Merger of MCT and MNACT creates pathway for growth

THE ongoing merger of Mapletree Commercial Trust (MCT) and Mapletree North Asia Commercial Trust (MNACT) is on track to create one of the top 10 largest Reits in Asia.

The merged entity, Mapletree Pan Asia Commercial Trust (MPACT) will have an estimated market capitalisation of over S$10 billion and will hold a diversified portfolio of 18 commercial assets across Singapore, China, Hong Kong, Japan and South Korea, with assets under management (AUM) of approximately S$17.1 billion.

The Reit managers believe that the merger will provide a pathway for growth by merging MCT, a Singapore-focused Reit, with MNACT, a ready and established platform that has scale and reach in North Asia.

MCT said that this will in turn bring about immediate financial benefits and access to attractive footholds into North Asia supported by established local operating teams with extensive experience and a strong track record.

Other key benefits cited by the Reits include enhanced financial flexibility to pursue more growth opportunities such as larger acquisitions and capital recycling opportunities, increased liquidity and index representation, enhanced geographic diversification, reduced single asset concentration and improved tenant diversification as well as immediate financial benefits in terms of distribution per unit (DPU) and net asset value (NAV) accretion on a historical pro forma basis.

Post-merger, MPACT will hold best-in-class assets such as Festival Walk in Hong Kong, Mapletree Business City and VivoCity in Singapore.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The Reit managers believe that together, these will improve overall cash flow stability and resilience through market cycles.

MPACT will host major tenants with global businesses such as Google, BMW, Seiko, HP Japan and NTT UD.

Together, the top 10 tenants by gross rental income (GRI) will contribute 23 per cent of its GRI post-merger. This is down from MCT’s 27.7 per cent and MNACT’s 37.7 per cent, reducing income concentration.

Unitholders of MCT and MNACT have voted in favour of the merger last month.

The merger will be effected through the acquisition by MCT of all the issued and paid-up units of MNACT by way of a trust scheme of arrangement.

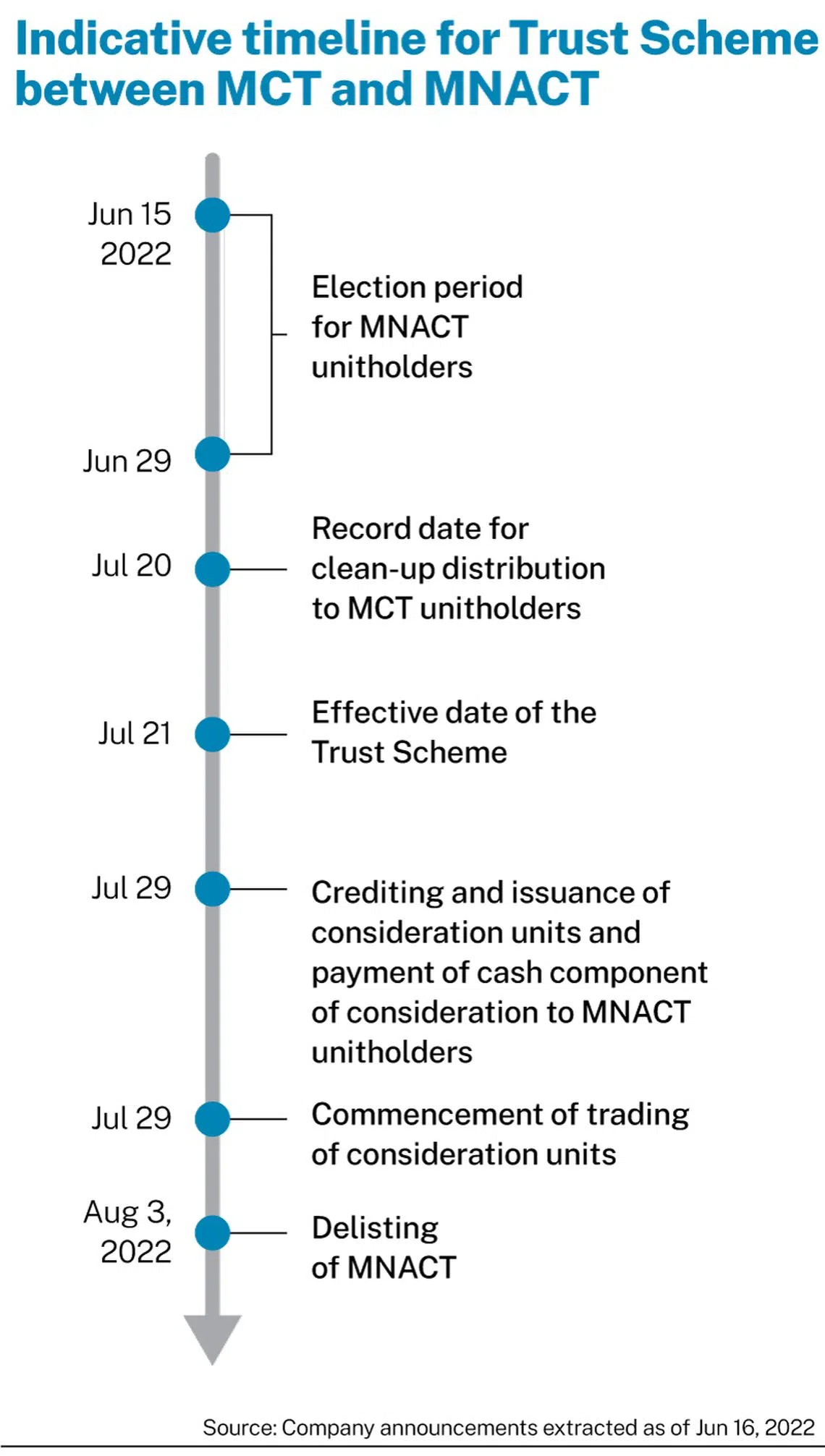

During the election period, each MNACT unitholder is entitled to choose only one form of scheme consideration: scrip-only, cash-and-scrip or cash-only options. The cash-only consideration will be the default form of the scheme consideration.

Based on indicative dates announced by the Reit managers, the election period is expected to run from Jun 15 to 29 while the merged entity is expected to begin trading on Jul 29.

MNACT’s estimated date of delisting will be on Aug 3.

The writer is a research analyst at SGX. For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook. Source: SGX Research S-Reits & Property Trusts Chartbook.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.