Sats Q2 net profit up 13.3% at S$78.9 million as clients front-load orders ahead of US tariffs

The group declares an interim dividend of S$0.02 per share, higher than S$0.015 a year ago

[SINGAPORE] In-flight caterer and ground handler Sats on Thursday (Nov 13) announced a Q2 FY2026 net profit of S$78.9 million, up 13.3 per cent from S$69.7 million in the corresponding year-ago period.

Revenue for the three months ended Sep 30 increased 8.4 per cent year on year to S$1.6 billion, from S$1.5 billion.

The group attributed this to the strong performance of its cargo handling business as well as steady contributions from its ground handling and food services segment.

“While volumes were strong, we recognise that the quarter benefited in part from front-loading ahead of tariff changes. We are actively managing our capacity and resources as demand patterns evolve,” said Kerry Mok, chief executive officer of Sats.

Revenue for its ground handling business, Gateway Services, rose 10.7 per cent to S$1.2 billion.

Revenue for its Food Solutions business, which falls under its food services segment, grew 1 per cent year on year to S$356.5 million in the latest quarter.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Growth in this segment was “modest” as the previous year-ago period benefited from catch-up pricing adjustments, said Sats.

Operating profit rose 23.7 per cent to S$157.4 million, reflecting “favourable operating leverage” due to gains in operational efficiency and volume growth, said Sats.

The group declared an interim dividend of S$0.02 per share, payable on Dec 5. This was higher than the S$0.015 announced in the corresponding period a year ago.

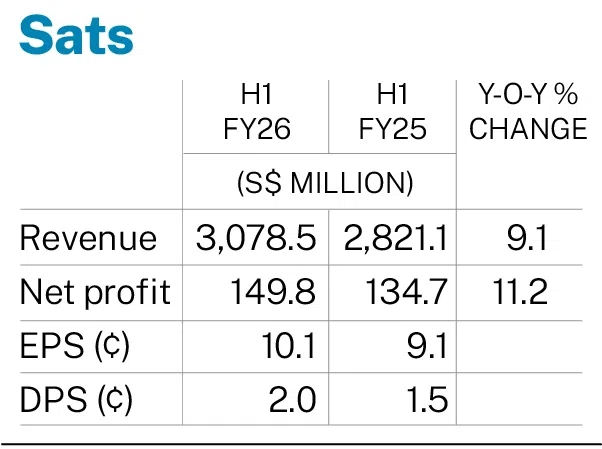

For the first half of FY2026, the group posted a net profit of S$149.8 million, up 11.2 per cent from S$134.7 million in the year-ago period.

This translates to earnings per share of S$0.101 for the six months, compared with earnings per share of S$0.091 previously.

H1 revenue was S$3.1 billion, up 9.1 per cent year on year from S$2.8 billion.

Shares of Sats ended 0.9 per cent or S$0.03 higher at S$3.55 on Thursday, before the announcement.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.