Sabana Reit’s Q3 income available for DPU up 38.4% at S$0.0101 on higher occupancy at New Tech Park

Revenue rises 5.3% year on year to S$29.9 million; net property income climbs 16% to S$16.9 million

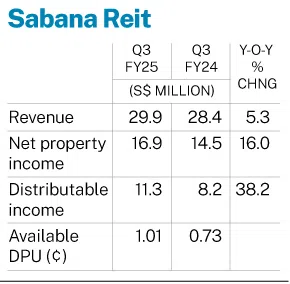

[SINGAPORE] Sabana Industrial Real Estate Investment Trust (Reit) posted a 38.4 per cent rise in income available for distribution per unit (DPU) to S$0.0101 for its third quarter ended Sep 30. This is compared to DPU of S$0.0073 in the year-ago period.

In a bourse filing on Wednesday (Oct 22), the manager of the Reit said revenue climbed 5.3 per cent to S$29.9 million, from S$28.4 million in Q3 2024. Meanwhile, net property income grew 16 per cent to S$16.9 million from S$14.5 million previously.

The total income available for distribution rose 38.2 per cent year on year to S$11.3 million from S$8.2 million.

The manager attributed the improvements in revenue and net property income to a higher overall portfolio occupancy rate of 87 per cent, as well as an 11.3 per cent positive rental reversion.

It singled out New Tech Park as the “crown jewel” for its “sterling” Q3 performance. The business park’s occupancy rate hit a 12-year high of 94.7 per cent as at Sep 30, up from 86 per cent as at Jun 30.

“Every quarter since Q1 2024, New Tech Park’s occupancy rate has consistently outperformed that of the business park segment reported by JTC,” the manager noted.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“In spite of the prevailing benign conditions of Singapore business parks, New Tech Park’s strong performance has bucked the trend, with occupancy outperforming the islandwide average.”

The manager also said that 24 new and renewed leases concluded in Q3, totalling 333,182 square feet. In addition, all of the leases expiring in 2025 have been addressed, with 79.5 per cent renewed or replaced.

For the period, the Reit’s weighted average lease expiry by gross rental income stood at 2.8 years.

Its aggregate leverage was 38 per cent, compared with 37.7 per cent as at Jun 30. The weighted average debt maturity fell to 2.2 years, from 2.4 years in the previous quarter.

Units of Sabana Reit closed unchanged at S$0.43 on Wednesday.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.