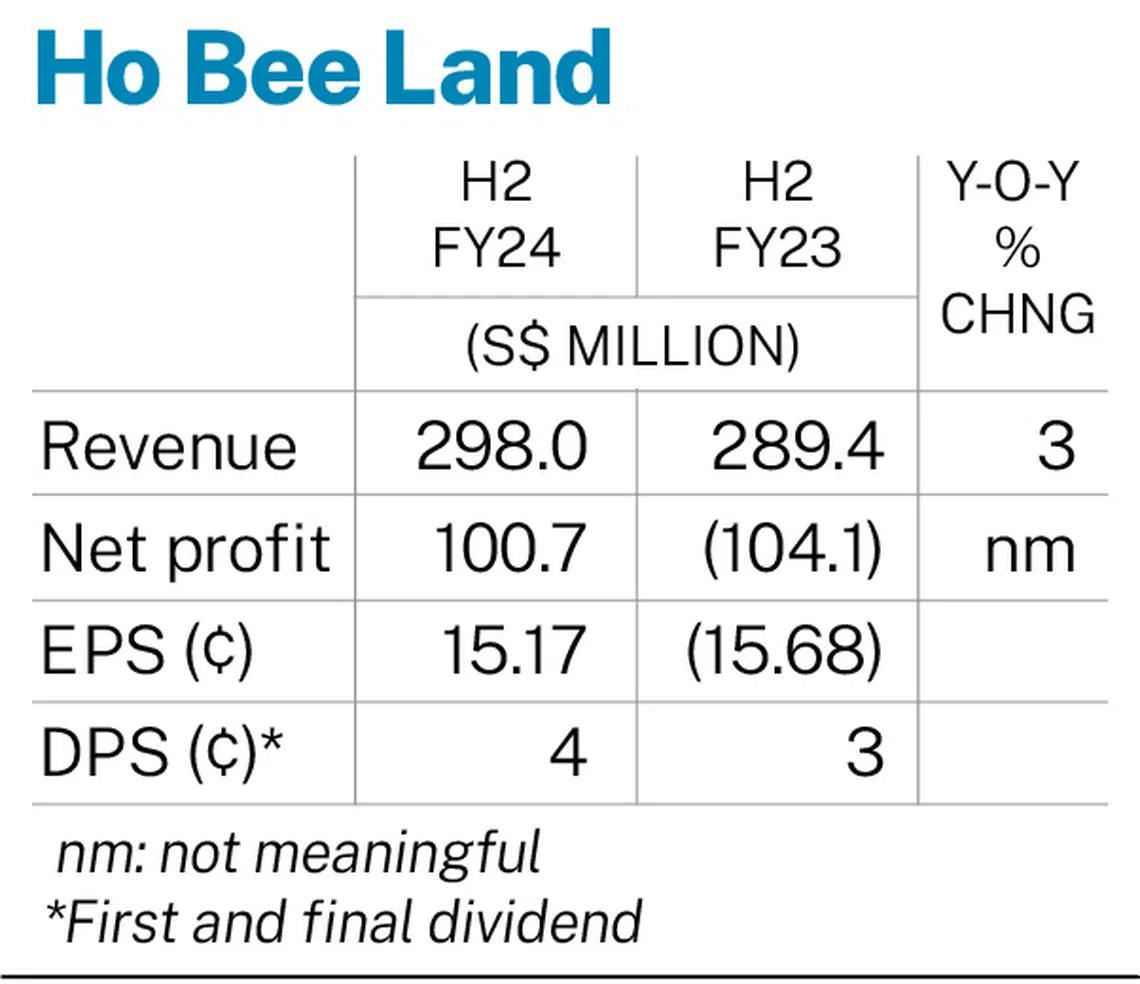

HO BEE Land reported earnings of S$100.7 million for the second half of the 2024 financial year ended December, reversing from a loss of S$104.1 million in the same period a year before.

This was in spite of a marginal increase of 3 per cent in revenue to S$298 million from $289.4 million, according to its financial results published on Wednesday (Feb 26).

The improvement in net profit came partly from S$66.6 million in other gains and fair value changes, compared with a loss of S$10.3 million for this item in H2 FY2023.

Other gains included a S$34.8 million divestment gain on the stake sale of its landmark biomedical life-science development in one-north, Elementum, and a S$36.2 million remeasurement gain on the jointly controlled entity holding Elementum.

The group disposed of its 49 per cent interest in HB Universal, a subsidiary which holds Elementum in Singapore, for S$133.6 million in August 2024.

Meanwhile, the valuation of its investment properties in London has stabilised, with a reduction of S$5.8 million in fair value, compared with a S$155.6 million plunge in H2 FY2023.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Earnings per share stood at S$0.1517, compared with a loss per share of S$0.1568.

The board has recommended a first and final dividend of S$0.04 per share, payable on May 23. The corresponding dividend for FY2023 was S$0.03 per share.

For FY2024, the revenue of S$528 million was 19 per cent higher, mainly from increased development sales in Australia and the stable rental income across the group’s property portfolio in Singapore and London.

The full-year net profit was S$109.6 million, whereas it was a loss of S$259.8 million in FY2023.

The group’s net asset value was S$5.56 per share as at Dec 31, 2024, marginally higher than S$5.42 as at Dec 31, 2023.

Its net gearing improved to 0.66 times from 0.8 times.

The counter closed down 1.1 per cent or S$0.02 at S$1.75 on Wednesday, before the financial results were published.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.